Chapter 3

advertisement

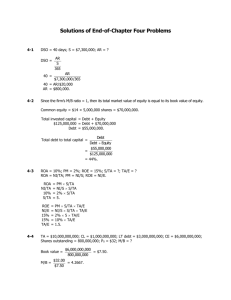

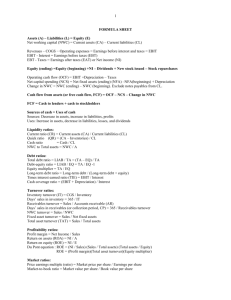

Chapter 3 Analysis of Financial Statements SOLUTIONS TO END-OF-CHAPTER PROBLEMS 3-1 DSO = 40 days; S = $7,300,000; AR = ? AR S 365 DSO = AR $7,300,000/365 40 = AR/$20,000 AR = $800,000. 40 = 3-2 A/E = 2.4; D/A = ? D 1 = 1 - A A E D 1 = 1 A 2.4 D . = 0.5833 = 58.33%. A 3-3 3-4 ROA = 10%; PM = 2%; ROE = 15%; S/TA = ?; TA/E = ? ROA = NI/A; PM = NI/S; ROE = NI/E. ROA NI/A 10% S/TA = = = = PM S/TA NI/S S/TA 2% S/TA 5. ROE NI/E 15% 15% TA/E = = = = = PM S/TA TA/E NI/S S/TA TA/E 2% 5 TA/E 10% TA/E 1.5. TA = $10,000,000,000; CL = $1,000,000,000; LT debt = $3,000,000,000; CE = $6,000,000,000; Shares outstanding = 800,000,000; P0 = $32; M/B = ? 3-1 Book value = M/B = 3-5 $6,000,000,000 = $7.50. 800,000,000 $32.00 = 4.2667. $7.50 TA = $12,000,000,000; T = 40%; EBIT/TA = 15%; ROA = 5%; TIE = ? EBIT = 0.15 $12,000,000,000 EBIT = $1,800,000,000. NI = 0.05 $12,000,000,000 NI = $600,000,000. Now use the income statement format to determine interest so you can calculate the firm’s TIE ratio. EBIT $1,800,000,000 See above. INT = EBIT – EBT = $1,800,000,000 - $1,000,000,000 INT 800,000,000 EBT $1,000,000,000 EBT = $600,000,000/0.6 Taxes (40%) 400,000,000 NI $ 600,000,000 See above. TIE = EBIT/INT = $1,800,000,000/$800,000,000 = 2.25. 3-6 We are given ROA = 3% and Sales/Total assets = 1.5. ROA = Profit margin Total assets turnover 3% = Profit margin(1.5) Profit margin = 3%/1.5 = 2%. From Du Pont equation: We can also calculate the company’s debt ratio in a similar manner, given the facts of the problem. We are given ROA(NI/A) and ROE(NI/E); if we use the reciprocal of ROE we have the following equation: E A E A E A D A 3-2 NI E D E and = 1 , so A NI A A 1 = 3% 0.05 = = 60% . = 1 - 0.60 = 0.40 = 40% . Alternatively, ROE = ROA EM 5% = 3% EM EM = 5%/3% = 5/3 = TA/E. Take reciprocal: E/TA = 3/5 = 60%; therefore, D/A = 1 - 0.60 = 0.40 = 40%. Thus, the firm’s profit margin = 2% and its debt ratio = 40%. 3-7 Present current ratio = $1,312,500 = 2.5. $525,000 Minimum current ratio = $1,312,500 + NP = 2.0. $525,000 + NP $1,312,500 + NP = $1,050,000 + 2NP NP = $262,500. Short-term debt can increase by a maximum of $262,500 without violating a 2 to 1 current ratio, assuming that the entire increase in notes payable is used to increase current assets. Since we assumed that the additional funds would be used to increase inventory, the inventory account will increase to $637,500 and current assets will total $1,575,000. 3-8 TIE = EBIT/INT, so find EBIT and INT. Interest = $500,000 0.1 = $50,000. Net income = $2,000,000 0.05 = $100,000. Pre-tax income (EBT) = $100,000/(1 - T) = $100,000/0.7 = $142,857. EBIT = EBT + Interest = $142,857 + $50,000 = $192,857. TIE = $192,857/$50,000 = 3.86. 3-9 TA = $30,000,000,000; EBIT/TA = 20%; TIE = 8; DA = $3,200,000,000; Lease payments = $2,000,000,000; Principal payments = $1,000,000,000; EBITDA coverage = ? EBIT/$30,000,000,000 = 0.2 EBIT = $6,000,000,000. 3-3 8 = EBIT/INT 8 = $6,000,000,000/INT INT = $750,000,000. EBITDA = EBIT + DA = $6,000,000,000 + $3,200,000,000 = $9,200,000,000. EBITDA Lease payments INT Princ. pmts Lease pmts $9,200,000,000 $2,000,000,000 = $750,000,000 $1,000,000,000 $2,000,000,000 $11,200,000,000 = = 2.9867. $3,750,000,000 EBITDA coverage ratio = 3-10 ROE = Profit margin TA turnover Equity multiplier = NI/Sales Sales/TA TA/Equity. Now we need to determine the inputs for the equation from the data that were given. On the left we set up an income statement, and we put numbers in it on the right: Sales (given) - Cost EBIT (given) - INT (given) EBT - Taxes (34%) NI $10,000,000 na $ 1,000,000 300,000 $ 700,000 238,000 $ 462,000 Now we can use some ratios to get some more data: Total assets turnover = 2 = S/TA; TA = S/2 = $10,000,000/2 = $5,000,000. D/A = 60%; so E/A = 40%; and, therefore, Equity multiplier = TA/E = 1/(E/A) = 1/0.4 = 2.5. Now we can complete the Du Pont equation to determine ROE: ROE = $462,000/$10,000,000 $10,000,000/$5,000,000 2.5 = 0.231 = 23.1%. 