Chapter 9 Cash Collection Systems

advertisement

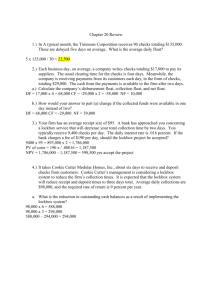

Chapter 9 Cash Collection Systems The Cash Flow Timeline Order Placed Order Received < Inventory > Sale Payment Sent Cash Received Accounts Collection < Receivable > < Float > Time ==> Accounts < Payable > Invoice Received Disbursement < Float > Payment Sent Cash Disbursed Learning Objectives To understand the various options firms have to collect customer payments. To differentiate between the various collection system and choose that system best suited for the company. To collect the basic data necessary for a lockbox study. To understand how a lockbox model works. The Cash Flow Timeline for Collection Float Check Mailed Check Received Check Deposited Good Funds Received Time => Mail Float Processing Float Collection Float Availability Float Collection Float Collection float is the time interval between mailing of the check and the date at which cash is made available at the depositor’s account. Mail float is the time that elapses from the point when check is written until it is received by the payee. Mail ranges from 1 day for local checks to 10 days for international checks Processing Float is the period of time extending from receipt of check until it is deposited in the payee’s account. Small companies, governments and non profits have normally higher processing float. It ranges from few hours to one or more days. The other name for “clearing delay” is known as Availability Float. It can range from immediately to as much as five days if weekends are involved. Dollar Day Float & Annual Cost of Float Dollar Day Float is a popular concept used to calculate the cost of float; it incorporates both the length of the float and the dollar amount involved. It is calculated by multiplying the individual remittances with the corresponding collection float Average Daily Dollar Day Float is calculated by dividing the aggregate dollar day float by the number of days in a month Annual cost of float is the total dollar value the firm is losing because of the collection float. Cost of Float Remittances $ 50,000 1,200,000 500,000 1,000 ------------$1,751,000 x Collection Float 2 5 7 10 = Dollar-Day Float $ 100,000 6,000,000 3,500,000 10,000 ------------$9,610,000 Average Dollar-Day Float = Dollar-Day Float/Days in month =$9,610,000/30=$ 320,333.33 Average Collection Float = Dollar-Day Float/ Remittances =$9,610,000/$1,751,000=5.49 days Annual Cost of Float = Average Dollar-Day Float x Rate =$320,333.33*.08=$25,626.67 [Assume, Rate= 8%] Types of Collection Systems Company processing centers- Management may decide to process and deposit its own checks referred to as company processing center. The competing types of company processing centers include decentralized and centralized processing system. Lockbox systems Company Processing Centers Deciding which to use depends primarily on the volume of the checks processed and the dollar size of the checks. Decentralized collection systems With a decentralized collection system various field officers or collection end points receive payments directly from the customers. Mail delay and Availability delay is minimal whereas processing delay tends to be longer Centralized collection systems Corporate headquarters receives all customer remittance Quick processing system thus less processing float. More control over the funds. Mail float and Availability float is normally higher. Collection system Cost Factors Company Processing Centers Common data N 1,000 F $1,500 D Decentralized Centralized 7 6 VC $0.25 $0.20 FC $100 $600 i 0.10/365 Company Processing Centers Total cost (Decentralized) = $1,000 x [($1,500 x 7 x 0.10/365) + $0.25] + $100 = $3,226.71 Total cost (Centralized) = $1,000 x [($1,500 x 6 x 0.10/365) + $0.20] + $600 = $3,265.75 Lockbox Collection Systems A lockbox collection system is a blend of the two company processing system with exception of that a bank or a third party handles the processing. Retail Large volume of standardized invoice materials where checks have low average face value Wholesale A lock box system consist of dispersed collection sites, similar to the decentralized company processing centers and it resembles a centralized collection system in that deposited funds are transferred on a frequent basis from the lockbox collection sites to the corporate headquarters. Smaller volume with non standardized remittance information and larger dollar amounts Cost Factors, TC = N x [(F x D x i/365) + VC] + FC Lockbox cost analysis Common data Citibank Chase 6 5 VC $0.45 $0.50 FC $225 $275 N 1,000 F $1,500 D i 0.10/365 Lockbox cost analysis Total cost (Citibank) = 1,000 x [($1,500 x 6 x 0.10/365) + $0.45] + $225 = $3,140.75 Total cost (Chase) = 1,000 x [($1,500 x 5 x 0.10/365) + $0.50] + $275 = $2,829.79 Lockbox cost analysis Common data N 100,000 F $15 D i Citibank 6 Chase 5 0.10/365 VC $0.45 $0.50 FC $225 $275 Lockbox cost analysis Total cost (Citibank) = $47,690.75 Total cost (Chase) = $52,329.79 Lockbox Location Study Customer groups Best approach when customer group is relatively smaller Remittance sample The sample should reflect the size of the company Should incorporate the largest dollar values Mail availability schedule The Lockbox Optimization Model The model determines the number of lockboxes that will minimize total cost. In addition the model provides the optimal lockbox locations and allocates the among the selected lockbox sites. Complete enumeration is a popular technique used to optimize the number and use of lockbox sites, which will ultimately maximize shareholder wealth.