Parity Conditions in International Finance and Currency Forecasting

advertisement

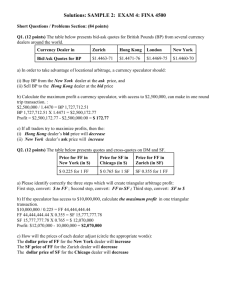

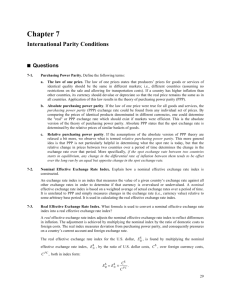

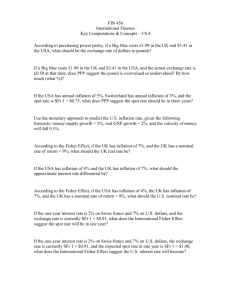

Shapiro: Chapter 4 – The Law of One Price Chapter 4 Problems Problem 4.7 The Law of One Price “Exchange-adjusted prices … of identical, tradable goods and financial assets … The Law of One Price “Exchange-adjusted prices … of identical, tradable goods and financial assets … must be within transaction costs of equality worldwide.” The Law of One Price Enforced by arbitrageurs - ??? Enforced by arbitrageurs - buy in one market and sell in another “Students Find $100 Textbooks Cost $50, Purchased Overseas” New York Times, 10-21-03 Biology Textbook Amazon (USA) Amount $146.15 Amazon (UK) Gross Margin Shipping Cost $ 63.49 $ 82.67 $ 8.05 Net Margin $ 74.62 The Law of One Price Enforced by arbitrageurs - buy in one market and sell in another Risk-adjusted expected returns on financial assets in different markets should be equal 5 Key Economic Relationships Purchasing Power Parity (PPP) Fisher Effect (FE) International Fisher Effect (IFE) Interest Rate Parity (IRP) Forward Rates as unbiased predictors of future spot rates (UFR) Exhibit 4.1 Five Key Theoretical Relationships Among Spot Rates, Forward Rates, Inflation Rates, and Interest Rates Expected % Change of Spot Rate -3% UFR Forward Discount or Premium -3% PPP IFE Interest Rate Differential +3% IRP FE Expected Inflation Rate Differential +3% Purchasing Power Parity (PPP) “The ratio between domestic and foreign price levels should equal the equilibrium exchange rate between domestic and foreign currencies.” $1 = loaf of bread $1 = £0.6475 £0.6475 = loaf of bread Purchasing Power Parity (PPP) Version: “Exchange rate between the home currency and any foreign currency will adjust to reflect changes in the price levels of the two countries.” Relative Purchasing Power Parity (PPP) Inflation = 5% (USA) Inflation = 3% (Switzerland) $ value of SFr should rise by 2% et t ) (1 + ih --- = -----------t e0 (1 + if) 2% Purchasing Power Parity (PPP) Inflation = 5% (USA) Inflation = 3% (Switzerland) e0 = SFr 1 = $0.75 (spot) What is e3? Purchasing Power Parity e3 (1 .05) 3 e0 (1 .03) 3 Purchasing Power Parity e3 (1 .05) 3 e0 (1 .03) 3 e3 e0 (1.0194) 3 Purchasing Power Parity e3 (1 .05) 3 e0 (1 .03) 3 e3 e0 (1.0194) 3 e3 .75(1.0594) $0.7945 Purchasing Power Parity (PPP) The exchange rate change during a period should equal the inflation differential for that same period. “Currencies with high rates of inflation should devalue relative to currencies with lower rates of inflation.” Purchasing Power Parity (PPP) Shapiro: Exhibit 4.4 Fisher Effect Nominal interest rate (r) consists of: – real required rate of return, a – an inflation premium, i 1 + r = (1 + a)(1 + i) Real returns are equalized across countries through arbitrage. Fisher Effect ah = af rh - rf = ih - if Currencies with high rates of inflation should bear higher interest rates than currencies with lower rates of inflation Exhibit 4.7 Fisher Effect: Empirical Data, May 2007 International Fisher Effect “Currencies with low interest rates are expected to appreciate relative to currencies with high interest rates.” International Fisher Effect 1 rh e1 1 r f e0 where e1 is the expected exchange rate. International Fisher Effect The expected home country (HC) returns from investing at home and abroad should be equal. 