Last Year's Exam 1

advertisement

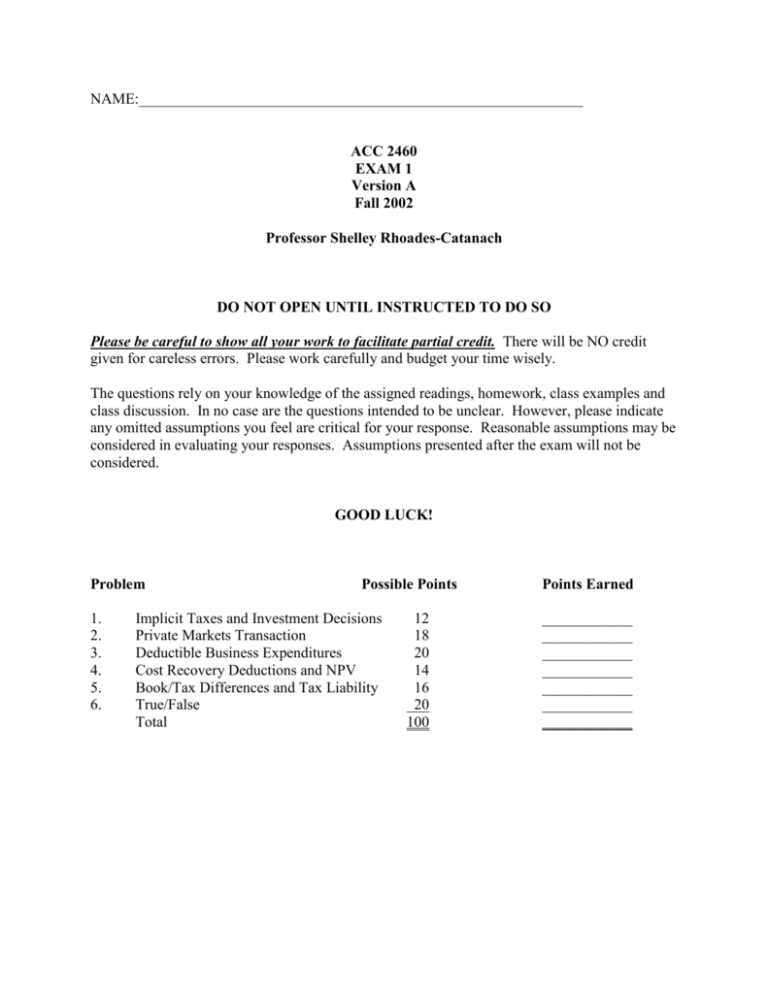

NAME:___________________________________________________________ ACC 2460 EXAM 1 Version A Fall 2002 Professor Shelley Rhoades-Catanach DO NOT OPEN UNTIL INSTRUCTED TO DO SO Please be careful to show all your work to facilitate partial credit. There will be NO credit given for careless errors. Please work carefully and budget your time wisely. The questions rely on your knowledge of the assigned readings, homework, class examples and class discussion. In no case are the questions intended to be unclear. However, please indicate any omitted assumptions you feel are critical for your response. Reasonable assumptions may be considered in evaluating your responses. Assumptions presented after the exam will not be considered. GOOD LUCK! Problem 1. 2. 3. 4. 5. 6. Possible Points Implicit Taxes and Investment Decisions Private Markets Transaction Deductible Business Expenditures Cost Recovery Deductions and NPV Book/Tax Differences and Tax Liability True/False Total 12 18 20 14 16 20 100 Points Earned ____________ ____________ ____________ ____________ ____________ ____________ ____________ 1. (12 points) Alvin is considering investing $5,000 in one of two potential investments: (1) a purchase of municipal bonds or a purchase of fully taxable corporate bonds. a. Which of these two investments bears implicit taxes? Explain why. b. Suppose that the municipal bonds pay interest of 4% and that Alvin’s marginal tax rate is 40%. What rate of interest would Alvin need to earn on a purchase of taxable corporate bonds to be indifferent between these two investments? c. How much implicit tax will Alvin’s investment bear if he chooses to buy the municipal bonds? Who receives the benefit of the implicit taxes? d. Suppose that Alvin can purchase taxable corporate bonds paying 7% interest. Which investment should he choose? Calculate his annual after-tax cash flow from each alternative. e. Which tax planning variable (entity, time period, jurisdiction, or character) explains the difference in after-tax returns from these two investment alternatives? 2. (18 points) French Corporation wishes to hire Leslie as a consultant to design a comprehensive staff training program. The project is expected to take one year, and the parties have agreed to a tentative price of $60,000. Leslie has requested payment of ½ of the fee now, with the remainder paid in one year when the project is complete. a. If Leslie expects her marginal tax rate to be 36% in both years, calculate the aftertax net present value of this contract to Leslie, using an 8% discount rate. b. French Corporation expects its marginal tax rate to be 25% this year and 35% next year. Calculate the net present value of French’s after-tax cost to enter into this contract, using an 8% discount rate. c. Given that French expects its tax rate to increase next year, it would prefer to pay more of the cost of the contract when the project is complete. Consider an alternative proposal under which French pays Leslie $10,000 this year, and $53,000 in one year when the contract is complete. Calculate the after-tax benefit of this counter proposal to Leslie, and the after-tax cost to French. Are both parties better off under this alternative than under the original plan? d. In what kind of market are these parties negotiating this transaction? e. Which tax planning maxim (entity variable, time period variable, jurisdiction variable, or character variable) explains the planning opportunity used by the parties to this transaction? 3. (20 points) In each of the following cases, indicate the amount of current 2002 tax deduction, if any, available to the taxpayer. a. A cash basis calendar year taxpayer paid $15,000 of property tax on December 31, 2002. The tax is for the first six months of 2003. b. A cash basis calendar year taxpayer bought $50,000 of inventory on December 31, 2002. c. A cash basis taxpayer paid $11,000 to the bank, representing $10,000 principal payment on an outstanding loan, and $1,000 of interest cost. d. An accrual basis taxpayer recorded a $100,000 contingent liability for book purposes, representing its likely loss under a pending lawsuit for negligence. e. An accrual basis taxpayer recorded $50,000 of book bad