GCSE Finance Test - Trinity School Nottingham

advertisement

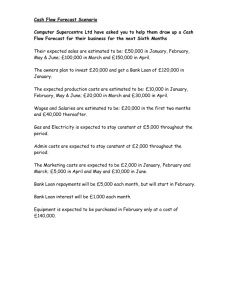

GCSE Finance Test Year 10 Business Studies 1. There are a number of sources of finance available to a business. These can be classed as either internal or external sources. (a) From the list below put a tick in the box next to each one that is an external source. Bank loan Retained profits Sale of assets Sale of shares Venture Capital [3] Banks will not lend large sums of money to a business unless it can provide security. (b)(i) State the meaning of the term ‘security’. [1] (ii) State an example of an item a business could use as security for a bank loan. [1] (c) State two reasons why a bank would insist on security before granting a loan. Reason 1 [1] Reason 2 [1] Please turn over ScreenScene plc needs to raise £200 million to modernise existing cinemas and to fund the building of new facilities. Finance options available are: Share issue Trade Credit Sale and lease back Bank Loan Overdraft (d)(i) From the list above choose two methods that are most suitable. Method 1 [1] Method 2 [1] (ii) Which is the better option of the two methods? [1] (iii) Give two reasons for your choice. Reason 1 [1] Reason 2 [1] Look at the Cash Flow Forecast January 2009 - April 2009 for ScreenScene plc Ellesmere Park Multiplex. (e)(i) In the Cash Flow Forecast the cost of insurance, payable in April, has been left out. This costs £1000. Enter this in a suitable box in the Cash Flow Forecast. [1] (ii) Enter the values missing from the three grey boxes. [3] (f) At the end of which month does ScreenScene plc first appear to have a cash flow problem? [1] (g) Suggest the most appropriate source of finance to deal with this cash flow problem. [1] (h) State two reasons why businesses may suffer from cash flow problems. Reason 1 [1] Reason 2 [1]