IM03

advertisement

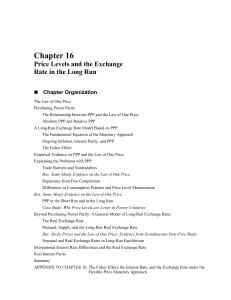

Integrated Markets Part III It’s the real thing Real Interest Parity Real interest rate (r) Nominal interest rate (i) i$ = r$ + p$e, p$e = expected inflation, and i¥ = r¥ + p¥e Don’t You Just Love Math! If (i$ - i¥) = 4%, as before Then, r$ + p$e - r¥ - p¥e = 4% Or, (r$ - r¥) + (p$e - p¥e) = 4% So, (r$ - r¥) = 4% - (p$e - p¥e) What are e p$ & e p¥ ? p$e 2% Jpn inflation rate: p¥e - 2% Therefore, (r$ - r¥) (2 – (-2) - 4 And r$ - r¥ 0 US inflation rate: Just What the Doctor Ordered Note that uncovered interest parity has to be true for real interest parity to hold If real interest parity does not hold, and capital is mobile, real interest parity will hold Purchasing Power Parity The Law of One Price (LOOP) Gold, silver, oil, and securities with identical risk & return each have the same price everywhere That’s common sense Actual applications may require considerable disentangling of tariffs & local taxes, transportation costs Weaker For real estate it clearly does not work in any absolute sense But, if humans were perfectly mobile, would real estate prices become uniform everywhere? People are already very mobile; comparable units in major cities have become comparably expensive. How about comparable rural locations? Back to PPP PPP is also common sense, but isn’t that simple What is a “representative market basket of goods?” Absolute PPP: ER = relative prices Very strong assumption. ER(¥/$) = P¥/P$ ER(¥/$) = P¥/P$ If ER = 110, as it does now A New York salary of $100 a day is as livable as a Tokyo salary of ¥11,000 a day An Alaska salary of $500.00 per week is equivalent a Hokkaido salary of ¥55,000 A one week $3000 ecotourism package in Maui should be identical or similar to a ¥330,000 package in Okinawa Relative PPP Using the above equation and a little mathematics, Ln(¥/$) = ln(P¥) – ln(P$), Taking derivatives with respect to time, %Δ(¥/$) = %ΔP¥ - %ΔP$ This equation says that the per cent appreciation of the dollar should equal the Japanese inflation rate minus the US inflation rate THE REAL EXCHANGE RATE RXR[¥/$] = ER[¥/$]*P$/P¥ In percentage change terms, this means that %∆RXR[¥/$] = %∆R[¥/$] + %∆P$ - %∆P¥ We know much about those last two terms: US & JPN’s rates of inflation Let’s use that knowledge Long-Run Exchange Rate Changes In general, MV = Py. Hence, M$V$ = P$y$, & M$V$/y$, = P$, M¥V¥ = P¥y¥ & M¥V¥/y¥ = P¥ OK, rearrange terms to get: R(¥/$) = P¥/P$ = (M¥/M$)(V¥/V$)(y$/y¥) Reality Check R(¥/$) = P¥/P$ = (M¥/M$)(V¥/V$)(y$/y¥) Is this equation valid? LHS: R(¥/$), has fallen recently, 120 to 110 (yen appreciation) P¥/P$ has also fallen due to minor deflation in Japan & minor inflation in USA So R(¥/$) = P¥/P$ is OK What About the RHS? Is (M¥/M$)(V¥/V$)(y$/y¥) falling? We know that (M¥/M$) is rising due to Japanese use of monetary policy to stimulate the economy We also know that (y$/y¥) is rising due to faster growth rate in USA Two of the terms are rising? (M¥/M$)(V¥/V$)(y$/y¥) This means that (V¥/V$) must be falling rapidly enough to offset the other two terms What do we know about velocity that could lead to that conclusion? Let’s Talk About R(d/$) = Pd/P$ = (Md/M$)(Vd/V$)(y$/yd) d, of course, stands for dong What about the currencies of Korea, China, Europe?