US_FinancialMarkets_..

advertisement

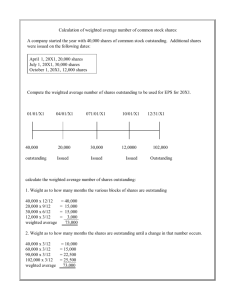

The Stock Market I. Introduction The stock market of a country can be divided into two large interrelated markets: (1) the primary market, where newly issued shares are sold; and (2) the secondary market, where outstanding shares are traded In the primary market, a company needing funds can sell newly issued shares by using an underwriter (usually a large brokerage firm). The primary market is a global market; since newly issued shares can be sold anywhere the underwriter has a branch office. The underwriter performs an important middleman service; since the issuing company would generally not be able to sell its shares over such a large geographic area. If the company is issuing a large amount of shares, then it may want to use a large number of different security firms to underwrite these securities. Information regarding the issuance will be contained in a prospectus, which can be obtained from the underwriters. Newly issued stock generally has a par or face value. However, when sold in the primary market, it will have a price determined by supply and demand. Therefore, except for some accounting relations, the par value is not of great importance. The stock that is issued can be either common stock or preferred stock. Common stock gives the owner voting rights in the stockholder meetings; however, it does not have a fixed dividend like preferred stock. Moreover, preferred stock dividends must be paid first before any common stock dividends can be paid. The importance of corporate stock is that it carries limited liability. If the company amasses debts, the personal assets of the stockholders cannot be taken to pay these debts. The stockholder is liable only for the money he or she has invested in the stock. After the stock has been issued and bought by investors, it becomes stock outstanding. If the company buys back some of its stock previously issued, then the stock outstanding will decrease. However, the total number of shares issued will not decrease. Shares repurchased in a stock buyback plan are called treasury stock. The number of shares outstanding is very important in calculating certain financial ratios (e.g., the P/E ratio). Outstanding shares in corporations are often traded in organized secondary markets. Such companies are what we call listed corporations. The secondary markets mainly consist of various stock exchanges and the over-the-counter (OTC) market. Listings on stock exchanges or the OTC are very important because they increase the liquidity of the stock. Very few people would be willing to purchase stock if they thought they could not sell it when necessary. Liquidity is a measure of how quickly an asset can be sold for cash without a large reduction in its price. A strong secondary market raises the liquidity of the stock and thus its value to investors. The largest and most famous secondary market for stock is the New York Stock Exchange (NYSE). Secondary markets in stock have been going through substantial consolidation over the last 10 years. In 2007 the NYSE was merged with the electronic stock exchange Euronext, which is based in Amsterdam. In 2012 it was announced that the NYSE Euronext would be merged with Intercontinental Exchange a futures exchange located in Atlanta. To date, the merger is waiting on European regulators to give the green light. The transaction will make the ICE-NYSE the third largest exchange in the world, behind Hong Kong Exchanges and Clearing, and the CME Group. Foreign companies can also sometimes obtain listings on these exchanges. The American Stock Exchange was purchased by NYSE Euronext in 2008. Many regional stock exchanges in the US were purchased by the NYSE Euronext or NASDAQ. NASDAQ stands for the National Association of Securities Dealers and Automated Quotations. It is the largest over the counter market for stock in the world. NASDAQ is controlled by NASDAQ OMX Group, which owns the OMX stock exchange. II. Important Concepts Regarding Stock The starting point for understanding investment in stock is the stock-bond arbitrage relation. This can be written as Pt e1 Pt Dte1 r Nt Pt Pt where Pt the current stock price, Pt e1 next period’s expected stock price, Dte1 expected dividends that will be paid in the next period, r the interest rate on government bonds, a risk premium for holding risky stocks rather than less risky government bonds, and N t time period t news-shock specifically and positively related to the stock (but not to its expected future dividends) and/or unrelated or negatively related to the bond market. This last variable is very complex but is generally treated as having a zero expected value and therefore is often ignored in fundamental analysis. The equation above shows that stocks and bonds provide the same risk-adjusted yields if there is equilibrium between the two markets. Note however that a rise in N t will immediately raise the current price, Pt , and may affect the expected price, Pt e1 . An important assumption is that this shock will have a stronger effect on Pt than on Pt e1 . This says that N t will jump wildly up and down for many different reasons