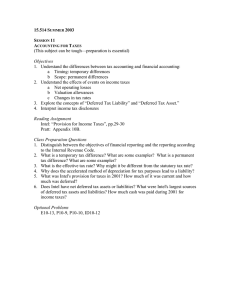

11-28-12 Basics of the liability method

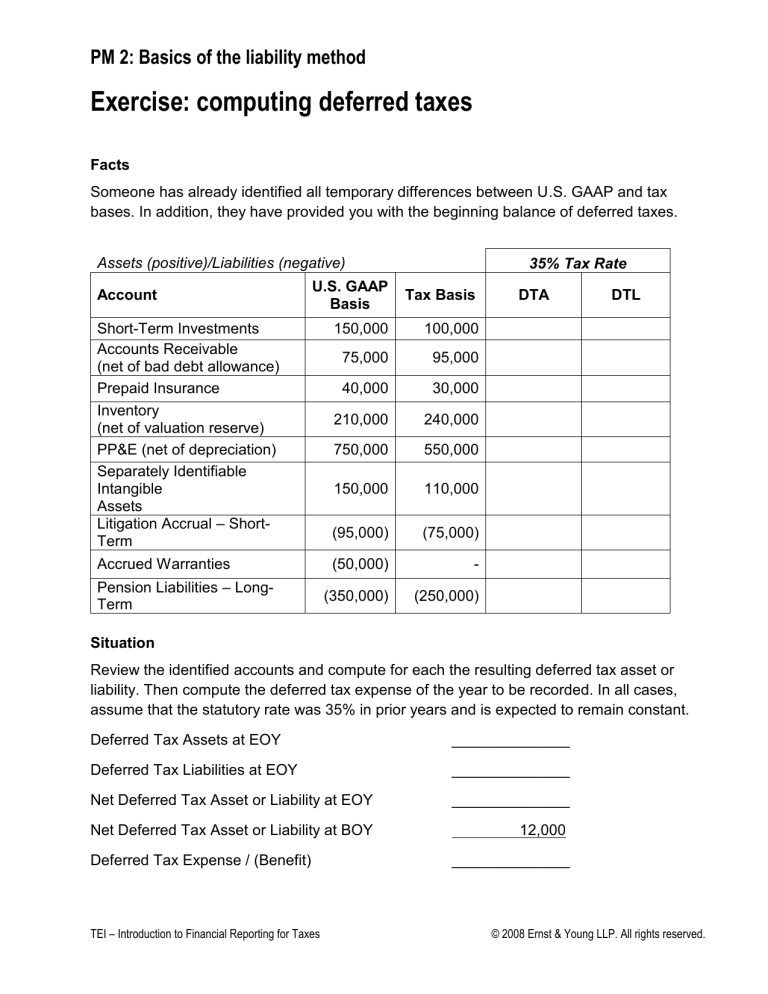

PM 2: Basics of the liability method

Exercise: computing deferred taxes

Facts

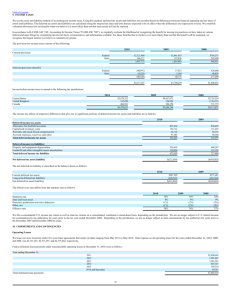

Someone has already identified all temporary differences between U.S. GAAP and tax bases. In addition, they have provided you with the beginning balance of deferred taxes.

Assets (positive)/Liabilities (negative)

Account

U.S. GAAP

Basis

Short-Term Investments

Accounts Receivable

(net of bad debt allowance)

Prepaid Insurance

Inventory

(net of valuation reserve)

PP&E (net of depreciation)

Separately Identifiable

Intangible

Assets

Litigation Accrual – Short-

Term

Accrued Warranties

Pension Liabilities

– Long-

Term

150,000

75,000

40,000

210,000

750,000

150,000

(95,000)

(50,000)

(350,000)

Tax Basis

100,000

95,000

30,000

240,000

550,000

110,000

(75,000)

-

(250,000)

35% Tax Rate

DTA DTL

Situation

Review the identified accounts and compute for each the resulting deferred tax asset or liability. Then compute the deferred tax expense of the year to be recorded. In all cases, assume that the statutory rate was 35% in prior years and is expected to remain constant.

Deferred Tax Assets at EOY ______________

Deferred Tax Liabilities at EOY ______________

Net Deferred Tax Asset or Liability at EOY ______________

Net Deferred Tax Asset or Liability at BOY 12,000

Deferred Tax Expense / (Benefit) ______________

TEI – Introduction to Financial Reporting for Taxes © 2008 Ernst & Young LLP. All rights reserved.