nyse and nasdaq net advances surge to highest levels of the year

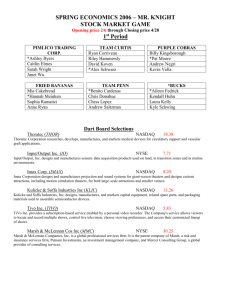

advertisement

Mon, Aug 15 2011 7:58 AM ET Previous Market MessageNext Market Message NYSE AND NASDAQ NET ADVANCES SURGE TO HIGHEST LEVELS OF THE YEAR -- SETTING RESISTANCE FOR THE DOW, NASDAQ AND NY COMPOSITE By Arthur Hill NYSE AND NASDAQ NET ADVANCES SURGE TO HIGHEST LEVELS OF THE YEAR...Link for today’s video. The July-August decline started with a negative breadth surge on July 27th. Charts in the Market Message for that day showed Net Advances for both the NYSE and the Nasdaq plunging to their lowest levels of the year. Net Advances plunged even further on August 4th and 8th. Early August breadth was the most negative of the year. Breadth did an incredible about face with the biggest positive breadth surges of the year last Tuesday and Thursday. Chart 1 shows the Nasdaq AD Line (gray) with Net Advances Percent ($NAAD:$NATOT) in the indicator window. The Nasdaq is the pink dotted line. Notice how advances off the March and June lows started with big positive breadth surges. These surges are like the first stage of a rocket launch. Enormous power is required to get the rocket off the ground and establish upside momentum. Less power is needed to maintain upside momentum after the launch. It is very unusual to see to big negative breadth surges and two big positive breadth surges in such a short period of time. Being the more recent, the positive breadth surges carry more weight and suggest that this oversold bounce will extend further. (click to view a live version of this chart) Chart 1 (click to view a live version of this chart) Chart 2 Chart 2 shows the NYSE AD Line with Net Advances Percent ($NYAD:$NYTOT). The NY Composite ($NYA) is the pink dotted line. Breadth surges signaled the start of the March and June advances (black arrows). The positive breadth surges on Tuesday and Thursday were both above .80 (80 percent). This is because over 90% of all NYSE stocks advanced. The rest were unchanged or declined. Keep in mind that Net Advances equals advancing issues less declining issues. Net Advances Percent is Net Advances divided by total issues traded. Chart 3 shows the Nasdaq AD Volume Line and Net Advancing Volume Percent for reference. Chart 4 shows the same indicators for the NYSE. (click to view a live version of this chart) Chart 3 (click to view a live version of this chart) Chart 4 SETTING RESISTANCE FOR THE DOW, NASDAQ AND NY COMPOSITE... On Friday I showed potential resistance levels for the S&P 500 ETF (SPY) and Russell 2000 ETF (IWM). These were based on broken support and the Fibonacci Retracements Tool. As an addition, I will show resistance levels for the Nasdaq, NY Composite and Dow as well. These techniques can be applied to any security that broke support with a sharp decline the last few weeks. That pretty much applies to the majority of stocks right now. Broken support and the 50% retracement mark resistance for the Nasdaq. The resistance zone for the Dow centers around 10700. Resistance for the NY Composite ($NYA) resides around 7900. (click to view a live version of this chart) Chart 5 (click to view a live version of this chart) Chart 6 (click to view a live version of this chart) Chart 7 Any Comments On This Article? 20110815-1