Chapter 20 Review Solutions

advertisement

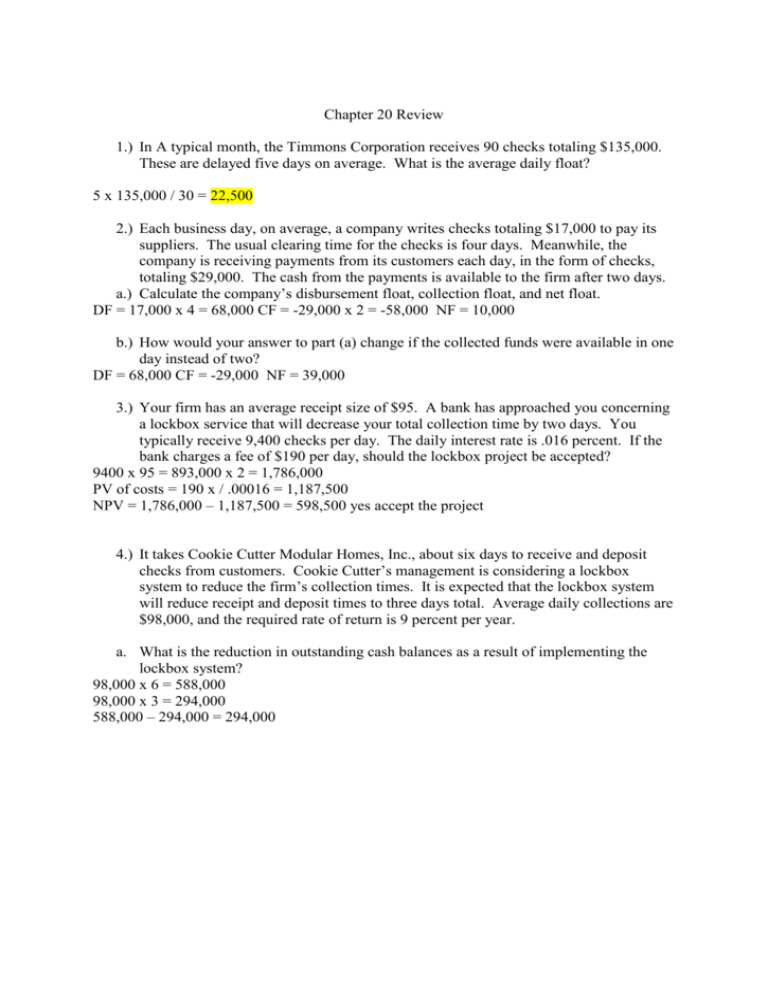

Chapter 20 Review 1.) In A typical month, the Timmons Corporation receives 90 checks totaling $135,000. These are delayed five days on average. What is the average daily float? 5 x 135,000 / 30 = 22,500 2.) Each business day, on average, a company writes checks totaling $17,000 to pay its suppliers. The usual clearing time for the checks is four days. Meanwhile, the company is receiving payments from its customers each day, in the form of checks, totaling $29,000. The cash from the payments is available to the firm after two days. a.) Calculate the company’s disbursement float, collection float, and net float. DF = 17,000 x 4 = 68,000 CF = -29,000 x 2 = -58,000 NF = 10,000 b.) How would your answer to part (a) change if the collected funds were available in one day instead of two? DF = 68,000 CF = -29,000 NF = 39,000 3.) Your firm has an average receipt size of $95. A bank has approached you concerning a lockbox service that will decrease your total collection time by two days. You typically receive 9,400 checks per day. The daily interest rate is .016 percent. If the bank charges a fee of $190 per day, should the lockbox project be accepted? 9400 x 95 = 893,000 x 2 = 1,786,000 PV of costs = 190 x / .00016 = 1,187,500 NPV = 1,786,000 – 1,187,500 = 598,500 yes accept the project 4.) It takes Cookie Cutter Modular Homes, Inc., about six days to receive and deposit checks from customers. Cookie Cutter’s management is considering a lockbox system to reduce the firm’s collection times. It is expected that the lockbox system will reduce receipt and deposit times to three days total. Average daily collections are $98,000, and the required rate of return is 9 percent per year. a. What is the reduction in outstanding cash balances as a result of implementing the lockbox system? 98,000 x 6 = 588,000 98,000 x 3 = 294,000 588,000 – 294,000 = 294,000