Five - Suffolk University

advertisement

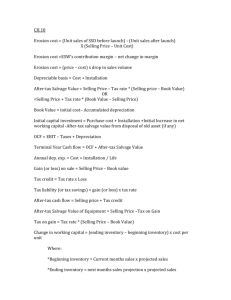

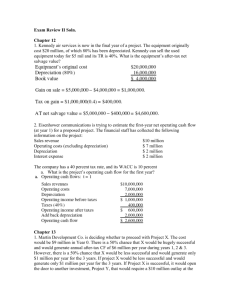

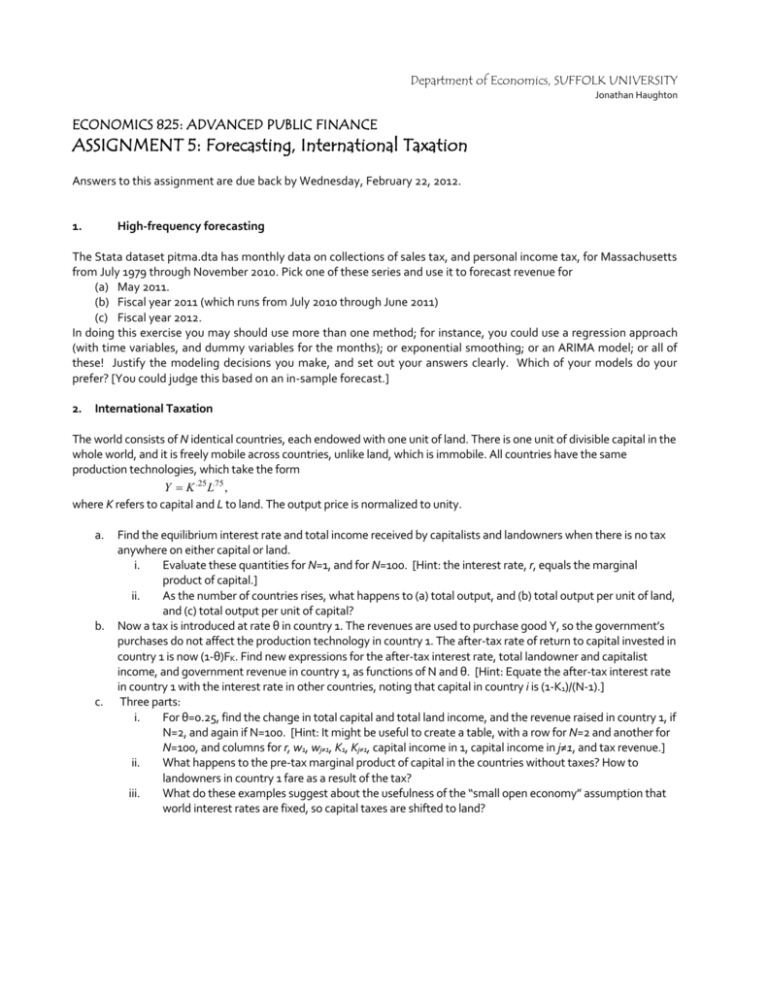

Department of Economics, SUFFOLK UNIVERSITY Jonathan Haughton ECONOMICS 825: ADVANCED PUBLIC FINANCE ASSIGNMENT 5: Forecasting, International Taxation Answers to this assignment are due back by Wednesday, February 22, 2012. 1. High-frequency forecasting The Stata dataset pitma.dta has monthly data on collections of sales tax, and personal income tax, for Massachusetts from July 1979 through November 2010. Pick one of these series and use it to forecast revenue for (a) May 2011. (b) Fiscal year 2011 (which runs from July 2010 through June 2011) (c) Fiscal year 2012. In doing this exercise you may should use more than one method; for instance, you could use a regression approach (with time variables, and dummy variables for the months); or exponential smoothing; or an ARIMA model; or all of these! Justify the modeling decisions you make, and set out your answers clearly. Which of your models do your prefer? [You could judge this based on an in-sample forecast.] 2. International Taxation The world consists of N identical countries, each endowed with one unit of land. There is one unit of divisible capital in the whole world, and it is freely mobile across countries, unlike land, which is immobile. All countries have the same production technologies, which take the form Y K .25 L.75 , where K refers to capital and L to land. The output price is normalized to unity. a. b. c. Find the equilibrium interest rate and total income received by capitalists and landowners when there is no tax anywhere on either capital or land. i. Evaluate these quantities for N=1, and for N=100. [Hint: the interest rate, r, equals the marginal product of capital.] ii. As the number of countries rises, what happens to (a) total output, and (b) total output per unit of land, and (c) total output per unit of capital? Now a tax is introduced at rate θ in country 1. The revenues are used to purchase good Y, so the government’s purchases do not affect the production technology in country 1. The after-tax rate of return to capital invested in country 1 is now (1-θ)FK. Find new expressions for the after-tax interest rate, total landowner and capitalist income, and government revenue in country 1, as functions of N and θ. [Hint: Equate the after-tax interest rate in country 1 with the interest rate in other countries, noting that capital in country i is (1-K1)/(N-1).] Three parts: i. For θ=0.25, find the change in total capital and total land income, and the revenue raised in country 1, if N=2, and again if N=100. [Hint: It might be useful to create a table, with a row for N=2 and another for N=100, and columns for r, w1, wj≠1, K1, Kj≠1, capital income in 1, capital income in j≠1, and tax revenue.] ii. What happens to the pre-tax marginal product of capital in the countries without taxes? How to landowners in country 1 fare as a result of the tax? iii. What do these examples suggest about the usefulness of the “small open economy” assumption that world interest rates are fixed, so capital taxes are shifted to land?