3-4 3-11 Known data: TA = $1,000,000; kd = 8%; T = 40%; BEP = 0.2 = EBIT/Total assets, so EBIT = 0.2($1,000,000) = $200,000; D/A = 0.5 = 50%, so Equity = $500,000. EBIT Interest EBT Tax (40%) NI D/A = 0% $200,000 0 $200,000 80,000 $120,000 D/A = 50% $200,000 40,000* $160,000 64,000 $ 96,000 NI $120,000 $96,000 = = 12% = 19.2% Equity $1,000,000 $500,000 Difference in ROE = 19.2% - 12.0% = 7.2%. ROE = *If D/A = 50%, then half of the assets are financed by debt, so Debt = $500,000. At an 8 percent interest rate, INT = $40,000. 3-12 Statement a is correct. Refer to the solution setup for Problem 3-11 and think about it this way: (1) Adding assets will not affect common equity if the assets are financed with debt. (2) Adding assets will cause expected EBIT to increase by the amount EBIT = BEP(added assets). (3) Interest expense will increase by the amount kd(added assets). (4) Pre-tax income will rise by the amount (added assets)(BEP - kd). Assuming BEP > kd, if pre-tax income increases so will net income. (5) If expected net income increases but common equity is held constant, then the expected ROE will also increase. Note that if kd > BEP, then adding assets financed by debt would lower net income and thus the ROE. Therefore, Statement a is true--if assets financed by debt are added, and if the expected BEP on those assets exceeds the cost of debt, then the firm’s ROE will increase. Statements b, c, and d are false, because the BEP ratio uses EBIT, which is calculated before the effects of taxes or interest charges are felt. Of course, Statement e is also false. 3-13 a. Currently, ROE is ROE1 = $15,000/$200,000 = 7.5%. The current ratio will be set such that 2.5 = CA/CL. CL is $50,000, and it will not change, so we can solve to find the new level of current assets: CA = 2.5(CL) = 2.5($50,000) = $125,000. This is the level of current assets that will produce a current ratio of 2.5. At present, current assets amount to $210,000, so they can be reduced by $210,000 - $125,000 = $85,000. If the $85,000 generated is used to retire common equity, then the new common equity balance will be $200,000 - $85,000 = $115,000. Assuming that net income is unchanged, the new ROE will be ROE2 = $15,000/$115,000 = 13.04%. Therefore, ROE will increase by 13.04% 7.50% = 5.54%. b. 1. Doubling the dollar amounts would not affect the answer; it would still be 5.54%. 3-5 2. Common equity would increase by $25,000 from the Part a scenario, which would mean a new ROE of $15,000/$140,000 = 10.71%, which would mean a difference of 10.71% - 7.50% = 3.21%. 3. An inventory turnover of 2 would mean inventories of $100,000, down $50,000 from the current level. That would mean an ROE of $15,000/$150,000 = 10.00%, so the change in ROE would be 10.00% 7.5% = 2.5%. 