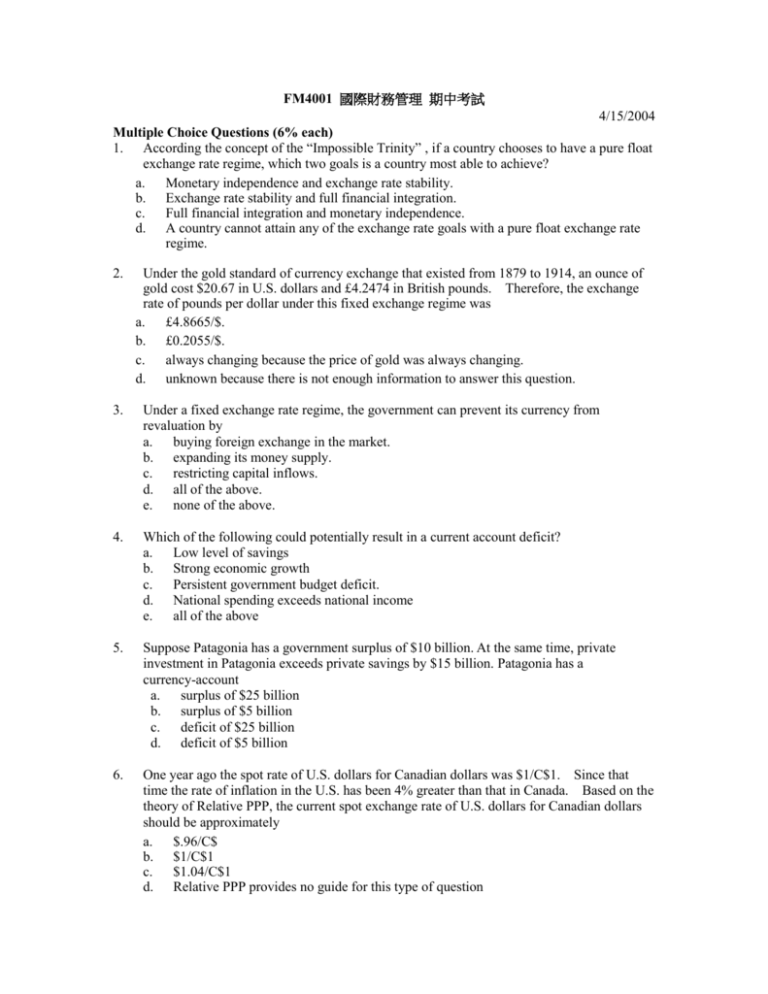

FM401 國際財務管理 期中考試

advertisement

FM4001 國際財務管理 期中考試 4/15/2004 Multiple Choice Questions (6% each) 1. According the concept of the “Impossible Trinity” , if a country chooses to have a pure float exchange rate regime, which two goals is a country most able to achieve? a. Monetary independence and exchange rate stability. b. Exchange rate stability and full financial integration. c. Full financial integration and monetary independence. d. A country cannot attain any of the exchange rate goals with a pure float exchange rate regime. 2. Under the gold standard of currency exchange that existed from 1879 to 1914, an ounce of gold cost $20.67 in U.S. dollars and £4.2474 in British pounds. Therefore, the exchange rate of pounds per dollar under this fixed exchange regime was a. £4.8665/$. b. £0.2055/$. c. always changing because the price of gold was always changing. d. unknown because there is not enough information to answer this question. 3. Under a fixed exchange rate regime, the government can prevent its currency from revaluation by a. buying foreign exchange in the market. b. expanding its money supply. c. restricting capital inflows. d. all of the above. e. none of the above. 4. Which of the following could potentially result in a current account deficit? a. Low level of savings b. Strong economic growth c. Persistent government budget deficit. d. National spending exceeds national income e. all of the above 5. Suppose Patagonia has a government surplus of $10 billion. At the same time, private investment in Patagonia exceeds private savings by $15 billion. Patagonia has a currency-account a. surplus of $25 billion b. surplus of $5 billion c. deficit of $25 billion d. deficit of $5 billion 6. One year ago the spot rate of U.S. dollars for Canadian dollars was $1/C$1. Since that time the rate of inflation in the U.S. has been 4% greater than that in Canada. Based on the theory of Relative PPP, the current spot exchange rate of U.S. dollars for Canadian dollars should be approximately a. $.96/C$ b. $1/C$1 c. $1.04/C$1 d. Relative PPP provides no guide for this type of question 7. If we set the real effective exchange rate index between Canada and the United States equal to 100 in 1998, and find that the U.S. dollar has risen to a value of 112.6, then from a competitive perspective the U.S. dollar is) a. overvalued. b. undervalued. c. very competitive. d. There is not enough information to answer this question. 8. Sony of Japan produces DVD players and exports them to the United States. Last year the exchange rate was 130¥/$ and Sony charged $150 per DVD player. Currently the spot exchange rate is 110¥/$ and Sony is charging $170 per DVD player. What is the degree of pass through by Sony of Japan on their DVD players? a. 95.9% b. 86.7% c. 73.2% d. 4.1% 9. According to the international Fisher Effect, if an investor purchases a five-year U.S. bond that has an annual interest rate of 5% rather than a comparable British bond that has an annual interest rate of 6%, then the investor must be expecting a. the U.S. dollar to appreciate approximately 1% per year over the next 5 years. b. the forward British pound has a premium of approximately 1% per year. c. the U.S. inflation rate exceeds British inflation rate by approximately 1% per year over the next 5 years. d. All of the above e. None of the above. 