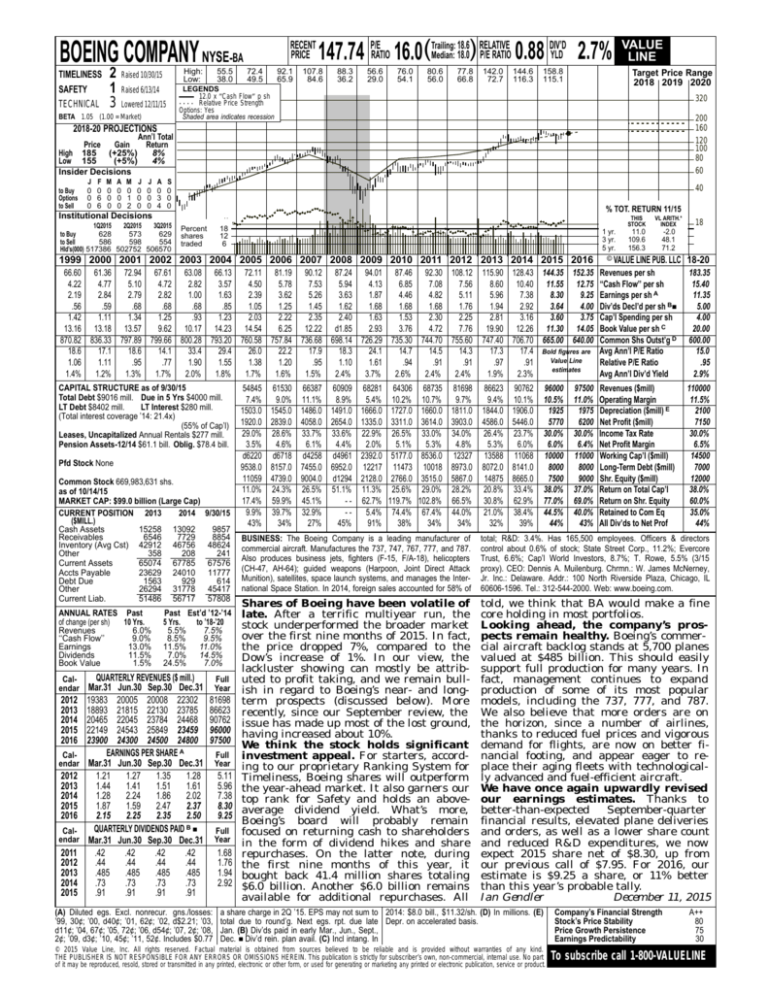

BOEING COMPANY NYSE-BA

TIMELINESS

SAFETY

TECHNICAL

2

1

3

High:

Low:

Raised 10/30/15

55.5

38.0

RECENT

PRICE

72.4

49.5

92.1

65.9

18.6 RELATIVE

DIV’D

Median: 18.0) P/E RATIO 0.88 YLD 2.7%

147.74 P/ERATIO 16.0(Trailing:

107.8

84.6

88.3

36.2

56.6

29.0

76.0

54.1

80.6

56.0

77.8

66.8

142.0

72.7

144.6

116.3

158.8

115.1

Target Price Range

2018 2019 2020

LEGENDS

12.0 x ″Cash Flow″ p sh

. . . . Relative Price Strength

Options: Yes

Shaded area indicates recession

Raised 6/13/14

Lowered 12/11/15

BETA 1.05 (1.00 = Market)

VALUE

LINE

320

200

160

120

100

80

60

2018-20 PROJECTIONS

Ann’l Total

Price

Gain

Return

High 185 (+25%)

8%

Low 155

(+5%)

4%

Insider Decisions

to Buy

Options

to Sell

J

0

0

0

F

0

6

6

M

0

0

0

A

0

0

0

M

0

1

2

J

0

0

0

J

0

0

0

A

0

3

4

S

0

0

0

40

% TOT. RETURN 11/15

Institutional Decisions

1Q2015

2Q2015

3Q2015

628

573

629

to Buy

to Sell

586

598

554

Hld’s(000) 517386 502752 506570

Percent

shares

traded

18

12

6

1 yr.

3 yr.

5 yr.