1 + rh = (1 + rf)(e1/e0) Nominal vs. Real Rate of Interest [The Economist, 2-5-16] Country Euro Area Japan Canada USA Britain Australia Mexico Brazil 10 Yr Nominal 2015 Inflation Real Rate (%) Rate(%) Rate (%) Nominal vs. Real Rate of Interest [The Economist, 2-5-16] Country 10 Yr Nominal 2015 Inflation Real Rate (%) Rate(%) Rate (%) Euro Area 0.45 Japan 0.22 Canada 1.25 USA 2.01 Britain 1.75 Australia 2.68 Mexico 6.13 Brazil 16.52 Nominal vs. Real Rate of Interest [The Economist, 2-5-16] Country 10 Yr Nominal 2015 Inflation Real Rate (%) Rate(%) Rate (%) Euro Area 0.45 0.1 Japan 0.22 0.7 Canada 1.25 1.2 USA 2.01 0.2 Britain 1.75 0.1 Australia 2.68 1.6 Mexico 6.13 2.7 Brazil 16.52 9.6 Nominal vs. Real Rate of Interest [The Economist, 2-5-16] Country 10 Yr Nominal 2015 Inflation Real Rate (%) Rate(%) Rate (%) Euro Area 0.45 0.1 0.35 Japan 0.22 0.7 -0.48 Canada 1.25 1.2 0.05 USA 2.01 0.2 1.81 Britain 1.75 0.1 1.65 Australia 2.68 1.6 1.08 Mexico 6.13 2.7 3.43 Brazil 16.52 9.6 6.92 Interest Rate Parity (IRP) [Covered Interest Arbitrage] “A condition where the interest rate differential is approximately equal to the forward differential between two currencies.” Interest Rate Parity (IRP) [Covered Interest Arbitrage] Interest rate (London) = 12% Interest rate (New York) = 7% £ spot rate: £1 = $1.95 1-year forward rate: £1 = $1.88 Forward differential: • ($1.88 - $1.95) / $1.95 = -3.6% Rate differential: 12% - 7% = 5% Covered Interest Arbitrage Spot Market: – beginning of the year Borrow $1,000,000 (NY) at 7% Buy £ at £ = $1.95 Receive £ 512,820.5 Invest £ 512,820.5 at 12% Spot Market: – end of the year Forward Market: - beginning of the year Forward Market: – end of the year Covered Interest Arbitrage Spot Market: – beginning of the year Borrow $1,000,000 (NY) at 7% Buy £ at £ = $1.95 Receive £ 512,820.5 Invest £ 512,820.5 at 12% Spot Market: – end of the year Forward Market: - beginning of the year Sell £ 574,358.9 @ £1 = $1.88 Forward Market: – end of the year Covered Interest Arbitrage Spot Market: – beginning of the year Borrow $1,000,000 (NY) at 7% Buy £ at £ = $1.95 Receive £ 512,820.5 Invest £ 512,820.5 at 12% Spot Market: – end of the year Forward Market: - beginning of the year Sell £ 574,358.9 @ £1 = $1.88 Forward Market: – end of the year Collect £574,358.9 Convert to $1,079,795 Covered Interest Arbitrage Spot Market: – beginning of the year Borrow $1,000,000 (NY) at 7% Buy £ at £ = $1.95 Receive £ 512,820.5 Invest £ 512,820.5 at 12% Spot Market: – end of the year Repay: $1,000,000 Pay Interest: $70,000 Net Profit: $9,795 Forward Market: - beginning of the year Sell £ 574,358.9 @ £1 = $1.88 Forward Market: – end of the year Collect £574,358.9 Convert to $1,079,795 Forward Rates as Unbiased Predictors of Future Spot Rates (UFR) “The forward rate should reflect the expected future spot rate on the date of settlement.” f1 = e1 Forward Rates as Unbiased Predictors of Future Spot Rates (UFR) Example: 90-day forward rate: SFr1 = $0.75 – future spot rate: SFr1 = $0.75 Empirical evidence: – forward rate appears biased – bias caused by risk premium – premium appears to average out – Currency Forecasting Forecasting requirements: superior models superior, consistent information small, temporary deviations predict government intervention Currency Forecasting Market-based forecasts: – forward rates – interest rate differentials Model-based forecasts – fundamental analysis – technical analysis Shapiro: Problem 4-7a iUSA = 10% iGDR = 4% €1 = $0.95 Which currency will appreciate? Exchange rates for next five years? €t = $0.95(1.10/1.04)t Shapiro: Problem 4-7a Year (t) Exchange Rate 1 e1 = 1.0048 2 e2 = 1.0628 3 e3 = 1.1241 4 e4 = 1.1889 5 e5 = 1.2575