Sample Test

advertisement

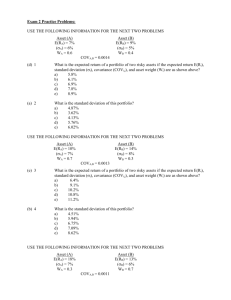

Corporate Finance MGRS 365 – Exam IV Ali Nejadmalayeri November 5, 2002 NAME: ID: R 0 0 0 __ __ __ __ __ __ __ __ __ Each question has 12½ points. Please answer all questions and show your work. Good Luck. Use the following to answer questions 1 – 3: Over the 1926–1998 period, the major assets perform as following: Asset Large-company stocks Small-company stocks Long-term government bonds US Treasury bills Average Return 13.2% 17.4% 5.7% 3.8% Standard Deviation 20.3% 33.8% 9.2% 3.2% 1. Assume that the dividend yield for a prototypical small-stock company is 1.4%, and the stock is selling for $100. After one year, what will be the value of a portfolio consisting of 1000 shares of such a company? Total Return = Capital Gain (Loss) + Dividend Yield Capital Gain Small Stocks = 17.4% – 1.4% = 16% = Price End / Price Beg. – 1 Price End = 1.16 100 = 116 Value End = Price End #Shares = $116,000 2. If all assets’ returns are normally distributed, what range of returns can you NOT state, with 99% confidence, that next year's large-company stocks return might be equal to? With 99% change outcomes fall in the range of [avg. – 3 std. , avg. + 3 std.] So outside this is the range that ( , avg. – 3 std.] AND [avg. + 3 std., + ) or in this case ( , 13.2% – 60.9%] AND [13.2% + 60.9%, + ) = ( , 47.7%] AND [74.1%, + ) 3. Assume the small stock returns are normally distributed. With 95% confidence, what is the highest return you would expect to earn on small stocks? With 95% change outcomes fall in the range of [avg. – 2 std. , avg. + 2 std.] So the largest outcome is avg. + 2 std. = 7.4% + 67.6% = 85% Use the following to answer questions 4 – 5: State Boom Bust 4. Probability 0.60 0.40 Return on A 25% –15% Return on B 15% 5% What is the expected return on a portfolio with weights of 75% in asset A and 25% in asset B? State Boom Bust Probability 0.60 0.40 Return on Portfolio ¾ 25% + ¼ 15% = 22.5% ¾ –15% + ¼ 5% = –10% Expected return = 0.60 22.5% + 0.40 –10% = 9.5% Corporate Finance MGRS 365 – Exam IV Ali Nejadmalayeri November 5, 2002 NAME: ID: R 0 0 0 __ __ __ __ __ __ __ __ __ 5. What is the standard deviation of returns on a portfolio with weights of 75% in asset A and 25% in asset B? State Boom Bust Probability 0.60 0.40 ( Expected Return on Portfolio – Return on Portfolio)2 ( 22.5% – 9.5% ) 2 = 132 = 169 (–10% – 9.5% ) 2 = –19.52 = 380.25 Var. of return = 0.60 169 + 0.40 380.25 = 253.5 Std. Dev. of return = 15.92% Use the following to answer questions 6 – 8: Security A B Risk-free asset Standard Deviation 8% 14% ??? Beta 1.2 ? ??? An equally weighted portfolio of stocks A and B has a beta of 1.10. What’s the stock B’s beta? 6. Return 15% 12% 3% portfolio = wA A + wB B = ½ 1.2 + ½ B = 1.1 B = 1 7. Assume that stock A is justly-priced. Is stock B also justly-priced? or, under-priced? or, over-priced? Prove your answer. Since A is justly priced then: rm – rf = 15% – 3% / 1.2 = 10% However the reward to risk ratio of B is 12% – 3% / 1 = 9% which is less than 10%, so B is overpriced, i.e., it does not generate high enough return. 8. What’s the risk-free asset’s beta? What’s the risk-free asset’s standard deviation? Which of A and B has the least total risk? Which of A and B has the least systematic risk? Justify your answer. f = 0; f = 0; no systematic or idiosyncratic risk! B >A B has more total risk, note total risk is measured by variance B < A A has more systematic risk, note total risk is measured by beta For idiosyncratic risk we need to know market total risk, then the idiosyncratic risk = [2 – 2M] ½