significant accounting policies

advertisement

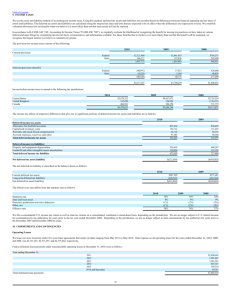

Note 34: SIGNIFICANT ACCOUNTING POLICIES For the Period ended 31.03.2015 1. Basis for Preparation of financial statements: The financial statements of the company have been prepared in accordance with the Generally Accepted Accounting Principles in India (Indian GAAP). The Company has prepared these financial statements to comply in all material respects with the accounting principles generally accepted in India, including the Accounting Standards notified under the Companies Act, 2013. The financial statements have been prepared on an accrual basis and under the historical cost convention and have been prepared on the basis of going concern concept and under the historical cost convention. The accounting policies adopted in the preparation of financial statements are consistent with those of previous year. The Company is a distribution licensee under Section 14 of the Electricity Act, 2003. The provisions of the Electricity Act, 2003 read with the rules made there under prevails wherever the same are inconsistent with the provisions of the Companies Act, 2013 in terms of Section 174 of the Electricity Act, 2003.Further, in certain areas where different accounting treatment has been prescribed under GAAP and Electricity (Supply) (Annual Accounts) Rules 1985 (ESAAR,1985) for an item of income/expenditure or Asset/Liability, the accounting treatment prescribed under ESAAR 1985 has been adopted as per Section 174 of the Electricity Act, 2003. Further, assets and liabilities created under applicable electricity laws continue to be depicted under appropriate heads in the Balance Sheet. 2. Use of Estimates: In the preparation of the Financial Statements, the Company has made estimates and assumptions that affect the reported amounts of assets and liabilities on the date of the financial statements and the reported amounts of revenues and expenses during the reported period to conform with the generally accepted accounting principles. Differences between actual results and estimates are recognized in the period in which results are known/materialized. 3. FIXED ASSETS a) Fixed assets acquired/constructed are valued at actual cost of acquisition/construction or at standard rate as the case may be, during the current year. b) Assets transferred by M/s. Karnataka Power Transmission Corporation Ltd, (KPTCL) at the time of transfer of Assets Rs 566.77 Cr have been stated at the cost of transfer indicated by KPTCL in document. c) In respect of Assets shared with KPTCL, the ownership and title vests with KPTCL and as such, they are not reflected in the books of accounts of the Corporation. But the share of maintenance expenditure in respect of such assets is charged to Profit & Loss account and the accounts system was not enabled to monitor the same. d) Contribution, Grants and Subsidies towards cost of capital assets have not been reduced from the cost of assets but have been treated as “Capital Reserve”. The depreciation pertaining to such fixed assets is withdrawn from the grants for implementing AS-12 from 2013-14 onwards. 4. DEPRECIATION a) The revised rate of Depreciation stated in Annexure-1 as per notification by CERC vide Notification No.L-7/145 (160)/2008- CERC dated 19th January 2009 has been adopted with effect from 01.04.2009. b) Depreciation is calculated annually based on straight-line method over the useful life of the asset under historical cost. c) Depreciation on all assets is provided up to 90% of the original cost. Residual d) value of 10% is maintained in the books. Plant and Machinery costing Rs. 500/- or less individually are written off fully in the year in which they are installed and put to use. e) Depreciation is charged from the first year of operation. In case of operation of the assets for part of the year, depreciation is charged on Prorata basis. f) In respect of released assets depreciation is charged up to the date of dismantling and not for the whole year as was done in the earlier years. g) Rates of Depreciation are not in conformity with the rates prescribed in Schedule XIV, of the Company’s Act 1956, but followed the CERC Regulations. 5. CAPITAL WORKS IN PROGRESS a. Materials issued to Capital Works In Progress are valued at standard rate as per O & M Schedule of rates for the year. O&M Rates are revised annually. b. Expenses allocable as Capital Expenditure and incurred by Divisions / Circles / Zones and Administrative Offices are not capitalized, since the costing methods and procedures are not fully evolved yet. c. Interest on borrowing cost are capitalized on the specific projects which take substantial period of time to get ready for intended use. 6. INVENTORY a) Inventories are valued at Standard Rate, which is determined by Corporation from time to time based on previous purchase price and prevailing market rates (published as O & M Schedule of Rates). The difference between actual cost and the Standard rate is debited or credited to Material Cost Variance Account, as the case may be. The balance under this account is transferred to Material Cost Variance Reserve. The debit balance under Material Cost Variance is debited to P&L Account. b) Dismantled assets are valued at written down value of assets 7. RECOGNITION OF REVENUE SURPLUS: The Corporation follows the method of recognizing the Revenue surplus (Net Profit after tax) for the year as per CERC guidelines, at a minimum of 15.5% ROE. 8. RETIREMENT BENEFITS: a) Pension & Gratuity are provided based on the rates prescribed by ‘KPTCL & ESCOMs Pension & Gratuity Trusts’. Presently the Rates of contribution w.e.f. 1st April 2011 made towards Pension & Gratuity is as under. Employee Benefit Rate On Pension 30.00 % Basic pay + D.P and DA Gratuity 6.01 % Basic pay + D.P b) Leave encashment & family benefit fund is provided based on the cash Basis, payable as per company’s rules. 