Building taxpayer culture in Mozambique, Tanzania and Zambia

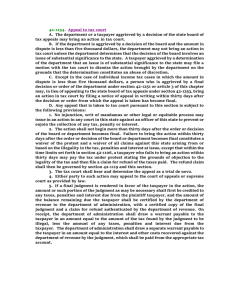

advertisement

Building taxpayer culture in Mozambique, Tanzania and Zambia Odd-Helge Fjeldstad Chr. Michelsen Institute & International Centre for Tax and Development www.CMI.no & www.ICTD.ac Oslo, 15 November 2012 1 Purposes of the study: (1) Examine strategies and measures on how to build taxpayer cultures through constructive engagement between governments and citizens over tax issues in Mozambique, Tanzania and Zambia (2) Advice the authorities on how this knowledge can be translated into practical, effective and concrete development policies Non compliance Deliberate fraud Deliberate fraud General General non-compliant non-compliant Attempt to comply, but fail Attempt to comply, but fail Compliant Compliant Voluntary compliance Is it right or wrong not to pay taxes? (Afrobarometer 2011/12) 60 54 51 49 50 46 46 40 37 33 Not wrong at all 35 32 31 Wrong, but understandable 30 Wrong and punishable 20 20 Don't know 19 11 10 10 6 5 4 2 5 5 0 Kenya Tanzania Zimbabwe Uganda South Africa Tanzania: 3 citizen surveys Why do people pay taxes? Changes over time They have no opportunity to evade They anticipate Why do people pay taxes? public services They feel obligations towards the government They will avoid disturbances Others Don’t know 2003 9,9 2006 12,3 2009 7,5 22,6 50,4 52,7 9,6 11,6 9,0 45,6 14,1 24,1 3,9 8,4 3,5 8,1 0,9 5,9 In your experience, how easy or difficult is it to find out what taxes and fees your are supposed to pay to the government? (Afrobarometer 2011/12) 80 73 73 73 70 63 60 50 % 44 Easy 40 35 Difficult Don't know 30 20 23 21 18 20 19 14 9 10 8 5 0 Kenya Tanzania Zimbabwe Uganda South Africa How do taxpayers perceive the Tax Agency? Factors influencing taxpayer behavior 1. Opportunities 2. Economic deterrence 3. 4. 5. • • • • • • • • • • Perceived probability of detection and size of sanctions Affordability ‘Tax burden’ Compliance costs Benefits of registering as taxpayer Perceptions of the tax system’s fairness Provision of services in return for taxes paid Practises/procedures for revenue collection Comparative treatment Others’ tax behaviour Tax moral Personal norms Social norms Areas for interventions to build taxpayer culture Tax policy • Legislation: party info • PP-consultations • Tax incentives/exemptions 3rd Tax adm. • Enforcement • Foster compliance • Technical capacity Factors outside the tax system • • Linking tax & public expenditure Broader citizen engagement Building taxpayer culture: Implications for policy 1. Strengthen tax policy making • TA to Min. of Finance: legislation & analytical capacity (e.g. 3rd part info.) • Advisory, training and research support to Parliamentarians • Document the extent and costs of tax exemptions 2. Develop tax administrative capacity • Better understanding of taxpayers: foster compliance, not simply enforce • Build expertise on specialised tax audit functions • Strengthen analytical capacity of the tax adm’s 3. Create broader citizen engagement around taxation • More emphasis on the ‘demand side’ to strengthen citizen engagement • A broader approach than natural resource taxation • Build local research capacity (domestic research institutions) • Inspire students to focus on tax topics (TJN) 4. A general warning for donor assistance • Avoid unhealthy ‘competition’ among development agencies • Donor coordination and cooperation should be emphasised “In a society where tax morale is high, there are low levels of tax evasion and avoidance. It is only in a social culture where citizens generally appreciate their responsibility for sustaining state services and where they have a trust in their state institutions and leaders that a tax moral evolves” ADB (2010: 6) Rwanda Case Study THANK YOU FOR YOUR ATTENTION!