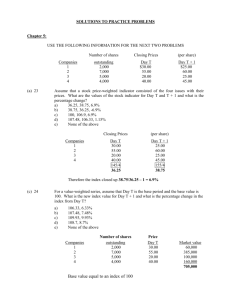

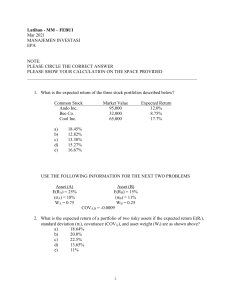

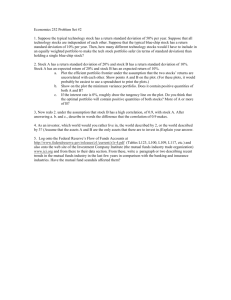

use the following information for the next two problems

advertisement

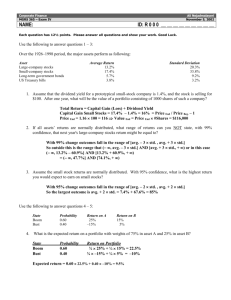

Exam 2 Practice Problems: USE THE FOLLOWING INFORMATION FOR THE NEXT TWO PROBLEMS Asset (A) E(RA) = 7% (A) = 6% WA = 0.6 Asset (B) E(RB) = 9% (B) = 5% WB = 0.4 COVA,B = 0.0014 (d) 1 What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation (i), covariance (COVi,j), and asset weight (Wi) are as shown above? a) 5.8% b) 6.1% c) 6.9% d) 7.8% e) 8.9% (a) 2 What is the standard deviation of this portfolio? a) 4.87% b) 3.62% c) 4.13% d) 5.76% e) 6.02% USE THE FOLLOWING INFORMATION FOR THE NEXT TWO PROBLEMS Asset (A) E(RA) = 10% (A) = 7% WA = 0.7 Asset (B) E(RB) = 14% (B) = 8% WB = 0.3 COVA,B = 0.0013 (e) 3 What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation (i), covariance (COVi,j), and asset weight (Wi) are as shown above? a) 6.4% b) 9.1% c) 10.2% d) 10.8% e) 11.2% (b) 4 What is the standard deviation of this portfolio? a) 4.51% b) 5.94% c) 6.75% d) 7.09% e) 8.62% USE THE FOLLOWING INFORMATION FOR THE NEXT TWO PROBLEMS Asset (A) E(RA) = 18% (A) = 7% WA = 0.3 Asset (B) E(RB) = 13% (B) = 6% WB = 0.7 COVA,B = 0.0011 (d) 5 What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation (i), covariance (COVi,j), and asset weight (Wi) are as shown above? a) 10.10% b) 11.60% c) 13.88% d) 14.50% e) 15.37% (a) 6 What is the standard deviation of this portfolio? a) 5.16% b) 5.89% c) 6.11% d) 6.57% e) 7.02% (e) 7 Calculate the expected return for D Industries which has a beta of 1.0 when the risk free rate is 0.03 and you expect the market return to be 0.13. a) 8.6% b) 9.2% c) 11.0% d) 12.0% e) 13.0% (d) 8 Calculate the expected return for E Services which has a beta of 1.5 when the risk free rate is 0.05 and you expect the market return to be 0.11. a) 10.6% b) 12.1% c) 13.6% d) 14.0% e) 16.2% (c) 9 Calculate the expected return for F Inc. which has a beta of 1.3 when the risk free rate is 0.06 and you expect the market return to be 0.125. a) 12.65% b) 13.55% c) 14.45% d) 15.05% e) 16.34% (d) 10 Recently you have received a tip that the stock of Buttercup Industries is going to rise from $76.00 to $85.00 per share over the next year. You know that the annual return on the S&P 500 has been 13% and the 90-day T-bill rate has been yielding 3% per year over the past 10 years. If beta for Buttercup is 1.0, will you purchase the stock? a) Yes, because it is overvalued. b) Yes, because it is undervalued. c) No, because it is undervalued. d) No, because it is overvalued. e) Yes, because the expected return equals the estimated return. USE THE FOLLOWING INFORMATION FOR THE NEXT THREE PROBLEMS You expect the risk-free rate (RFR) to be 5 percent and the market return to be 9 percent. You also have the following information about three stocks. STOCK X Y Z BETA 1.50 0.50 2.00 CURRENT PRICE $ 22 $ 40 $ 45 EXPECTED EXPECTED PRICE DIVIDEND $ 23 $ 0.75 $ 43 $ 1.50 $ 49 $ 1.00 (b) 11 What are the expected (required) rates of return for the three stocks (in the order X, Y, Z)? a) 16.50%, 5.50%, 22.00% b) 11.00%, 7.00%, 13.00% c) 7.95%, 11.25%, 11.11% d) 6.20%, 2.20%, 8.20% e) 15.00%, 3.50%, 7.30% (a) 12 What are the estimated rates of return for the three stocks (in the order X, Y, Z)? a) 7.95%, 11.25%, 11.11% b) 6.20%, 2.20%, 8.20% c) 16.50%, 5.50%, 22.00% d) 11.00%, 7.00%, 13.00% e) 15.00%, 3.50%, 7.30% (e) 13 What is your investment strategy concerning the three stocks? a) Buy stock Y, it is undervalued. b) Buy stock X and Z, they are undervalued. c) Sell stocks X and Z, they are overvalued. d) Sell stock Y, it is overvalued. e) Choices a and c USE THE FOLLOWING INFORMATION FOR THE NEXT TWO PROBLEMS The National Motor Company's last dividend was $1.25 and the directors expect to maintain the historic 4 percent annual rate of growth. You plan to purchase the stock today because you feel that the growth rate will increase to 7 percent for the next three years and the stock will then reach $25.00 per share. (d) 14 How much should you be willing to pay for the stock if you require a 16 percent return? a) b) c) d) e) $17.34 $18.90 $19.09 $19.21 None of the above (c) 15 How much should you be willing to pay for the stock if you feel that the 7 percent growth rate can be maintained indefinitely and you require a 16 percent return? a) b) c) d) e) $11.15 $14.44 $14.86 $18.90 $19.24