9. INCOME TAXES We use the asset and liability method of

advertisement

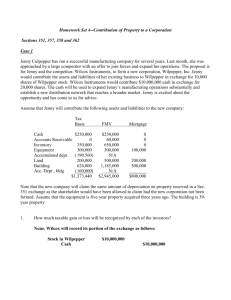

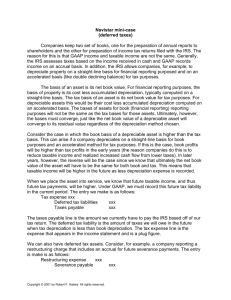

Table of Contents 9. INCOME TAXES We use the asset and liability method of accounting for income taxes. Using this method, deferred tax assets and liabilities are recorded based on differences between financial reporting and tax basis of assets and liabilities. The deferred tax assets and liabilities are calculated using the enacted tax rates and laws that are expected to be in effect when the differences are expected to reverse. We establish valuation allowances for tax benefits when we believe it is more likely than not that such assets will not be realized. In accordance with FASB ASC 740: Accounting for Income Taxes ("FASB ASC 740"), we regularly evaluate the likelihood of recognizing the benefit for income tax positions we have taken in various federal and state filings by considering all relevant facts, circumstances, and information available. For those benefits that we believe it is more likely than not that the benefit will be sustained, we recognize the largest amount we believe is cumulatively greater The provision for income taxes consists of the following: 2010 2009 2008 Current provision: Federal State $2,121,604 286,171 2,407,775 $1,461,655 197,828 1,659,483 $766,333 202,600 968,933 Federal State (80,991) (9,529) (90,520) 37,632 3,144 40,776 428,660 48,830 477,490 $2,317,255 $1,700,259 $1,446,423 Deferred provision (benefit): Income before income taxes is earned in the following tax jurisdictions: 2010 2009 United States United Kingdom Canada 2008 $5,670,352 319,290 486,981 $6,476,623 $4,437,072 324,924 284,350 $5,046,346 $3,716,554 (176,257) 571,775 $4,112,072 The income tax effects of temporary differences that give rise to significant portions of deferred income tax assets and liabilities are as follows: 2010 2009 Deferred income tax assets: Allowance for doubtful accounts Capitalized inventory costs Warrants and stock-based compensation Accrued expenses, reserves, and other Total deferred income tax assets $55,414 154,712 45,116 97,383 352,625 $50,650 131,447 45,116 89,384 316,597 Deferred income tax liabilities: Property and equipment depreciation Goodwill and other intangible assets amortization Total deferred income tax liabilities 534,639 139,020 673,659 604,287 123,193 727,480 $(321,034) $(410,883) Net deferred tax asset (liability) The net deferred tax liability is classified on the balance sheets as follows: 2010 Current deferred tax assets Long-term deferred tax liabilities Net deferred tax asset (liability) 2009 $307,509 (628,543) $(321,034) $271,481 (682,364) $(410,883) The effective tax rate differs from the statutory rate as follows: 2010 Statutory rate State and local taxes Domestic production activities deduction Other, net Effective rate 2009 34% 4% (1%) (1%) 36% 2008 34% 4% (2%) (2%) 34% 34% 9% (2%) (4%) 37% We file a consolidated U.S. income tax return as well as state tax returns on a consolidated, combined or stand-alone basis, depending on the jurisdiction. We are no longer subject to U.S. federal income tax examinations by tax authorities for years prior to the tax year ended December 2008. Depending on the jurisdiction, we are no longer subject to state examinations by tax authorities for years prior to the December 2007 and December 2008 tax years. 10. COMMITMENTS AND CONTINGENCIES Operating Leases We lease our store locations under five-year lease agreements that expire on dates ranging from May 2011 to May 2016. Rent expense on all operating leases for the years ended December 31, 2010, 2009, and 2008, was $2,721,281, $2,513,297, and $2,575,642, respectively. Future minimum lease payments under noncancelable operating leases at December 31, 2010 were as follows: Year ending December 31: 2011 2012 2013 2014 2015 2016 and thereafter $2,498,662 1,991,867 1,261,561 807,343 399,534 69,343 $7,028,310 Total minimum lease payments 23