Interest Parity

advertisement

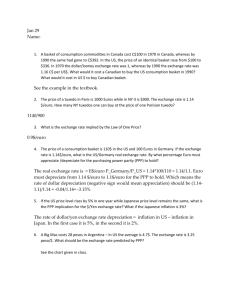

Exchange Rates and Interest Rates Interest Parity PPP and IP Relationship between exchange rates and prices ------ Purchasing Power Parity PPP is expected to hold when there is no arbitrage opportunity in goods markets. Relationship between exchange rates and interest rates ------ Interest Parity IP is expected to hold when there is no arbitrage opportunity in financial markets. PPP and IP Financial- asset prices adjust to new information more quickly than goods prices PPP does not hold in the short run Interest Parity 1/30/02 FT US$ Libor (3 months): 1.870 = i$ Euro Libor (3 months): 3.351 = i€ Euro spot: 0.8617 = E$/€ Euro 3 months forward: 0.8585 = F$/€ Euro currency Offshore Banking Euro dollar, Euro yen Euro banks Libor = London Interbank Offer Rate Interest Parity By investing $1,000 for 3 months, an investor in the US can earn 1,000 x (1+i$) = 1,000 x [1+(0.018704)] = 1,004.67 dollars at home. Alternatively, she can invest in the EU by converting dollars to euros and then investing the euros. Interest Parity $1,000 equal to 1,000 E$/€ = 1,000 0.8617 = 1,160.50 euros, which is the quantity of euros resulting from the 1,000 dollars invested. After three months, she will receive 1,160.50 x (1+i€) = 1,160.50 x [1+(0.03351 4)] = 1,170.22 euros. Interest Parity She will have to convert this investment return to dollars at the exchange rate that will prevail 3 months later, which is unknown today. To avoid this uncertainty, she can cover the investment in euro with a forward contract. Interest Parity She sells €1,170.22 to be received in 3 months in the forward market today. The covered return is (1,000 E$/€) x (1+i€) x F$/€ = 1,170.22 x F$/€ = 1,170.22 x 0.8585 = 1,004.64 dollars, which is pretty close to $1,004.67. Interest Parity Arbitrage makes the difference between the returns on two investment opportunities equal to zero. In other words, 1+i$ = (1+i€)(F$/€ /E$/€) or (1+i$)/ (1+i€) = (F$/€ /E$/€) Interest Parity Interest rate parity condition is given by (i$-i€)/ (1+i€) = (F$/€-E$/€) /E$/€ which is approximated by i$-i€ = (F$/€-E$/€) /E$/€ (Covered Interest Parity) In other words, the interest differential between the US and the EU is equal to the forward premium of the euro. Interest Parity To check CIP: (i$-i€) = (1.870 – 3.351)400 = -0.0037 (F$/€-E$/€) /E$/€ = (0.8585 – 0.8617)0.8617 = -0.0037 CIP can be rewritten as i$ =i€ + (forward premium) where (forward premium) = (F$/€-E$/€) /E$/€ Uncovered Interest Parity Suppose that a US investor is buying a UK bond without using the forward market. The 6 months £ Libor is 4.17250 %, but this is not the rate of return relevant for the US investor. UIP The effective rate is given by i£ + (Ee$/€-E$/€) /E$/€ = (UK interest rate) + (Expected rate of depreciation) where Ee$/€ stands for the expected exchange rate 3 month ahead. UIP In other words, the expected return on a pound investment is the UK interest rate plus the expected rate of depreciation of the dollar against the pound. UIP: an example Suppose an investor expects the dollar to appreciate by 1.15% over six months. Then, the expected return on a UK bond is (4.172502) – 1.15 = 0.936 %. This is almost same as the return on a US bond: 1.8702 = 0.935 %. In such a case, we say that Uncovered Interest Parity holds. Inflation and Interest Rates Nominal interest rate = i : the observed rate Real interest rate = r : the rate adjusted for inflation Fisher Effect Nobody lends someone money at 5% interest rate when the inflation rate is expected to be 6% for the next year. (Why?) The nominal interest rate incorporates inflation expectations to provide lenders enough level of real return. Fisher Effect Fisher Equation i = r + e where e = expected rate of inflation Higher the inflation expectations, higher will be the nominal interest rates. The interest rates were high in 1970s and 80s. Exchange rates, interest rates and inflation Fisher equations for two countries: i$ = r$ + USe i¥ = r¥ + Je If the real rate is the same between two countries, that is, r$ = r¥ , then i$ - i¥ = USe - Je = (F$/¥-E$/¥) /E$/¥ CIP, PPP, and FE Covered Interest Parity: i$ - i¥ = (F$/¥-E$/¥) /E$/¥ Relative PPP: USe - Je = % E$/¥ = (F$/¥-E$/¥) /E$/¥ Fisher equations for two countries: i$ = r$ + USe i¥ = r¥ + Je “CIP + Relative PPP + FE” implies r$ = r¥ Implications Suppose initially CIP holds: i$ - i¥ = (F$/¥-E$/¥) /E$/¥ Suppose further that the Democrats take over the senate and congress and start massive spending. Then, USe . (Why?) This implies i$ by Fisher equation (Why?) Three possible cases 1. 2. 3. Possibly, Ee . Then F . (Why?) More likely, Ee does not change. Then E . (Why?) Suppose that the US or Japan or both intervene the FX markets, trying to keep the exchange rate constant. Then, there will be no change in i$ - i¥ (Why?) But i$ (Why?) So, i¥ has to go up. Then, J will also go up. (Why?) Expected exchange rate and the Term Structure of Interest Rates How different are the interest rates for different maturities? Term Structure of Interest Rates In bonds market, there are 3-month, 6month, 1-year, 3-year, 10-year, and 30year bonds. Short-term, medium-term, long-term interest rates. Term Structure of Interest Rates Expectations Hypothesis: The expected return from the long-term bond tends to be equal to the return generated from holding the series of short-term bonds. Liquidity Premium Risk-averse investors more prefer lending short-term than long-term. (Why?) Long-term bonds incorporate a risk-premium.