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

66.60 61.36 72.94 67.61 63.08 66.13 72.11 81.19 90.12 87.24 94.01 87.46 92.30 108.12

4.22

4.77

5.10

4.72

2.82

3.57

4.50

5.78

7.53

5.94

4.13

6.85

7.08

7.56

2.19

2.84

2.79

2.82

1.00

1.63

2.39

3.62

5.26

3.63

1.87

4.46

4.82

5.11

.56

.59

.68

.68

.68

.85

1.05

1.25

1.45

1.62

1.68

1.68

1.68

1.76

1.42

1.11

1.34

1.25

.93

1.23

2.03

2.22

2.35

2.40

1.63

1.53

2.30

2.25

13.16 13.18 13.57

9.62 10.17 14.23 14.54

6.25 12.22 d1.85

2.93

3.76

4.72

7.76

870.82 836.33 797.89 799.66 800.28 793.20 760.58 757.84 736.68 698.14 726.29 735.30 744.70 755.60

18.6

17.1

18.6

14.1

33.4

29.4

26.0

22.2

17.9

18.3

24.1

14.7

14.5

14.3

1.06

1.11

.95

.77

1.90

1.55

1.38

1.20

.95

1.10

1.61

.94

.91

.91

1.4%

1.2%

1.3%

1.7%

2.0%

1.8%

1.7%

1.6%

1.5%

2.4%

3.7%

2.6%

2.4%

2.4%

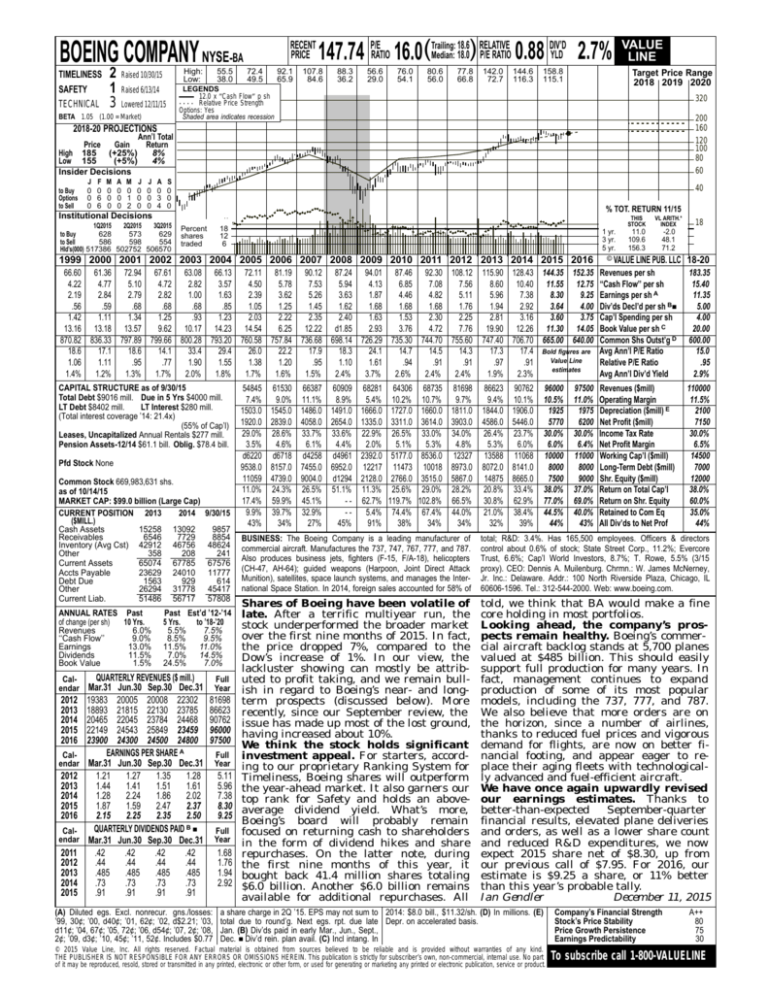

CAPITAL STRUCTURE as of 9/30/15

Total Debt $9016 mill. Due in 5 Yrs $4000 mill.

LT Debt $8402 mill.

LT Interest $280 mill.

(Total interest coverage ’14: 21.4x)

(55% of Cap’l)

Leases, Uncapitalized Annual Rentals $277 mill.

Pension Assets-12/14 $61.1 bill. Oblig. $78.4 bill.

Pfd Stock None

Common Stock 669,983,631 shs.

as of 10/14/15

MARKET CAP: $99.0 billion (Large Cap)

CURRENT POSITION 2013

2014

($MILL.)

