Navistar mini-case

(deferred taxes)

Companies keep two set of books, one for the preparation of annual reports to

shareholders and the other for preparation of income tax returns filed with the IRS. The

reason for this is that GAAP income and taxable income are not the same. Generally,

the IRS assesses taxes based on the income received in cash and GAAP records

income on an accrual basis. In addition, the IRS allows companies, for example, to

depreciate property on a straight-line basis for financial reporting purposed and on an

accelerated basis (like double declining balance) for tax purposes.

The basis of an asset is its net book value. For financial reporting purposes, the

basis of property is its cost less accumulated depreciation, typically computed on a

straight-line basis. The tax basis of an asset is its net book value for tax purposes. For

depreciable assets this would be their cost less accumulated depreciation computed on

an accelerated basis. The bases of assets for book (financial reporting) reporting

purposes will not be the same as the tax bases for those assets. Ultimately, however,

the bases must converge, just like the net book value of a depreciable asset will

converge to its residual value regardless of the depreciation method chosen.

Consider the case in which the book basis of a depreciable asset is higher than the tax

basis. This can arise if a company depreciates on a straight-line basis for book

purposes and an accelerated method for tax purposes. If this is the case, book profits

will be higher than tax profits in the early years (the reason companies do this is to

reduce taxable income and realized increased cash flow from lower taxes). In later

years, however, the reverse will be the case since we know that ultimately the net book

value of the asset will have to be the same for both book and tax. This means that

taxable income will be higher in the future as less depreciation expense is recorded.

When we place the asset into service, we know that future taxable income, and thus

future tax payments, will be higher. Under GAAP, we must record this future tax liability

in the current period. The entry we make is as follows:

Tax expense xxx

Deferred tax liabilities

xxx

Taxes payable

xxx

The taxes payable line is the amount we currently have to pay the IRS based off of our

tax return. The deferred tax liability is the amount of taxes we will owe in the future

when tax depreciation is less than book depreciation. The tax expense line is the

expense that appears in the income statement and is a plug figure.

We can also have deferred tax assets. Consider, for example, a company reporting a

restructuring charge that includes an accrual for future severance payments. The entry

is make is as follows:

Restructuring expense

xxx

Severance payable

xxx

Copyright © 2001 by Robert F. Halsey. All rights reserved.

The company, thus, reports the expense for book purposes currently when the liability is

incurred. For tax purposes, however, the expense is not a deduction until the severance

payments are actually paid. In this case, book income is less than tax income. We

know, however, that we will have a future deduction when the payments are made. This

is a future tax benefit and meets the test of an asset. So, we record a deferred tax

asset. Deferred tax assets reduce current the tax expense reported for book purposes

with the following entry:

Tax expense

xxx

Deferred tax asset xxx

Tax payable

xxx

Companies can have both deferred tax assets and deferred tax liabilities. The amount

of expense reported in the company’s income statement will depend on 1. the amount

of tax payable (current portion) and the changes in deterred tax assets and liabilities

(deferred portion). This mini-case is designed to give you an introduction into deferred

taxes. We will use the Navistar International annual report for this exercise, portions of

which follow. Please answer the following questions:

1. How much income tax expense did the company report for 2000? Of this

amount, how much is currently payable and how much is due to changes in

deferred tax assets and liabilities?

2. What deferred tax assets and liabilities does the company report in total? Are

the assets and liabilities reported separately or netted on the balance sheet?

3. What are the major categories of deferred tax assets and liabilities? How might

these arise?

4. The company reports net operating loss carry forwards. Generally, these relate

to taxable losses that, under the IRS code, can be carried forward to future

years to reduce taxable income in those years. If it is unlikely that the NOL’s will

be used before they expire, the company must set up a valuation allowance to

reduce the deferred tax asset, just like the allowance for doubtful accounts.

What will be the effect on current profitability if a company establishes a deferred

tax asset valuation allowance?

5. What changes does Navistar International report in its deferred tax valuation

allowance account for 2000? Describe what prompted the change and the effect

the change had on its reported income?

6. As an analyst, how should you view deferred tax asset valuation accounts?

Copyright © 2001 by Robert F. Halsey. All rights reserved.