9. REVENUE RECOGNITION a) Revenue from sale of energy is accounted on accrual basis. b) The sale of energy is as per the tariff fixed by the Karnataka Electricity Regulatory Commission (KERC). c) Revenue for the year is also adjusted by estimating un-billed revenue of previous year and current year. 10. PROVISIONS FOR BAD & DOUBTFUL DEBTS Provision for bad and doubtful debts is made in the accounting Divisions at 4 %( as per para 4.2 of Annexure V of ESAAR, 1985) on the net balance of Sundry Debtors for sale of power outstanding as at the end of the year till FY2009-10. From 2010-11 Policy has been changed as per specially constituted committee recommendation, the provision for bad and doubtful debts has been provided in the following manner. a. To treat the quantum of actual arrears outstanding under permanently disconnected installations under LT1 (BJ installations consuming more than 18 units), LT2, LT3, LT5 and HT tariff, wherever action has been taken under “Recovery of dues Act”, as the provision for Bad and doubtful of recovery. b. Not to consider the dues of IP (irrespective of disconnection), water supply & streetlight dues as bad and doubtful of recovery. 11. ACCOUNTING OF GRANTS a) Grants received for capital expenditure are included in Capital Reserves. b) Contributions received from customers for capital expenditure are included in capital reserve. c) Other Revenue grants are credited to the Profit & Loss Account. 10. POWER PURCHASE a) The Power Purchase cost is recognized based on the Government of Karnataka Order No. EN 131 PSR 2003 Dated 10th May 2005 for accounting the cost of power based on the billings made by Power Generators Pool allocated to CHAMUNDESHWARI ELECTRICITY SUPPLY CORPORATION LIMITED, MYSORE by the Government of Karnataka. b) The KERC in its Tariff Order-2009 has determined the transmission charges based on the installed generation capacity of the state. 11 Borrowing Cost: Borrowing cost attributable to the acquisition, construction or production of qualifying assets are added to the cost of those assets up to the date when the assets are ready for intended use. 12 Earnings per Share: Basic earnings per share are calculated by dividing the net profit for the period attributable to equity shareholders by the weighted average number of equity shares outstanding during the period. For the purpose of calculating diluted earnings per share, the net profit for the period attributable to equity shareholders and the weighted average number of shares outstanding during the period are adjusted for the effects of all dilutive potential equity share if any. 13 Accounting for Taxes on Income: Tax expense comprises of current and deferred tax, Current income tax is measured expected to be paid to the tax authorities in accordance with the Income-tax Act, 1961. Deferred income taxes reflects the net impact of current year timing differences between taxable income and accounting income for the year and reversal of timing differences of earlier years. Deferred tax is measured based on the tax rates and the tax laws enacted or substantively enacted at the Balance Sheet date. Deferred tax assets and deferred tax liabilities are offset, if a legally enforceable right exists to set off current tax assets against current tax liabilities and the deferred tax assets and deferred tax liabilities relate to the taxes on income levied by same governing taxation laws. Deferred tax assets are recognized only to the extent that there is reasonable certainty that sufficient future taxable income will be available against which such deferred tax assets can be realised. In situations where the Company has unabsorbed depreciation or carry forward tax losses, all deferred tax assets are recognised only if there is virtual certainty supported by convincing evidence that they can be realised against future taxable profits. At each Balance Sheet date the Company re-assesses unrecognized deferred tax asset. The Company recognises all unrecognized deferred tax assets to the extent that it has become reasonably certain or virtually certain, as the case may be, that sufficient future taxable income will be available against which such deferred tax assets can be realized. 14. Board has accepted the Accounts on 25.08.2015. Statutory Auditors have also certified on 26.8.2015.In the light of observations of the Comptroller and Auditor General of India during their supplementary audit conducted under Sec. 619(4) of the Companies Act,2013, necessary corrections have been incorporated. (Rs. in Lakhs) Particulars Prior to AG’s Audit After Supplementary Audit by AG Impact on Profit/ loss 2403.42 4027.37 1623.94 (+) (4533.77) (2909.82) 1623.94 (+) 232101.96 230820.86 1281.10(-) 78183.72 78725.54 541.82(+) 305751.91 306636.58 884.66(+) 141705.93 141379.42 326.51(-) 40115.89 40152.12 36.23(+) Impact on Reserves and surplus Trade Payables Other Current liabilities Total liabilities Tangible Assets Capital Progress Work in Increased(+)/ Decreased(-) Trade receivables Cash & Bank Balances Other current assets 235873.46 232914.48 2958.98(-) 5408.81 9408.81 4000.00(+) 18375.18 18509.11 133.93(+) Total Assets 441479.27 442363.94 884.66(+) Signatures to Notes 1 to 34 (A.Shivanna) Chief Financial Officer (N. Lakshmana) Director (T) PLACE: MYSORE DATE: In terms of our report of even date attached herewith For Ganesan and Company Chartered Accountants (G.HARIGOVIND) Partner Membership No 206563 (D.Kiran) Managing Director