10. The current U.S. dollar-yen spot rate is 125¥/$. If the 90-day forward exchange rate is 127 ¥/$ then the yen is selling at a per annum _________ of ___________. a. premium; 1.57% b. premium; 6.30% c. discount; 1.57% d. discount; 6.30% e. none of the above 11. A major U.S. multinational firm has forecast the Euro/dollar rate to be 1.10/$ one year hence, and an exchange rate of $1.40 for the British pound (£) in the same time period. What does this imply the companies expected rate for the Euro per pound to be in one year? a. 1.40Euro/£ b. 1.40£/Euro c. 1.54£/Euro d. 1.54Euro/£ e. none of the above 12. Which of the following is not identified as a root of the Asian currency crisis? a. the collapse of some Asian currencies b. the rapid economic growth in the United States c. corporate socialism d. banking stability and management Essay Questions (14% each) 13. Assume you are a trader with Deutsche Bank. From the quote screen on your computer terminal, you notice that Dresdner Bank is quoting €1.6230/$ and Credit Suisse is offering SF1.4260/$. You learn that UBS is making a direct market between the Swiss franc and the mark, with a current €/SF quote of 1.1250. Assume that you have $5,000,000 with which to conduct the arbitrage. Can you make money by triangular arbitrage?If so, explain the steps and compute your profit. 14. Currently, the spot exchange rate is $1.50/£ and the three-month forward exchange rate is $1.52/£. The three-month interest rate is 8.0% per annum in the U.S. and 5.8% per annum in the U.K. Assume that you can borrow as much as $1,500,000 or £1,000,000. How would you carry out covered interest arbitrage? Show all the steps and determine the arbitrage profit. FM4001 Name: Class: Midterm Exam (4/15/ 2004) Answer sheet I.D.: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. Answers: c a b d e d c c a d d b 13. Solution: To make a triangular arbitrage profit the Deutsche Bank trader would sell $5,000,000 to Dresdner Bank at €1.6230/$1.00. This trade would yield €8,115,000 = $5,000,000 x 1.6230. The Deutsche Bank trader would then sell the deutsche marks for Swiss francs to Union Bank of Switzerland at a price of €1.1250/SF1.00, yielding SF7,213,333 = €8,115,000/1.1250. The Dresdner trader will resell the Swiss francs to Credit Suisse for $5,058,438 =SF7, 213,333/1.4260, yielding a triangular arbitrage profit of $58,438. 14. (1+I$) = 1.02 (1+I£)(F/S) = (1.0145)(1.52/1.50) = 1.0280 Thus, IRP is not holding exactly. (1) Borrow $1,500,000; repayment will be $1,530,000. (2) Buy £1,000,000 spot using $1,500,000. (3) Invest £1,000,000 at the pound interest rate of 1.45%; maturity value will be £1,014,500. (4) Sell £1,014,500 forward for $1,542,040; Arbitrage profit will be $12,040 平均 100 分 90-99 80-89 70-79 60-69 50-59 40-49 30-39 75 3 11 28 25 10 10 3 2