- Blue Point Investment Management

advertisement

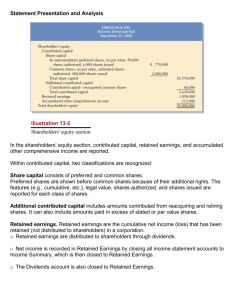

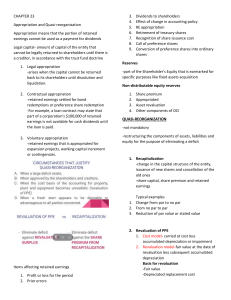

Key Items to Look for in Financial Statements That Lead to Good Questions Income Statement: 1) Revenue – Is the company’s Revenue growing over time? Is the Revenue trend consistent? 2) Special Items – Does management have a history of taking Special Items which are not previously recognized expenses? Usually found just before pretax income. If so, it indicates management has a problem matching up revenue and expenses. 3) Net Income – Is the Net Income trend consistent with Revenue? Is Net Income growing faster or slower than Revenue? 4) Common Shares Outstanding - Is the company issuing shares, i.e. increasing the shares outstanding? Ben Bernanke would call this quantitative easing. If so, earnings per share(EPS) will be diluted (reduced) by the increased Common Shares Outstanding. The inverse is true if the Common Shares are repurchased. Balance Sheet: (Note the balance sheet measures of finance companies are heavily levered, i.e. high debt-tocapital. Banks and insurance companies must state all liabilities owed to depositors and to policy holders. In any given period, only a small fraction of the deposits or insurance policies are paid out.) 1) Cash – How big is the Cash position relative to Total Assets? Is the Cash position growing or shrinking? 2) Long-Term Debt – Does the company have manageable levels of debt? Can the company pay Current Maturities of Long-Term Debt as they come due? 3) Goodwill/Intangibles – Compare Goodwill/Intangibles to Shareholders Equity. If over half of Shareholders Equity is attributable to Goodwill/Intangibles, it means Common Equity Shareholders could be badly disadvantaged if the company ceased to be a going concern or writes down the Goodwill/Intangible assets. 4) Retained Earnings – Over multiple periods has the company’s management created Retained Earnings? Retained Earnings will be negative if management lost money in previous periods. Cash Flow Statement: 1) Operating Cash Flows - Do Operating Cash Flows aka Net Cash Flows from Operations approximately equal Net Income trends? If not, why not? There can be multiple reasons, e.g. a high growth business growing over 30% typically has negative Operating Cash Flows as its need for new inventory and growing accounts receivable (free 30-day loan to customers) exceeds the cash generated by the business. 2) Capital Expenditures – Are the Capital Expenditure trends detailed in the Investing Activities consistent with a growing business? Is management continuing to invest in the future? Financial Ratios: 1) Cash Conversion Cycle – Is the number of days it takes the company to convert inventory into cash growing or shrinking. Also called the Operating Cycle = Inventory Conversion Days + Accounts Receivable Conversion Days – Accounts Payable Conversion Days 2) Net Profit Margin – Measure Net Income as a % of Revenue. How stable are the Profit Margins? What are the trends? Portfolio Manager Observations Interesting Regional Resources: Jeff Hooke, author of “Security Analysis on Wall Street” http://www.hookeassociates.com/books.html He also provides perspective and commentary on mergers and acquisitions. Jack Cielsielski, author of “Analysts Accounting Observer” http://www.accountingobserver.com His commentary is widely covered http://www.accountingobserver.com/InTheNews/tabid/64/Default.aspx Howard M. Schilit, “Financial Shenanigans: How to Detect Accounting Gimmicks & Fraud in Financial Reports” http://www.whartonny.com/article.html?aid=1833 He founded the Center for Financial Research & Analysis (CFRA) in Rockville, MD https://www.cfraresearch.com Prepared by: Niall H. O’Malley Managing Director, Portfolio Manager Blue Point Investment Management, LLC (443) 600-8050 www.bluepointim.us Portfolio Manager Observations