1 - Homework Market

advertisement

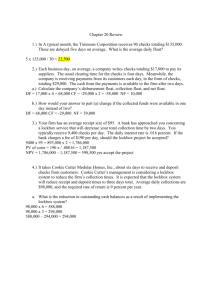

PLEASE ANSWER ALL QUESTIONS 1. (a) What is the value of a stock that is expected to pay a constant dividend of $4 per year if the required return is 15%? (b) You observe a stock price of $37.50. You expect a dividend growth of 10% and the most recent dividend was $3.00. What is the required return? 2. As the Project Manager of your company, consider an investment that costs $100,000 and has a cash inflow of $25,000 every year for 5 years. The required return is 9% and required payback is 4 years. (a) Compute the payback period for this project. (b) Compute the NPV for this project. (c) Would you accept this project and what decision rule should be the primary decision method? 3. A piece of newly purchased industrial equipment costs $960,000 and is classified as a seven-year property under MACRS. Calculate the annual depreciation allowances and end-of-the year book value for this equipment.\Hint: The seven-year-table is on page 277 of the text. 4. A firm has annual sales of 32,000 units at an average selling price of $62 a unit. The carrying cost per unit is $5.00. The fixed cost per order is $40. The inventory is allowed to fall to zero before it is restocked. Compute the economic order quantity for this firm (EOQ) 5. Today, Merkel & Sons deposited three checks for $510; $690, and $420, respectively. These checks will be added to the firm’s available balance tomorrow. The firm also wrote four checks today for $160 each. These are the only outstanding checks. The firm has $10,000 in its checking account. (i) Compute the disbursement float. (ii) Compute the collection float. (iii) Compute the Net Float. (iv) What is the firm’s book balance? (v) What is the firm’s available balance (Bank balance)? (vi) In a typical month, Oil Well Services receives checks worth a total of $211,000. On average, it takes 1.5 days for these checks to be added to the firm’s available balance once the checks have been deposited. What is the average daily float assuming that each month has 30 days? 6. Spencer Woods sells 380 units a year at an average price of $980 a unit. The credit terms of these sales are 2/10, net 45. On average, 92 percent of the firm’s customers take the discount while the others pay in 45 days. What is the average accounts receivables balance? 7. Wilson and Moore has a policy of keeping $15,000 in its bank account so that it can take advantage of buying This motive for holding cash is referred to as the _____ motive. 8. Suppose your firm has beginning inventory of $10,000 and ending inventory of $6000. Your accounts receivable beginning balance is $4,000 and ending balance is $9,000. Your average payable is $6,000. A net sales for the firm is $150,000 and cost of goods sold is $75,000. What are the operating cycle and cash cycle for this firm?