Contribution of Property to a Corporation – Sections 351, 357 and 361

advertisement

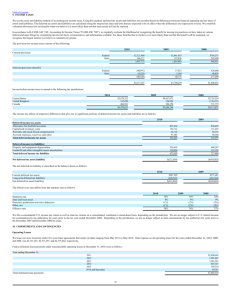

Homework Set 4--Contribution of Property to a Corporation Sections 351, 357, 358 and 362 Case 1 Jenny Culpepper has run a successful manufacturing company for several years. Last month, she was approached by a large competitor with an offer to join forces and expand her operations. The proposal is for Jenny and the competitor, Wilcox Instruments, to form a new corporation, Wilpepper, Inc. Jenny would contribute the assets and liabilities of her existing business to Wilpepper in exchange for 10,000 shares of Wilpepper stock. Wilcox Instruments would contribute $10,000,000 cash in exchange for 20,000 shares. The cash will be used to expand Jenny’s manufacturing operations substantially and establish a new distribution network that reaches a broader market. Jenny is excited about the opportunity and has come to us for advice. Assume that Jenny will contribute the following assets and liabilities to the new company: Tax Basis Cash $250,000 Accounts Receivable 0 Inventory 350,000 Equipment 300,000 Accumulated depr. ( 190,560) Land 200,000 Building 624,000 Acc. Depr., bldg ( 160,000) $1,373,440 FMV $250,000 60,000 650,000 300,000 N/A 500,000 1,185,000 N/A $2,945,000 Mortgage 0 0 0 100,000 200,000 500,000 ________ $800,000 Note that the new company will claim the same amount of depreciation on property received in a Sec. 351 exchange as the shareholder would have been allowed to claim had the new corporation not been formed. Assume that the equipment is five-year property acquired three years ago. The building is 39year property. 1. How much taxable gain or loss will be recognized by each of the investors? None. Wilcox will record its portion of the exchange as follows: Stock in Wilpepper Cash $10,000,000 $10,000,000 Jenny will record her portion as follows: Stock in Wilpepper $573,440 Liabilities 800,000 Acc. Depr-equip 190,560* Acc. Depr-bldg 160,000 Cash A/R Inventory Equipment Land Bldg 2. $250,000 0 350,000 300,000 200,000 624,000 What will be their tax bases in the stock received from Wilpepper? See above 3. How much would Wilpepper record as deferred tax liability in connection with the assets received from Jenny? Ignoring goodwill, Wilpepper is taking on a deferred tax liability of $534,330 [($2,945,000$1,373,440) * .34]. Of course, Wilpepper is also acquiring goodwill, for which it will receive no tax basis. If it paid FMV for the goodwill, it would take a tax basis of $2,855,000 ($5,000,000 stock value + $800,000 debt assumed - $2,945,000 FMV of tangible assets). The company would be allowed to amortize this asset over 15 years for tax, so it represents another $970,700 to be added to deferred tax liability—not sure we picked this portion up in class. 4. Prepare book and tax balance sheets for Wilpepper. For this purpose, assume the initial book value of the new corporation’s property is equal to its fair market value. You must record both goodwill and deferred tax liability on the book balance sheet (neither will have a value on the tax balance sheet). Tax Book Cash $10,250,000 $10,250,000 Accounts Receivable 0 60,000 Inventory 350,000 650,000 Equipment 300,000 300,000 Accumulated depreciation-equipment (190,560) 0 Land 200,000 500,000 Building 624,000 1,185,000 Accumulated depreciation-building (160,000) 0 Goodwill 0 4,360,030 $11,373,440 $17.305.030 Mortgages $800,000 $800,000 Deferred tax liability 0 1,505,030 Common stock 10,573,440 15,000,000 $11,373,440 $17,305,030 5. What is the present value of Wilpepper’s deferred tax liability? (Assume a discount rate of 4.7%) Wilpepper’s deferred tax liability with respect to each asset is summarized below: Built-in Gain A/R Inventory Equipment Land Building Deferred Tax Liability (34%) 60,000 300,000 190,560 300,000 721,000 ________ Present Value of DTL 19,4841 97,4211 164,0832 03 111,4364 _________ $392,424 $20,400 102,000 64,790 102,000 245,140 _________ $534,330 The present value of the amortization deduction for goodwill would be calculated as the present value of a 15-year annuity equal to the tax savings associated with the goodwill deduction the company would receive if it had paid $5,000,000 for the assets in a taxable transaction (GW÷15, times 34% tax rate). 1 2 Calculated by dividing difference by 1.047. The DTL with respect to the equipment will be recovered over six years, as follows: Actual* Year 1 depr (4th yr of actual Year 2 depr Year 3 depr Year 4 depr Year 5 depr Year 6 depr Totals 43,760 32,820 32,820 0 0 0 109,400 Allowed if Basis Stepped up 60,000 96,000 57,600 34,560 34,560 17,280 300,000 Present Value of difference** 15,511 57,635 21,590 28,760 27,469 13,118 164,083 * any method used to recover remaining $109,400 over remaining depreciable life is acceptable, given that the problem misstated the accumulated depreciation on the equipment. ** calculated as difference divided by 1.047 raised to the power of n, where n = 1-6. 3 Assuming land will not be disposed of. If you assume it will be disposed of at the end of 39 years, you would divide 102,000 by 1.047 raised to the power of 39. 4 Present value of an annuity equal to $245,140/39 (= 6,286) over 39 years at 4.07% (calculation per excel). Case 2 Assume the same facts as in Case 1 above. Further assume that two years after formation of the new corporation, Wilpepper Inc. agrees to admit a new investor. The new investor will contribute property with an original cost and tax basis of $850,000 and a fair market value of $6,000,000. The property is encumbered by a $1,500,000 mortgage for which Wilpepper will assume full responsibility. In exchange, she will receive stock making her a 20% shareholder in Wilpepper. 1. Will the new shareholder recognize any gain or loss on the exchange of property for her 20% stake in Wilpepper stock? If so, how much? Here, because the new shareholder receives only 20% of Wilpepper’s stock (and no other shareholders contribute property), the exchange is not between a shareholder and a controlled corporation. Accordingly, Sec. 351 does not apply and the transaction is wholly taxable. The new investor will recognize $5,150,000 gain on the exchange as reflected in the following accounting entry: Stock Mortgage 2. $4,500,000 1,500,000 Property Gain 850,000 5,150,000 What will be her tax basis in her newly received Wilpepper shares? $4,500,000 as indicated above. 3. What will be Wilpepper’s tax basis in the property received? Wilpepper will take a FMV basis in the property ($6,000,000) 4. How much will Wilpepper record as deferred tax liability with respect to the property acquired from the new shareholder? Zero – Wilpepper’s tax basis in the property will be equal to its fair market value.