Tootsie Roll Industries

advertisement

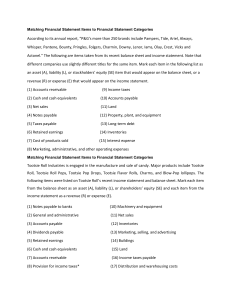

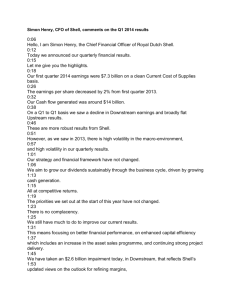

Tootsie Roll Industries AUDIT PRESENTATION BY KPMG Table of Contents: TOOTSIE ROLL REVIEW OF FINANCIAL STATEMENTS OVERALL EVALUATION THE FUTURE KPMG & TOOTSIE CONCLUSION / QUESTIONS Your Company Favorite candy company Most popular confectionary brands Distribution channels – 75 countries Strong among every age group, culture, demographic During every economic climate – truly enduring Family-run corporate culture Continued… Fiscally responsible focus – “America’s 200 Best Small Companies” by Forbes Magazine Highest ethical business standards – “100 Best Corporate Citizens” by Business Ethics Magazine Focus on high profitability Emphasis on ethics and integrity Involvement with the community and national concerns Income Statement Total Revenue increased over $22 million Net Income decreased $164,000 EPS increased from .93 in 2009 to .94 in 2010 Profit margin decreased from 10.87% in 2009 to 10.39% in 2010 Gross profit margin decreased from 36.29% in 2009 to 33.27% in 2010 Times interest earned increased from 265.11 in 2009 to 522.75 in 2010 Why did Net Income Decrease? Net earnings benefited from increased sales Cost of Goods Sold increased almost $30 million Cost of sugar and cocoa increase Provision for income taxes increased over $10 million Retained Earnings 2010 Retained Earnings at beginning of year Net Earnings Cash Dividends Stock Dividends Retained Earnings at the end of year Earnings per share Average Common and Class B Common shares Outstanding Dividends paid for the year Percent of net income paid out of cash dividends 148,582 53,714 (18,078) (46,806) $137,412 $0.94 56,997 2010: $64,884 33.67% 2009 145,123 53,878 (17,790) (32,629) $148,582 $0.93 57,738 2009: $50,419 33.02% • $0.32 of cash dividends paid out to stockholders in both years • Paid out cash dividends 86 years in a row Balance Sheet Working Capital Current Ratio Acid-Test Ratio Debt to Equity Ratio 2010 $179,086 4.06 2.76 28.62% 2009 155,812 3.78 2.45 27.95% Major Changes • Cash and cash equivalents increased almost $25 million • Added over $10 million in machinery and equipment • Liability for uncertain tax positions decreased almost $10 million • Capital in excess of par value increased over $23 million Cash Flows Increase in net cash: Operating activities $82,805 - 2010 compared to $76,994 – 2009 Net earnings benefited from increased sales No gain because of increased costs Investing activities - capital expenditures of $12,813 Showing continual reinvestment Plant, equipment, and information technology Not as must sale and maturity of securities From financing activities - paid cash dividends of $18,130 and purchased and retired $22,881 of its outstanding shares Treasury stock Able to do more of both Cash increased because of increased sales (operating activities): Reached new groups of customers New marketing plans Great Halloween season Our Overall Evaluation Net product sales in 2010 reached $517 million A record for the Company Increase of $22 million over 2009 net product sales Equals about 4.3% Another strong Halloween selling season Overall financial position remains very strong Net product sales Net earnings Related cash flows provided by operating activities Cash flows from operations plus maturities of short-term investments - adequate to meet the Company’s overall financing needs in 2011 Tootsie’s Future Key competitive advantage Well-known brands High volume for Retailers Attractive value for customers Entry into digital marketing = new opportunities Kosher certified open new markets Increase efficiency & eliminate waste Cash and stock dividends – 86 years in a row About KPMG U.S. Audit, Tax, and Advisory services firm Purpose – turn knowledge into value for our clients Comply with changing regulations and professional standards Proactive coordination and communication – Chicago office Provide our teams’ well-built understanding 23,000 employees strong / 144 countries Risk-based, industry specific, and tailored to our clients Give you an edge to competitors Any Questions?