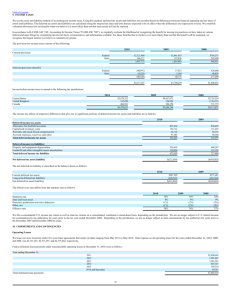

STATEMENT OF FINANCIAL CONDITION

Navistar International Corporation

and Consolidated Subsidiaries

---------------------------------As of October 31

Millions of dollars

2000

1999

ASSETS

Current assets

Cash and cash equivalents ............................

Marketable securities ................................

Receivables, net .....................................

Inventories ..........................................

Deferred tax asset, net ..............................

Other assets .........................................

$

297

167

1,075

648

198

82

-----

$

243

138

1,550

625

229

57

-----

Total current assets ......................................

2,467

2,842

Marketable securities .....................................

Finance and other receivables, net ........................

Property and equipment, net ...............................

Investments and other assets ..............................

Prepaid and intangible pension assets .....................

Deferred tax asset, net ...................................

37

1,467

1,779

234

297

664

-----

195

1,268

1,475

207

274

667

-----

Total assets ..............................................

$ 6,945

=====

$ 6,928

=====

$

$

LIABILITIES AND SHAREOWNERS' EQUITY

Liabilities

Current liabilities

Notes payable and current maturities of long-term debt

Accounts payable, principally trade ..................

Other liabilities ....................................

482

1,096

831

-----

192

1,399

911

-----

Total current liabilities .................................

2,409

2,502

Debt:

Manufacturing operations ...........................

Financial services operations ......................

Postretirement benefits liability .........................

Other liabilities .........................................

437

1,711

660

414

-----

445

1,630

634

426

-----

Total liabilities ................................

5,631

-----

5,637

-----

4

4

Commitments and contingencies

Shareowners' equity

Series D convertible junior preference stock ..............

Common stock

Copyright © 2001 by Robert F. Halsey. All rights reserved.

(75.3 million shares issued) .........................

Retained earnings (deficit) ...............................

Accumulated other comprehensive loss ......................

Common stock held in treasury, at cost

(15.9 million and 12.1 million shares held) ..........

2,139

(143)

(177)

2,139

(297)

(197)

(509)

-----

(358)

-----

Total shareowners' equity ........................

1,314

-----

1,291

-----

Total liabilities and shareowners' equity .................

$ 6,945

=====

$ 6,928

=====

Copyright © 2001 by Robert F. Halsey. All rights reserved.

STATEMENT OF INCOME

Navistar International Corporation

and Consolidated Subsidiaries

-----------------------------------------------------For the Years Ended October 31

Millions of dollars, except share data

Sales and revenues

Sales of manufactured products.................................

Finance and insurance revenue..................................

Other income...................................................

2000

$

Total sales and revenues..................................

Costs and expenses

Cost of products and services sold.............................

Cost of products sold related to restructuring.................

8,119

288

44

----8,451

-----

1999

$

8,326

256

60

----8,642

-----

1998

$

7,629

201

55

----7,885

-----

6,774

20

----6,794

286

146

280

488

146

87

----8,227

-----

6,862

----6,862

216

281

486

135

71

----8,051

-----

6,498

----6,498

174

192

427

105

79

----7,475

-----

Income before income taxes............................

Income tax expense....................................

224

65

-----

591

47

-----

410

111

-----

Net income.....................................................

159

544

299

Less dividends on Series G preferred stock.....................

----159

=====

----544

=====

11

----288

=====

Total cost of products and services sold..................

Restructuring and loss on anticipated sale of business.........

Postretirement benefits........................................

Engineering and research expense...............................

Sales, general and administrative expense......................

Interest expense...............................................

Other expense..................................................

Total costs and expenses..................................

Net income applicable to common stock..........................

Copyright © 2001 by Robert F. Halsey. All rights reserved.

$

$

$

3.

INCOME TAXES

The domestic and foreign components of income before income taxes consist

of the following:

Millions of dollars

2000

1999

1998

- -------------------------------------------------------------------------------Domestic ..........................

Foreign ...........................

$ 145

79

-----

$ 489

102

-----

$ 403

7

-----

Total income before income taxes ..