4. If the company had 10,000 shares outstanding, then its EPS would be $15,000/10,000 = $1.50. The stock has a book value of $200,000/10,000 = $20, so the shares retired would be $85,000/$20 = 4,250, leaving 10,000 - 4,250 = 5,750 shares. The new EPS would be $15,000/5,750 = $2.6087, so the increase in EPS would be $2.6087 - $1.50 = $1.1087, which is a 73.91 percent increase, the same as the increase in ROE. 5. If the stock was selling for twice book value, or 2 $20 = $40, then only half as many shares could be retired ($85,000/$40 = 2,125), so the remaining shares would be 10,000 - 2,125 = 7,875, and the new EPS would be $15,000/7,875 = $1.9048, for an increase of $1.9048 - $1.5000 = $0.4048. c. We could have started with lower inventory and higher accounts receivable, then had you calculate the DSO, then move to a lower DSO that would require a reduction in receivables, and then determine the effects on ROE and EPS under different conditions. Similarly, we could have focused on fixed assets and the FA turnover ratio. In any of these cases, we could have had you use the funds generated to retire debt, which would have lowered interest charges and consequently increased net income and EPS. If we had to increase assets, then we would have had to finance this increase by adding either debt or equity, which would have lowered ROE and EPS, other things held constant. Finally, note that we could have asked some conceptual questions about the problem, either as a part of the problem or without any reference to the problem. For example, “If funds are generated by reducing assets, and if those funds are used to retire common stock, will EPS and/or ROE be affected by whether or not the stock sells above, at, or below book value?” 3-14 TA = $7,500,000,000; EBIT/TA = 10%; TIE = 2.5; DA = $1,250,000,000; Lease payments = $775,000,000; Principal payments = $500,000,000; EBITDA coverage = ? EBIT/$7,500,000,000 = 0.10 EBIT = $750,000,000. 2.5 = EBIT/INT 2.5 = $750,000,000/INT INT = $300,000,000. 3-6 EBITDA = EBIT + DA = $750,000,000 + $1,250,000,000 = $2,000,000,000. EBITDA Lease payments INT Princ. pmts Lease pmts $2,000,000,000 $775,000,000 = $300,000,000 $500,000,000 $775,000,000 $2,775,000,000 = = 1.7619 1.76. $1,575,000,000 EBITDA coverage ratio = 3-15 TA = $5,000,000,000; T = 40%; EBIT/TA = 10%; ROA = 5%; TIE ? EBIT 0.10 $5,000,000,000 EBIT $500,000,000. NI 0.05 $5,000,000,000 NI $250,000,000. Now use the income statement format to determine interest so you can calculate the firm’s TIE ratio. EBIT $500,000,000 INT 83,333,333 EBT $416,666,667 Taxes (40%) 166,666,667 NI $250,000,000 See above. INT = EBIT – EBT = $500,000,000 - $416,666,667 EBT = $250,000,000/0.6 See above. TIE = EBIT/INT = $500,000,000/$83,333,333 = 6.0. 3-16 Total market value = $3,750,000,000(1.9) = $7,125,000,000. Market value per share = $7,125,000,000/50,000,000 = $142.50. Alternative solution: Book value per share = $3,750,000,000/50,000,000 = $75. Market value per share = $75(1.9) = $142.50. 3-17 Step 1: Solve for 55 = 55Sales = Sales = current annual sales using the DSO equation: $750,000/(Sales/365) $273,750,000 $4,977,272.73. 3-7 Step 2: If sales fall by 15%, the new sales level will be $4,977,272.73(0.85) = $4,230,681.82. Again, using the DSO equation, solve for the new accounts receivable figure as follows: 35 = AR/($4,230,681.82/365) 35 = AR/$11,590.91 AR = $405,681.82 $405,682. 3-18 The current EPS is $2,000,000/500,000 shares or $4.00. The current P/E ratio is then $40/$4 = 10.00. The new number of shares outstanding will be 650,000. Thus, the new EPS = $3,250,000/650,000 = $5.00. If the shares are selling for 10 times EPS, then they must be selling for $5.00(10) = $50. 3-19 Step 1: Calculate total assets from information given. Sales = $6 million. 