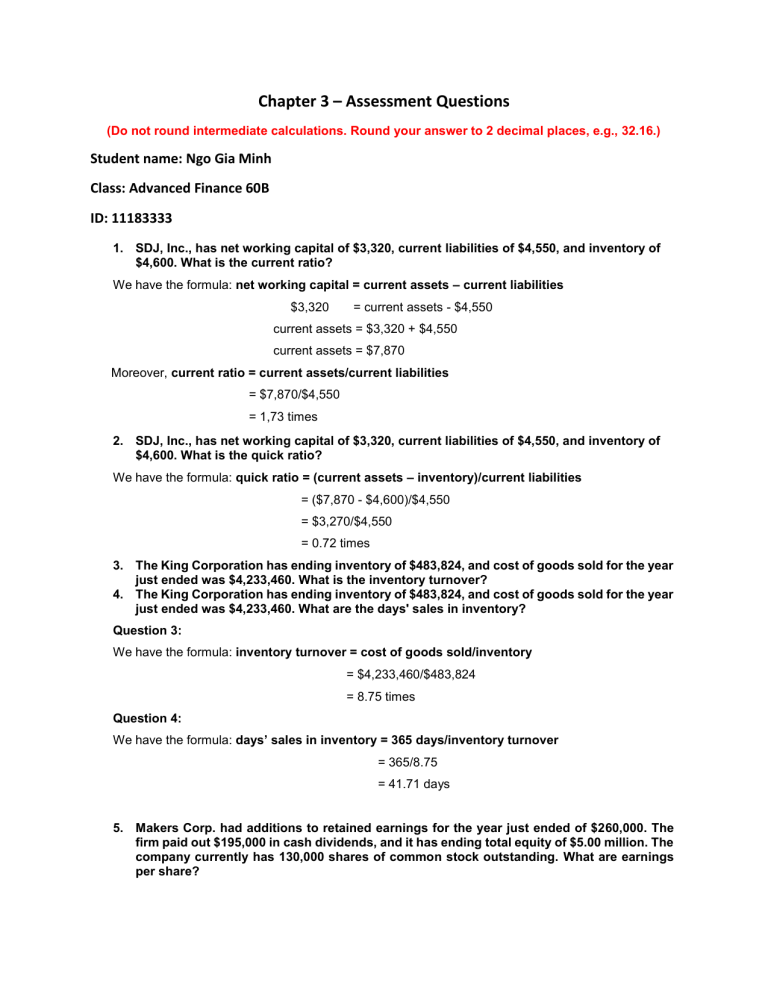

Chapter 3 – Assessment Questions (Do not round intermediate calculations. Round your answer to 2 decimal places, e.g., 32.16.) Student name: Ngo Gia Minh Class: Advanced Finance 60B ID: 11183333 1. SDJ, Inc., has net working capital of $3,320, current liabilities of $4,550, and inventory of $4,600. What is the current ratio? We have the formula: net working capital = current assets – current liabilities $3,320 = current assets - $4,550 current assets = $3,320 + $4,550 current assets = $7,870 Moreover, current ratio = current assets/current liabilities = $7,870/$4,550 = 1,73 times 2. SDJ, Inc., has net working capital of $3,320, current liabilities of $4,550, and inventory of $4,600. What is the quick ratio? We have the formula: quick ratio = (current assets – inventory)/current liabilities = ($7,870 - $4,600)/$4,550 = $3,270/$4,550 = 0.72 times 3. The King Corporation has ending inventory of $483,824, and cost of goods sold for the year just ended was $4,233,460. What is the inventory turnover? 4. The King Corporation has ending inventory of $483,824, and cost of goods sold for the year just ended was $4,233,460. What are the days' sales in inventory? Question 3: We have the formula: inventory turnover = cost of goods sold/inventory = $4,233,460/$483,824 = 8.75 times Question 4: We have the formula: days’ sales in inventory = 365 days/inventory turnover = 365/8.75 = 41.71 days 5. Makers Corp. had additions to retained earnings for the year just ended of $260,000. The firm paid out $195,000 in cash dividends, and it has ending total equity of $5.00 million. The company currently has 130,000 shares of common stock outstanding. What are earnings per share? We need to know that: net income = returned earnings + dividends = $260,000 + $195,000 = $455,000 So, we have the formula: earnings per share = net income/shares outstanding = $455,000/130,000 shares = $3.5 6. Makers Corp. had additions to retained earnings for the year just ended of $260,000. The firm paid out $195,000 in cash dividends, and it has ending total equity of $5.00 million. The company currently has 130,000 shares of common stock outstanding. What are dividends per share? We have the formula: dividends per share = dividends/share outstanding = $195,000/130,000 shares = $1.5 7. Makers Corp. had additions to retained earnings for the year just ended of $260,000. The firm paid out $195,000 in cash dividends, and it has ending total equity of $5.00 million. The company currently has 130,000 shares of common stock outstanding. What is the book value per share? We have the formula: book value per share = total equity/shares outstanding = $5,000,000/130,000 shares = $38.46 8. Makers Corp. had additions to retained earnings for the year just ended of $260,000. The firm paid out $195,000 in cash dividends, and it has ending total equity of $5.00 million. The company currently has 130,000 shares of common stock outstanding. If the stock currently sells for $73 per share, what is the market-to-book ratio? We have the formula: market-to-book ratio = price per share/book value per share (answer from question 7) = $73/$38.46 = 1.89 9. Makers Corp. had additions to retained earnings for the year just ended of $260,000. The firm paid out $195,000 in cash dividends, and it has ending total equity of $5.00 million. The company currently has 130,000 shares of common stock outstanding. What is the priceearnings ratio? We have the formula: price earnings ratio = price per share (from question 8)/earning per share (answer from question 5) = $73/$3.5 = 20.86 times 10. Makers Corp. had additions to retained earnings for the year just ended of $260,000. The firm paid out $195,000 in cash dividends, and it has ending total equity of $5.00 million. The company currently has 130,000 shares of common stock outstanding. If the company had sales of $4.16 million, what is the price-sales ratio? We need to know sales per share = sales/shares outstanding = $4,160,000/130,000 shares = $32 We have the formula: price-sales ratio = price per share (from question 8)/sales per share = $73/$32 = 2.28 times