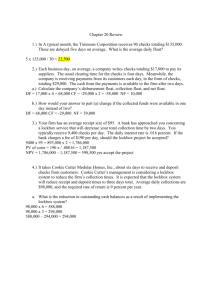

Developments in Banking Services

advertisement

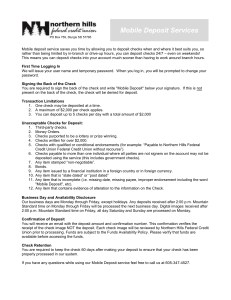

Office Managers, Finance & Accounting Conference May 20 – 21, 2010 Heidi Chafe, CoBank AVP & Senior Cash Management Consultant Agenda Cash Management Objectives Key Areas of Cash Management – Services to Meet Objectives Developments in Banking Services 2 Cash Management Objectives Optimizing how your dollars are utilized each day is key to making your money work for your cooperative and your members… Optimize the use of your cooperative’s cash Minimize borrowing expenses Maximize investment income Enhance efficiencies Reduce administrative and operating costs Maximize control – system users, cash application & float 3 Key Areas of Cash Management: Collections Objectives: Accelerate inflow of funds Reduce clearing and mail float Update accounts receivable Manage & enhance control - system users and cash flows Services to accomplish your objectives: Remote Deposit – Image Cash Letter and/or Remote Deposit Capture Lockbox Services ACH Customer Billing Merchant Services 4 Key Areas of Cash Management: Concentration Objectives: Reduce idle account balances Simplify management of your cash Gain greater control of funds flow Maximize return opportunity Reduce borrowings Services to accomplish your objectives: Investment and/or Loan Sweep Automated Cash Concentration - bank-to-bank sweep Increase investments 5 Key Areas of Cash Management: Disbursement Objectives: Manage the use of your funds Extend or control float – “just-in-time” funding Timely information Ensure payment matches Prevent fraud & errors Services to accomplish your objectives: Controlled Disbursement Positive Pay Fraud Protection – Checks & ACH Paid Check Imaging 6 Developments in Banking Services Services now afforded by technology & legislation: Check 21/Truncation – Remote Deposit Services Scan checks upon receipt in your office Submit your deposit electronically to your bank account – by image or file Eliminates the need to make a trip to the bank and offers extended deadline Advantaged availability on deposited funds Check Conversion & Electronic Checks – Merchant Services Process checks through a terminal at the counter and settle the transaction as an ACH transaction Employ account verification and/or funds guarantee 7 Remote Deposit – Scanning Equipment 8 Remote Deposit – IRD Sample Check 21: Sample IRD or “Substitute Check” 9 Contact Information Heidi Chafe Senior Consultant Cash Management / eCommerce (303) 740-4029 hchafe@cobank.com 10