Jaques v. Commissioner

advertisement

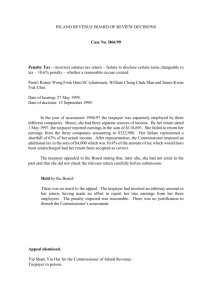

Jaques v. Commissioner Xinzheng Lin TX 8020 Citation: Jaques v. Commissioner, 935 F.2d 104 (1991), 67 AFTR 2d 91-1108, 91-1 USTC P 50292; aff’g TC Memo 1989673 (1989), PH TCM P 89673, 58 CCH TCM 1026. History: CA-6 and TC for government. Judge: Martin Facts: The taxpayer made withdrawals from his wholly owned corporation to pay day-to-day personal living expenses and these withdrawals were reflected as “Account Receivable – officer” made on the books of the corporation. The taxpayer did not execute notes for these withdrawals nor was there a maturity date set for repayment. There was no collateral pledged as security for the repayment. The taxpayer considered the withdrawals as loan which is not taxable. The government treated the withdrawals as constructive dividend but not loans. Issue: Are withdrawals from taxpayer’s wholly owned corporation to pay his personal expenses taxable constructive dividends, not non-taxable loans? Holding: Yes, the amounts withdrawn by taxpayer is not intended to be loans, thus were taxable distribution under Section 316 of the Internal Revenue Code. Reasoning: Despite classification of withdrawals as loans by taxpayer and corporation and taxpayer’s small, sporadic repayments, taxpayer didn’t show intent to repay at time withdrawals were made. There was neither written loan agreement nor collateral pledged. There was no fixed schedule of repayment or attempt to enforce repayment. The corporation had substantial current earnings but did not pay any dividends during this period.