3.2 = Sales/TA $6,000,000 3.2 = Assets Assets = $1,875,000. Step 2: Calculate net income. There is 50% debt and 50% equity, so Equity = $1,875,000 0.5 = $937,500. ROE = NI/S S/TA TA/E 0.12 = NI/$6,000,000 3.2 $1,875,000/$937,500 6.4NI 0.12 = $6,000,000 $720,000 = 6.4NI $112,500 = NI. 3-20 Given ROA = 8% and net income of $600,000, total assets must be $7,500,000. NI TA $600,000 8% = TA TA = $7,500,000. ROA = To calculate BEP, we still need EBIT. income statement: EBIT Interest EBT Taxes (35%) NI 3-8 $1,148,077 225,000 $ 923,077 323,077 $ 600,000 To calculate EBIT construct a partial ($225,000 + $923,077) (Given) $600,000/0.65 EBIT TA $1,148,077 = $7,500,000 = 0.1531 = 15.31%. BEP = 3-21 1. Debt = (0.50)(Total assets) = (0.50)($300,000) = $150,000. 2. Accounts payable = Debt – Long-term debt = $150,000 - $60,000 = $90,000. 3. Common stock = Total liabilities - Debt - Retained earnings and equity = $300,000 - $150,000 - $97,500 = $52,500. 4. Sales = (1.5)(Total assets) = (1.5)($300,000) = $450,000. 5. Inventories = Sales/5 = $450,000/5 = $90,000. 6. Accounts receivable = (Sales/365)(DSO) = ($450,000/365)(36.5) = $45,000. 7. Cash + Accounts receivable + Inventories Cash + $45,000 + $90,000 Cash + $135,000 Cash = = = = (1.8)(Accounts payable) (1.8)($90,000) $162,000 $27,000. 8. Fixed assets = Total assets - (Cash + Accts rec. + Inventories) Fixed assets = $300,000 - ($27,000 + $45,000 + $90,000) Fixed assets = $138,000. 9. Cost of goods sold = (Sales)(1 - 0.25) = ($450,000)(0.75) = $337,500. 3-9 3-22 a. (Dollar amounts in thousands.) Firm DSO = Industry Average Current assets Current liabilities = $655,000 $330,000 = 1.98 Accounts receivable Sales/365 = $336,000 $4,404.11 = 76.3 days Sales Inventories = $1,607,500 $241,500 = 6.66 6.7 Sales Total assets = $1,607,500 = $947,500 1.70 3.0 Net income Sales = $27,300 = $1,607,500 1.7% 1.2% Net income Total assets = $27,300 $947,500 = 2.9% 3.6% Net income Common equity = $27,300 $361,000 = 7.6% 9.0% Total debt Total assets = $586,500 $947,500 = 61.9% 60.0% 2.0 35 days b. For the firm, ROE = PM T.A. turnover EM = 1.7% 1.7 $947,500 = 7.6%. $361,000 For the industry, ROE = 1.2% 3 2.5 = 9%. Note: To find the industry ratio of assets to common equity, recognize that 1 - (total debt/total assets) = common equity/total assets. So, common equity/total assets = 40%, and 1/0.40 = 2.5 = total assets/common equity. c. The firm’s days sales outstanding is more than twice as long as the industry average, indicating that the firm should tighten credit or enforce a more stringent collection policy. The total assets turnover ratio is well below the industry average so sales should be increased, assets decreased, or both. While the company’s profit margin is higher than the industry average, its other profitability ratios are low compared to the industry--net income should be higher given the amount of equity and assets. However, the company seems to be in an average liquidity position and financial leverage is similar to others in the industry. 3 - 10 d. If 2002 represents a period of supernormal growth for the firm, ratios based on this year will be distorted and a comparison between them and industry averages will have little meaning. Potential investors who look only at 2002 ratios will be misled, and a return to normal conditions in 2003 could hurt the firm’s stock price. 