Cash Assets

15258 13092

Receivables

6546

7729

Inventory (Avg Cst) 42912 46756

Other

358

208

Current Assets

65074 67785

Accts Payable

23629 24010

Debt Due

1563

929

Other

26294 31778

Current Liab.

51486 56717

ANNUAL RATES Past

of change (per sh)

10 Yrs.

Revenues

6.0%

‘‘Cash Flow’’

9.0%

Earnings

13.0%

Dividends

11.5%

Book Value

1.5%

Calendar

2012

2013

2014

2015

2016

Calendar

2012

2013

2014

2015

2016

Calendar

2011

2012

2013

2014

2015

9/30/15

9857

8854

48624

241

67576

11777

614

45417

57808

Past Est’d ’12-’14

5 Yrs.

to ’18-’20

5.5%

7.5%

8.5%

9.5%

11.5% 11.0%

7.0% 14.5%

24.5%

7.0%

QUARTERLY REVENUES ($ mill.)

Mar.31 Jun.30 Sep.30 Dec.31

19383 20005 20008 22302

18893 21815 22130 23785

20465 22045 23784 24468

22149 24543 25849 23459

23900 24300 24500 24800

EARNINGS PER SHARE A

Mar.31 Jun.30 Sep.30 Dec.31

1.21

1.27

1.35

1.28

1.44

1.41

1.51

1.61

1.28

2.24

1.86

2.02

1.87

1.59

2.47

2.37

2.15

2.25

2.35

2.50

QUARTERLY DIVIDENDS PAID B ■

Mar.31 Jun.30 Sep.30 Dec.31

.42

.42

.42

.42

.44

.44

.44

.44

.485

.485

.485

.485

.73

.73

.73

.73

.91

.91

.91

.91

Full

Year

81698

86623

90762

96000

97500

(A) Diluted egs. Excl. nonrecur. gns./losses:

’99, 30¢; ’00, d40¢; ’01, 62¢; ’02, d$2.21; ’03,

d11¢; ’04, 67¢; ’05, 72¢; ’06, d54¢; ’07, 2¢; ’08,

2¢; ’09, d3¢; ’10, 45¢; ’11, 52¢. Includes $0.77

Full

Year

5.11

5.96

7.38

8.30

9.25

Full

Year

1.68

1.76

1.94

2.92

54845

7.4%

1503.0

1920.0

29.0%

3.5%

d6220

9538.0

11059

11.0%

17.4%

9.9%

43%

61530

9.0%

1545.0

2839.0

28.6%

4.6%

d6718

8157.0

4739.0

24.3%

59.9%

39.7%

34%

66387 60909 68281 64306 68735

11.1%

8.9%

5.4% 10.2% 10.7%

1486.0 1491.0 1666.0 1727.0 1660.0

4058.0 2654.0 1335.0 3311.0 3614.0

33.7% 33.6% 22.9% 26.5% 33.0%

6.1%

4.4%

2.0%

5.1%

5.3%

d4258 d4961 2392.0 5177.0 8536.0

7455.0 6952.0 12217 11473 10018

9004.0 d1294 2128.0 2766.0 3515.0

26.5% 51.1% 11.3% 25.6% 29.0%

45.1%

- - 62.7% 119.7% 102.8%

32.9%

-5.4% 74.4% 67.4%

27%

45%

91%

38%

34%

81698

9.7%

1811.0

3903.0

34.0%

4.8%

12327

8973.0

5867.0

28.2%

66.5%

44.0%

34%

THIS

STOCK

VL ARITH.*

INDEX

11.0

109.6

156.3

-2.0

48.1

71.2

© VALUE LINE PUB. LLC

18

18-20

115.90 128.43 144.35 152.35

8.60 10.40 11.55 12.75

5.96

7.38

8.30

9.25

1.94

2.92

3.64

4.00

2.81

3.16

3.60

3.75

19.90 12.26 11.30 14.05

747.40 706.70 665.00 640.00

17.3

17.4 Bold figures are

Value Line

.97

.91

estimates

1.9%

2.3%

Revenues per sh

‘‘Cash Flow’’ per sh

Earnings per sh A

Div’ds Decl’d per sh B■

Cap’l Spending per sh

Book Value per sh C

Common Shs Outst’g D

Avg Ann’l P/E Ratio

Relative P/E Ratio

Avg Ann’l Div’d Yield

183.35

15.40

11.35

5.00

4.00

20.00

600.00

15.0

.95

2.9%

86623

9.4%

1844.0

4586.0

26.4%

5.3%

13588

8072.0

14875

20.8%

30.8%

21.0%

32%

Revenues ($mill)

