Current Assets - Human Kinetics

advertisement

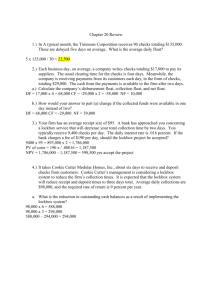

C H A P T E R 12 Short-Term Financial Management Chapter 12 Chapter Objectives • Understand the definition of net working capital and see how net working capital is calculated. • Discuss cash management by sport businesses, including how much cash to hold. • Understand what is involved in the efficient collection and disbursement of cash. • Describe how firms manage the granting of credit and how they set credit terms. • Identify issues that arise as businesses engage in collections management, the conversion of accounts receivable to cash. Key Terms Net Working Capital • Current assets – current liabilities Short-Term Financial Management • Centers on current assets and current liabilities, which generate inflows or outflows of cash to or from a business within one year or less Current Assets Current Assets • Cash and other assets that are expected to be converted to cash within one year Accounts Receivable • Unpaid bills for goods and services that have been sold to customers • An extremely important current asset based on the value of accounts receivable relative to other current assets (continued) Current Assets (continued) Types of Current Assets • Cash • Marketable securities • Accounts receivable • Inventories • Prepaid expenses • Other types of current assets Current Liabilities Types of Current Liabilities • Short-term debt • Accounts payable • Accrued income taxes • Current payments on long-term debt • Accrued liabilities • Unearned or deferred credits • Other types of current liabilities Current Assets and Liabilities Current assets and liabilities for all U.S. manufacturing corporations in second quarter of 2011. All numbers are in billions. Current Assets ($ billions) Current Liabilities ($ billions) Cash 344.1 Short-term debt 166.0 Marketable securities 172.3 Accounts payable 510.6 Accounts receivable 669.6 Accrued income taxes 31.4 Inventories 672.3 Current payments due on long-term debt 117.8 Other current assets 391.2 Other current liabilities 732.7 Total $2,249.5 Data from U.S. Department of Commerce 2011. Total $1,558.50 Cash Management Decisions • Cash management: The efficient collection and disbursement of cash. • How much cash to hold? • How best to replenish cash? – Marketable securities vs. borrowing • The reason for holding cash (despite the fact that it doesn’t earn interest) is the need for liquidity (i.e., having an asset on hand for immediate transactions). Collection and Disbursement of Cash The financial manager’s true concern is with available balance rather than ledger balance. • Payment float: Checks written by the firm and not yet cleared. • Availability float: Checks received by the firm and deposited but not yet cleared. • Net float: The net effect of checks in the process of collection (payment – availability float). Benefit of Float • Interest is earned on available balance from the bank while payment float occurs (assuming the business has an interest-earning account with the bank). Methods of Reducing Float Concentration Banking • This method involves making payments to a local office as opposed to corporate headquarters. • It reduces mail time, and local checks reduce check processing time. Lockbox System • Concentration banking can also be combined with a lockbox system. • In a lockbox system, the company pays a local bank to handle the administrative chores so it is not necessary to establish a branch office to handle receipt of payments. (continued) Methods of Reducing Float (continued) Disbursements • Slowing down disbursements is another technique for reducing float. Electronic Fund Transfers • This method reduces the use of paper checks, thereby speeding up collections and reducing availability float. Credit Management • The terms of credit become important in determining the amount of accounts receivable appearing on the balance sheet. 1/10/30 o Customers receive a 1% discount for paying within 10 days 2/10/30 o Customers receive a 2% discount for paying within 10 days If customers have a poor credit record: • COD (cash on delivery) • CBD (cash before delivery) Average Daily Sales Outstanding • Assume Under Armour annual sales are $4 million. • Therefore, its average daily sales = $4,000,000 / 365 days = $10,959 per day. o The average daily sales outstanding = (avg. daily sales) / (current accounts receivable). o Assume that accounts receivable equal $186,300. • Then the average daily sales outstanding equals $186,300 / $10,959 = 17 days. • This means that when making a purchase, the average Under Armour customer pays in 17 days. Aging Report • An aging report tabulates receivables by account ages. o Can provide more detailed information Sample Aging Report Age of account Percent of total accounts receivable 0 to 30 days 60% 31 to 60 days 15% 61 to 90 days 15% 90 to 120 days 6% over 121 days 4% Total 100% • This company has serious collections problems and should be reviewing its collections policies. o A significant number of customers are past due (40% are accounts outstanding more than 30 days). Questions for Class Discussion 1. How should a business monitor collections activity? 2. How has the advent of greater volumes of electronic funds transfers affected the accumulation of float by a business? 3. Businesses can increase cash flow by stretching out payments to vendors by an additional fifteen days. If this is so obvious, why is it that companies do not necessarily do this? 4. If a company has excess cash available, should it use that cash to pay its vendors more quickly? (continued) Questions for Class Discussion (continued) 5. Is it better business practice to make all customers pay before receiving a product, as opposed to having receivables? 6. For a professional sport organization such as an NFL team, list some of the financial activities that may be classified under short-term financial management.