debt expense under the reserve method of accounting for bad debts. It also wrote off accounts receivable with a balance of $75,000. f. On December 31, 2002, an accrual basis taxpayer recorded wages payable of $250,000, representing amounts due to its workers for hours worked during December of 2002. These amounts were paid on January 7, 2003. g. During 2002, a cash basis taxpayer paid $5,000 for business meals, $2,000 for business entertainment, and $7,000 for business travel. h. On December 31, 2002, a cash basis calendar year taxpayer paid $36,000 of rent on a 3-year lease of equipment. The lease begins on January 1, 2003 and ends on December 31, 2005. i. During 2002, a cash basis taxpayer paid the following business-related taxes: $40,000 federal income tax, $6,000 state income tax, $1,000 local income tax, $3,000 sales tax, and $12,000 local property tax. 4. (14 points) During year 1, Acme Corporation purchased for $50,000 an asset considered 3-year recovery property under MACRS. Acme’s marginal tax rate is 34%, and it uses a 10% discount rate to calculate present value. a. Assuming that the mid-quarter convention and the limited expensing election do not apply to Acme, calculate MACRS deprecation of this asset for each year of its recovery period and the adjusted tax basis of the asset at the end of each year of its recovery period. b. Calculate Acme’s after-tax cash flows each year attributable to the purchase and depreciation of this asset, and the net present value of Acme’s after-tax cost of this asset. 5. (16 points) Lantana Corporation has $1 million of net income before tax on its 2002 financial statements prepared in accordance with GAAP. Its records reveal the following information. Lantana received a payment of $100,000 for merchandise to be shipped in early 2003. For financial statement purposes, this prepayment was credited to a deferred revenue account. Lantana paid a $20,000 fine to the state environmental agency for violations of pollution control regulations. Lantana was formed in 2000. At that time, it incurred $30,000 of organizational and start-up costs. For book purposes, these costs were expensed in 2000. Lantana received $1 million of insurance proceeds on the death of its CFO. Lantana paid $25,000 of premiums during 2002 related to officer’s life insurance policies for which Lantana is the beneficiary. a. Compute Lantana’s taxable income. b. Compute Lantana’s federal income tax liability. c. Compute Lantana’s average tax rate and marginal tax rate. Which of these tax rates should Lantana use for decision-making purposes? 6. (20 points) Indicate which of the following statements are True (T) or False (F). If the statement is false, briefly explain why. _____ a. Sales taxes are assessed by the federal government, not by state and local governments. If false, explain why: _____ b. Tax incidence refers to the party explicitly paying the tax to the levying tax authority. If false, explain why: _____ c. Tax collections can be increased by either increasing the tax rate or reducing the tax base. If false, explain why: _____ d. A tax system is horizontally equitable if persons with a greater ability to pay owe more tax than persons with a lesser ability to pay. If false, explain why: _____ e. Audit risk refers to the possibility that tax laws may change during the time period involved in a net present value calculation. If false, explain why: _____ f. Under the assignment of income doctrine, income must be taxed to the entity that renders the service or owns the capital with respect to which the income is paid. If false, explain why: _____ g. A permanent difference between book and taxable income occurs when an item of income, gain, expense, or loss is taken into account in a different taxable year (or years) for book purposes than for tax purposes. If false, explain why: _____ h. Capital improvements that substantially increase the value or useful life of an asset are immediately deductible for tax purposes. If false, explain why: _____ i. Tax basis of an asset may be recovered through depreciation, amortization, depletion, or when the taxpayer disposes of the asset. If false, explain why: _____ j. Purchased intangible assets, such as goodwill, cannot be amortized for tax purposes. If false, explain why: