November 15, 2007

Regulatory Alert #2007-109

Behavior That May Be Referred For Regulatory

Scrutiny Regarding Potentially Manipulative

PRLs and Wash Sales Activity

Please Route To:

Head Traders; Technical Contacts; Compliance Officers

What you need to know:

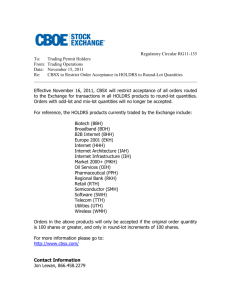

• Orders that may be routed to the New York Stock Exchange (NYSE) must comply with NYSE

interpretations regarding odd-lot activity, including the submission of partial round lot (PRL)

orders.

•

Transactions that violate the NYSE's requirements relating to the use of its odd-lot system,

including with respect to Partial Round Lots (PRLs), or that are potentially manipulative will

be referred by NASDAQ to the Financial Industry Regulatory Authority (FINRA) for further

investigation.

Who you should contact:

• NASDAQ MarketWatch at 800.211.4953 or 301.978.8501.

What information is NASDAQ providing?

NASDAQ® reminds member firms that orders routed to the NYSE must comply with NYSE

interpretations regarding odd-lot activity, including the submission of partial round lot (PRL)

orders. Transactions that violate the NYSE's requirements relating to the use of its odd-lot

system, including with respect to PRLs, or that are potentially manipulative will be referred by

NASDAQ to the Financial Industry Regulatory Authority (FINRA) for further investigation.

In NYSE Information Memo 07-60, NYSE Regulation stated that the NYSE's odd-lot system may not

be used in ways that are intended to circumvent the round-lot auction process. The NYSE has

advised that, among other things, the following activities are inconsistent with the proper

submission of odd-lot orders to the NYSE:

•

Effecting prearranged or wash sales in the round-lot portion of a PRL for the purpose of

effecting an execution of the odd-lot portion of the PRL with no market risk and at a more

favorable price than market conditions would have otherwise permitted. For example, when

the quote in XYZ is $0.05 - $0.15, a customer simultaneously bids $0.06 for 199 shares and

offers 100 shares at $0.06. This would cause 100 shares to execute at .06 (this would be a

prohibited wash sale), which would in turn force the specialist to sell to the customer the

remaining 99 shares at $0.06, thereby generating a riskless odd-lot trade at a better price

for the odd-lot than the market at the time would have provided.

•

Effecting prearranged or wash sales in odd-lots, which are trades in which an offer to buy is

coupled with an offer to sell back at the same or an advanced price (or the reverse). These

trades are violative because they are not actually exposed to the risk of the market.

Whether a transaction presents "market risk" is a facts and circumstances determination.

However, in order to be considered at the risk of the market, there can be no guarantee or

assurance of the price of the second transaction at the time of the first transaction. In

addition, the time period between the two transactions would not of itself determine

whether the trading had been effected at the risk of the market. Rather, factors such as the

liquidity of the security and the volume must be considered. Prearranged or wash sales in

odd-lots or partial round lots ("PRLs") should not be used to create a false or misleading

appearance of more actual or apparent active trading in such security. Such activity would

violate SEC and NYSE anti-manipulation and anti-fraud rules, and other NYSE rules

including but not limited to just and equitable principals of trade and good business

practices.

•

Other trading activity in odd-lot orders or in PRLs that is not consistent with traditional oddlot investment activity, including index arbitrage, certain types of program trading, security

classes not typically involved in program trading (e.g., REITs, certain narrowly based

structure products, etc.), or any pattern of activity that would suggest day trading is

otherwise clearly suspicious because it is inconsistent with traditional odd-lot investment

activity.

What do I need to do?

Please review NYSE Information Memo 07-60 for additional guidance regarding NYSE odd-lot

order requirements.

Where can I get additional information?

•

NASDAQ MarketWatch at 800.211.4953 or 301.978.8501.

NASDAQ is the largest U.S. electronic equities exchange. With approximately 3,100 companies, it lists more companies and, on

average, trades more shares per day than any other U.S. electronic market. It is home to companies that are leaders across all

areas of business including technology, retail, communications, financial services, transportation, media and biotechnology.

NASDAQ is the primary market for trading NASDAQ-listed stocks as well as a leading liquidity pool for trading NYSE-listed

stocks. For more information about NASDAQ, visit the NASDAQ Trader website at www.NASDAQTrader.com.

© Copyright 2007 The Nasdaq Stock Market, Inc. All Rights Reserved.