3-23 a. Firm Current ratio = Debt to total assets = Times interest = earned Current assets = Current liabilities Industry Average $303 $111 = 2.73 2 Debt Total assets = $135 $450 = 30.00% 30.00% EBIT Interest = $49.5 $4.5 = 11 7 $61.5 $6.5 = 9.46 9 $795 $159 = 5 10 EBITDA coverage = EBITDA Lease pymts = Princ. Lease INT pymts pymts Inventory turnover = Sales Inventories = Accounts receivable $66 = Sales/365 $795/365 DSO = F.A. Turnover = Sales Net fixed assets = $795 $147 = 5.41 6 T.A. Turnover = Sales Total assets = $795 $450 = 1.77 3 Net income Sales = $27 $795 = 3.40% 3.00% Net income Total assets = $27 $450 = 6.00% 9.00% = 6% 1.4286 = 8.57% 12.90% Profit margin = Return on total assets = Return on common equity = ROA EM = 30.3 days 24 days Alternatively, ROE = Net income $27 = = 8.57% 8.6%. Equity $315 3 - 11 b. ROE = Profit margin Total assets turnover Equity multiplier = Total assets Net income Sales Common equity Sales Total assets = $27 $795 $450 = 3.4% 1.77 1.4286 = 8.6%. $795 $450 $315 Profit margin Total assets turnover Equity multiplier Firm 3.4% 1.77 1.4286 Industry 3.0% 3.0 1.43* Comment Good Poor O.K. D E = TA TA 1 – 0.30 = 0.7 TA 1 EM = = = 1.43. 0.7 E * 1 - Alternatively, EM = ROE/ROA = 12.9%/9% = 1.43. c. Analysis of the Du Pont equation and the set of ratios shows that the turnover ratio of sales to assets is quite low. Either sales should be increased at the present level of assets, or the current level of assets should be decreased to be more in line with current sales. d. The comparison of inventory turnover ratios shows that other firms in the industry seem to be getting along with about half as much inventory per unit of sales as the firm. If the company’s inventory could be reduced, this would generate funds that could be used to retire debt, thus reducing interest charges and improving profits, and strengthening the debt position. There might also be some excess investment in fixed assets, perhaps indicative of excess capacity, as shown by a slightly lower-than-average fixed assets turnover ratio. However, this is not nearly as clear-cut as the overinvestment in inventory. e. If the firm had a sharp seasonal sales pattern, or if it grew rapidly during the year, many ratios might be distorted. Ratios involving cash, receivables, inventories, and current liabilities, as well as those based on sales, profits, and common equity, could be biased. It is possible to correct for such problems by using average rather than end-of-period figures. 3 - 12 3-24 a. Here are the firm’s base case ratios and other data as compared to the industry: Current Inventory turnover Days sales outstanding Fixed assets turnover Total assets turnover Return on assets Return on equity Debt ratio Profit margin on sales EPS Stock Price P/E ratio P/CF ratio M/B ratio Firm 2.3 4.8 37.4 days 10.0 2.3 5.9% 13.1 54.8 2.5 $4.71 $23.57 5.0 2.0 0.65 Industry 2.7 7.0 32.0 days 13.0 2.6 9.1% 18.2 50.0 3.5 n.a. n.a. 6.0 3.5 n.a. Comment Weak Poor Poor Poor Poor Bad Bad High Bad --Poor Poor -- The firm appears to be badly managed--all of its ratios are worse than the industry averages, and the result is low earnings, a low P/E, a low stock price, and a low M/B ratio. The company needs to do something to improve. b. A decrease in the inventory level would improve the inventory turnover, total assets turnover, and ROA, all of which are too low. It would have some impact on the current ratio, but it is difficult to say precisely how that ratio would be affected. If the lower inventory level allowed the company to reduce its current liabilities, then the current ratio would improve. The lower cost of goods sold would improve all of the profitability ratios and, if dividends were not increased, would lower the debt ratio through increased retained earnings. All of this should lead to a higher market/book ratio, a higher stock price, a higher price/earnings ratio, and a higher price/cash flow ratio. 3 - 13