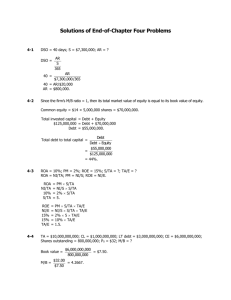

Solutions to Homework Problems

advertisement

Week-­‐2: Solutions to HW Problems CA - I CA 3-7 CA = $3,000,000; = 1.5; = 1.0; CL CL CL = ?; I = ? CA = 1.5 CL $3,000,000 = 1.5 CL 1.5 CL = $3,000,000 CL = $2,000,000. CA - I nv = 1.0 CL $3,000,000 - I nv = 1.0 $2,000,000 $3,000,000 - I nv = $2,000,000 I nv = $1,000,000. 3-8 We are given ROA = 4%, ROE = 7%, and TAT = Sales/Total assets = 1.2×. From Du Pont equation: ROA = Profit margin × Total assets turnover 4% = Profit margin (1.2) Profit margin = 4%/1.2 = 3.33%. We can also calculate the company’s liabilities-to-assets (L/TA) ratio in a similar manner, given the facts of the problem. We are given ROA = NI/TA and ROE= NI/E. We begin by finding the percentage of assets financed by equity, E/TA: E ⎛ NI ⎞ ⎛ E ⎞ ⎛ 1 ⎞ = ⎜ ⎟ ⎜ ⎟ = ROA ⎜ ⎟ = ROA/ROE TA ⎝ TA ⎠ ⎝ NI ⎠ ⎝ ROE ⎠ E = ROA/ROE = 4%/7% = 57.14%. TA By definition, L + E = Total liabilities & Equity = TA. Therefore, the percentage of the firm financed by liabilities is equal to 1 minus the percentage financed by equity: L E =1− = 1 −57.14% = 42.86%. TA TA To find the debt-to-total asset (i.e., the debt ratio), begin with the total liabilitiesto-assets ratio of 42.86%. We are given that half of the liabilities are debt, so the debt ratio is: Debt ratio = Debt-to-total assets = (0.5)(L/TA) = (0.5)(42.86%) = 21.43%. 3-10 TIE = EBIT/INT, so find EBIT and INT. Interest = $600,000 × 0.08 = $48,000. Net income = $3,000,000 × 0.03 = $90,000. Pre-tax income = $90,000/(1 - T) = $90,000/0.6 = $150,000. EBIT = $150,000 + $48,000 = $198,000. TIE = $198,000/$48,000 = 4.125×. The loan will not be renewed and they will go bankrupt! 3-14 Here are the firm’s base case ratios and other data as compared to the industry: Quick Current Inventory turnover Days sales outstanding Fixed assets turnover Total assets turnover Return on assets Return on equity Profit margin on sales Debt ratio Liabilities-to-assets EPS Stock Price P/E ratio P/CF ratio M/B ratio $511,000/$602,000 $1,405,000/$602,000 $3,739,000/$894,000 $439,000/$11,753 $4,290,000/$431,000 $4,290,000/$1,836,000 $108,408/$1,836,000 $108,408/$829,710 $108,408/$4,290,000 $504,290/$1,836,000 $1,006,290/$1,836,000 $4.71 $23.57 $23.57/$4.71 $23.57/$11.63 $23.57/$36.07 Firm = 0.8 = 2.3 = 4.2 = 37 days = 10.0 = 2.3 = 5.9% = 13.1% = 2.5% = 27.5% = 54.8% = 5.0 = 2.0 = 0.65 Industry Comment 1.0 Weak 2.7 Weak 7.0 Poor 32 days Poor 13.0 Poor 2.6 Poor 9.1% Bad 18.2% Bad 3.5% Bad 21.0% High 50.0% High n.a. -n.a. -6.0 Poor 3.5 Poor n.a. -- The firm appears to be badly managed--all of its ratios are worse than the industry averages, and the result is low earnings, a low P/E, P/CF ratio, a low stock price, and a low M/B ratio. The company needs to do something to improve.