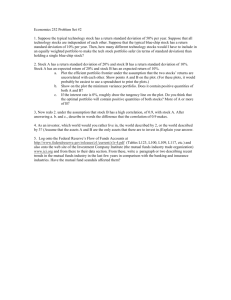

Project I

advertisement

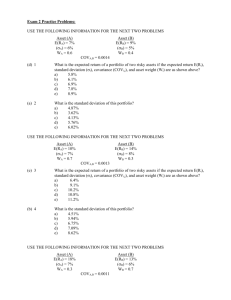

Project I. Finance Application1 Your group works as a team for a major brokerage firm. Your team’s job is to advise high net-worth clients in their investment decision-making process. To the extent you are successful, they and their friends will increase the amount of money you manage for them. As your clients are professionals in non-financial fields, they are somewhat unsophisticated in their approach to investing. Much of your job therefore, depends upon your ability to clearly and precisely educate them in their investment decision-making process. A brand new client has just been referred to you. She is a Medical Doctor at the local hospital, and has not invested in the stock market in the past. She has been watching the news, and talking to friends, and is convinced that the stock market will be going up. She has $1,000,000 to invest, and wants it invested aggressively. She gives you a list of 5 stocks and asks which one she should invest in. She believes that she should focus on only one stock that she knows very well. How do you respond? As a group, you decide the following: 1. You divide your group in to two teams: the analytical team, and the sales team. The analytical team (that’s your Econ203 group) will handle the analysis, and the sales team (these are a bunch of bozos who are majoring in underwater basketweaving) will handle the client contact—the client is unsophisticated so the thought is they should mesh well with her. While the group as a whole has the objective of analysis and presentation, you only need to concern yourself with the analytical portion. Completing the Project Homework will suffice in this regard. 2. As an analytical team, you realize you need to begin by building credibility with the client. To do so, you gather 5 years of monthly data on each of the stocks she has requested, as well as the S&P 500 Index.. You calculate the average monthly return and risk (standard deviation) associated with each item. As your client is intent on investing aggressively, you will want to include the “beta” associated with each instrument relative to the S&P 500 Index. Create a table with each of these values included, as well as the 3-month (constant maturity) Treasury Bill (which you will have to put into monthly terms for consistency).2 3. Your statistical training suggests that your client’s desire to invest in only one stock is unnecessarily risky. You need to demonstrate this fact with hard evidence. To illustrate this, you decide to use historical annual averages of one 1 Useful references for your analysis can be found in Keller & Warrack on pp. 107-111, Section 6.7, and Section 17.6. 2 You should maintain the data in monthly terms for this part of the project. Would the “beta” change if you put everything in annual terms? risky asset (S&P total return index) and one relatively safe asset (3-month constant maturity US Treasury Bill) and demonstrate how risk and return are impacted by combining them into a single portfolio. You do this by filling in the table given below, and by constructing a graph with risk on the horizontal axis and return on the vertical axis (connect the data points with a single line). NOTE that for this part of the analysis, you are using general market data as provided in this footnote, not data from your five firms.3 Armed with this analysis, you should point out to your client which weighting of bonds and stocks (of all the possible weights from 0 to 1, not only the weights given in your table—this can be done via visual inspection) would provide her with the maximum return, and which would provide the least risk. In particular, you should explain why the least risky portfolio is not necessarily comprised solely of the least risky asset. Finally, she would like to know what the graph you provided her would look like if the correlation coefficients were –1 and +1 instead of 0. Provide her with both of these graphs and tables as well. Benefits of Diversification Investment Proportion Bonds Stocks 0% 100% 20% 80% 40% 60% 60% 40% 80% 20% 100% 0% r= 0 Portfolio Expected Return Standard Deviation 4. A few weeks after your initial findings are passed on to the client, she returns with a few follow-up questions. She is very pleased with your analysis, and is now more aware of the risks associated with these asset classes. She would like to know the correlation coefficients between the five companies she provided you, and if she were to combine two of these companies into a portfolio based purely on risk reduction, which two of the five stocks she should combine into this portfolio.4 3 To perform the necessary calculations, you will need the following annual information: the historical return for bonds has been 9%, with standard deviation of 12%. Returns for the S&P 500 index has been 18%, with a standard deviation of 26%. Assume the correlation coefficient between the two assets is zero for the initial table and graph. 4 All you need to provide here is a table of the correlation coefficients between all five of the stocks. You should then select the pair of assets that reduces the risk by the largest amount relative to investing in each asset individually. You do not need to determine which pair necessarily provides the least overall risk. You should then calculate the expected return of only this pair of “recommended” assets for inclusion in your analysis.