Operating Margin

Depreciation ($mill) E

Net Profit ($mill)

Income Tax Rate

Net Profit Margin

Working Cap’l ($mill)

Long-Term Debt ($mill)

Shr. Equity ($mill)

Return on Total Cap’l

Return on Shr. Equity

Retained to Com Eq

All Div’ds to Net Prof

110000

11.5%

2100

7150

30.0%

6.5%

14500

7000

12000

38.0%

60.0%

35.0%

44%

90762

10.1%

1906.0

5446.0

23.7%

6.0%

11068

8141.0

8665.0

33.4%

62.9%

38.4%

39%

96000

10.5%

1925

5770

30.0%

6.0%

10000

8000

7500

38.0%

77.0%

44.5%

44%

97500

11.0%

1975

6200

30.0%

6.4%

11000

8000

9000

37.0%

69.0%

40.0%

43%

BUSINESS: The Boeing Company is a leading manufacturer of

commercial aircraft. Manufactures the 737, 747, 767, 777, and 787.

Also produces business jets, fighters (F-15, F/A-18), helicopters

(CH-47, AH-64); guided weapons (Harpoon, Joint Direct Attack

Munition), satellites, space launch systems, and manages the International Space Station. In 2014, foreign sales accounted for 58% of

total; R&D: 3.4%. Has 165,500 employees. Officers & directors

control about 0.6% of stock; State Street Corp., 11.2%; Evercore

Trust, 6.6%; Cap’l World Investors, 8.7%; T. Rowe, 5.5% (3/15

proxy). CEO: Dennis A. Muilenburg. Chrmn.: W. James McNerney,

Jr. Inc.: Delaware. Addr.: 100 North Riverside Plaza, Chicago, IL

60606-1596. Tel.: 312-544-2000. Web: www.boeing.com.

Shares of Boeing have been volatile of

late. After a terrific multiyear run, the

stock underperformed the broader market

over the first nine months of 2015. In fact,

the price dropped 7%, compared to the

Dow’s increase of 1%. In our view, the

lackluster showing can mostly be attributed to profit taking, and we remain bullish in regard to Boeing’s near- and longterm prospects (discussed below). More

recently, since our September review, the

issue has made up most of the lost ground,

having increased about 10%.

We think the stock holds significant

investment appeal. For starters, according to our proprietary Ranking System for

Timeliness, Boeing shares will outperform

the year-ahead market. It also garners our

top rank for Safety and holds an aboveaverage dividend yield. What’s more,

Boeing’s board will probably remain

focused on returning cash to shareholders

in the form of dividend hikes and share

repurchases. On the latter note, during

the first nine months of this year, it

bought back 41.4 million shares totaling

$6.0 billion. Another $6.0 billion remains

available for additional repurchases. All

told, we think that BA would make a fine

core holding in most portfolios.

Looking ahead, the company’s prospects remain healthy. Boeing’s commercial aircraft backlog stands at 5,700 planes

valued at $485 billion. This should easily

support full production for many years. In

fact, management continues to expand

production of some of its most popular

models, including the 737, 777, and 787.

We also believe that more orders are on

the horizon, since a number of airlines,

thanks to reduced fuel prices and vigorous

demand for flights, are now on better financial footing, and appear eager to replace their aging fleets with technologically advanced and fuel-efficient aircraft.

We have once again upwardly revised

our earnings estimates. Thanks to

better-than-expected

September-quarter

financial results, elevated plane deliveries

and orders, as well as a lower share count

and reduced R&D expenditures, we now

expect 2015 share net of $8.30, up from

our previous call of $7.95. For 2016, our

estimate is $9.25 a share, or 11% better

than this year’s probable tally.

Ian Gendler

December 11, 2015

a share charge in 2Q ’15. EPS may not sum to 2014: $8.0 bill., $11.32/sh. (D) In millions. (E)

total due to round’g. Next egs. rpt. due late Depr. on accelerated basis.

Jan. (B) Div’ds paid in early Mar., Jun., Sept.,

Dec. ■ Div’d rein. plan avail. (C) Incl intang. In

© 2015 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

Company’s Financial Strength

Stock’s Price Stability

Price Growth Persistence

Earnings Predictability

A++

80

75

30

To subscribe call 1-800-VALUELINE