and that the stock price will move along a path determined by the interest rate, the risk premium, and the growth of dividends or profits. Note also that a rise in r or will cause an immediate fall in Pt . An increase in Dte1 will raise the current price Pt . Many people try to guess the movements in N t but there are strong reasons to believe that such news cannot be predicted. Naturally, if one knew about N t at time (t-1) then one could make money. This is what is meant by inside information. III. Balance Sheets and Income Statements To clearly understand the financial condition of a corporation, one needs to study both the balance sheets and income statements of the company. An annual balance sheet lists the assets, liabilities and owners' equity of a corporation. By definition, owners' equity is equal to all assets minus all liabilities. The basic assets of a company include such things as cash, accounts receivable, inventory, and plant and equipment. These assets are used to produce revenue for the company. Total liabilities consist of mainly bank loans, accounts payable, and corporate bonds outstanding. Each of these will require future payments of money by the company. Owners' equity (or net worth) is composed of stock outstanding and retained earnings. It is important to note that the balance sheet shows the above information for one point in time, usually the last day of the year. By contrast, the quarterly income statement shows the revenues and expenditures made by the corporation during the past three months, usually compared with the same period in the previous year. The income statement gives a concise picture of how profits were made, income taxes were paid, and typically shows the earnings per share of common stock. Often it is important to understand how net earnings were made and not just how large they were. Careful analysis of the balance sheets and income statements can help one determine such things as whether a stock is currently undervalued, whether it may become the target of a hostile takeover, or even whether current earnings have been manipulated through clever accounting tricks. IV. Stock Indexes and Selling Short The NYSE has thousands of listed stocks, so it can often be difficult to judge the overall direction of the market. To judge general movements in the market, we must rely on a stock index. The most popular indexes are the three Dow Jones indexes: one each for industrials, transportation companies, and utilities. There is also a very broad based index called the NYSE Composite Index which considers the whole market. In addition, there is the S&P 500 index which covers the top 500 corporations. The NASDAQ index gives an average of a particular set of stocks trading OTC. Over a period of a year, the stock index will be affected by the health of the economy. Over shorter periods of time, there are many factors which affect the index, such as changes in interest rates, money supply, earnings reports, trade and budget deficits, and important political developments. When the index rises steadily, we call it a bull market. By contrast, when most stockholders and investors want to sell their stock, we call it a bear market. 1 Sometimes, the market will rise too far and then suddenly drop. This is called a market correction since the index was unrealistically high. We often say that the market fell because of profit-taking. Sometimes an investor feels that the market is going lower. He may choose to short a particular stock. Selling stock short means that the investor borrows stock from a broker and sells it now, with the intention of buying the same stock back at a lower price. The investor must maintain a margin account with the broker. If the stock the investor is shorting rises in price, he is required to increase the deposit in his margin account. Shorting stock creates a risk of unlimited losses for the investor, since the stock he is shorting can theoretically experience an unlimited rise in price. Short sellers can limit this risk by hedging with call options, which we will discuss later. 1 As Investopedia puts it “a market condition in which the prices of securities are falling, and widespread pessimism causes the negative sentiment to be self-sustaining. As investors anticipate losses in a bear market and selling continues, pessimism only grows. Although figures can vary, for many, a downturn of 20% or more in multiple broad market indexes, such as the Dow Jones Industrial Average (DJIA) or Standard & Poor's 500 Index (S&P 500), over at least a two-month period, is considered an entry into a bear market. “http://www.investopedia.com/terms/b/bearmarket.asp Discussion Questions: #1. What is the difference between the primary and secondary market for stock? #2. Who are underwriters and why are they important? #3. What is meant by limited liability? #4. What is the definition of liquidity? #5. What is the difference between common and preferred stock? #6. What factors are considered important in determining a stock’s price? #7. What are balance sheets and income statements? #8. What are some US stock indexes? #9. What is meant by bull and bear markets? #10. What does it mean to sell stock short?