$ 224

=====

$ 591

=====

$ 410

=====

The components of income tax expense consist of the following:

Millions of dollars

2000

1999

1998

- -------------------------------------------------------------------------------Current:

Federal .......................

State and local ...............

Foreign .......................

$

4

4

21

-----

$

11

4

25

-----

$

29

-----

40

-----

7

-----

38

7

11

-----

154

23

8

-----

127

19

3

-----

Total deferred expense ................

56

-----

185

-----

149

-----

Less research and development credit ..

Less valuation allowance adjustment ....

(20)

------

-(178)

-----

-(45)

-----

Total current expense .................

Deferred:

Federal .......................

State and local ...............

Foreign .......................

Total income tax expense ..............

$

65

=====

$

47

=====

4

3

------

$

111

=====

The deferred tax expense does not represent cash payment of income taxes

and was primarily generated by the utilization of net operating loss (NOL)

carryforwards and the increase of temporary differences, and will not require

future cash payments. Consolidated tax payments made during 2000, 1999 and 1998

were $29 million, $40 million and $7 million, respectively.

The relationship of the tax expense to income before taxes for 2000, 1999

and 1998 differs from the U.S. statutory rate (35%) because of state income

taxes and the benefit of NOL carryforwards in foreign countries. The 2000

effective tax rate reflects a $20 million research and development tax credit.

Also, the 1999 and 1998 effective tax rates reflect a $178 million and $45

million reduction in the deferred tax asset valuation allowance, respectively. A

valuation allowance has been provided for those NOL carryforwards and temporary

Copyright © 2001 by Robert F. Halsey. All rights reserved.

differences, which are estimated to expire before

effective tax rates for 2000, 1999 and 1998 were

respectively.

they are utilized. The

29.0%, 8.0% and 27.0%,

In the third quarter of 2000, the company completed a study of research and

development activities that occurred over the last several years and recorded

$20 million of research and development tax credits. These credits will be taken

against future income tax payments. During 1999, as a result of continued strong

industry demand, the continued successful implementation of the company's

manufacturing strategies, changes in the company's operating structure, and

other positive operating indicators, management reviewed its projected future

taxable income and evaluated the impact of these changes on its deferred tax

asset valuation allowance. This review resulted in a reduction to the deferred

tax asset valuation allowance of $178 million, which reduced income tax expense

during the third quarter of 1999. In addition, a $45 million reduction in the

valuation allowance was recorded during the fourth quarter of 1998 based on a

similar review.

Undistributed earnings of foreign subsidiaries were $171 million and $126

million at October 31, 2000 and 1999, respectively. Taxes have not been provided

on these earnings because no withholding taxes are applicable upon repatriation

and any U.S. tax would be substantially offset by the utilization of NOL

carryforwards.

Taxpaying entities of the company offset all deferred tax assets and

liabilities within each tax jurisdiction. The components of the deferred tax

asset (liability) at October 31 are as follows:

Millions of dollars

Deferred tax assets:

Net operating loss carryforwards...........................................

Alternative minimum tax and research and development credits...............

Postretirement benefits....................................................

Product liability and warranty.............................................

Employee incentive programs................................................

Restructuring costs........................................................

Other liabilities..........................................................

2000

$

Total deferred tax assets..................................................

Deferred tax liabilities:

Prepaid pension assets.....................................................

Depreciation...............................................................

Total deferred tax liabilities.............................................

Total deferred tax assets..................................................

Less valuation allowance...................................................

Net deferred U.S. tax assets...............................................

Copyright © 2001 by Robert F. Halsey. All rights reserved.

$

308

60

266

104

25

81

135

----979

-----

1999

$

397

35

266

116

77

129

----1,020

-----

(92)

(16)

----(108)

-----

(102)

(22)

----(124)

-----

871

(65)

----806

-----

896

(65)

----831

-----

$

At October 31, 2000, the company had $863 million of domestic and $87

million of foreign NOL carryforwards available to offset future taxable income.

Such carryforwards reflect income tax losses incurred which will expire as

follows, in millions of dollars:

2008......................................... $

2009.........................................

2011.........................................

Indefinite...................................

710

20

179

41

----

Total........................................ $

950

====

Additionally, the reversal of net temporary differences of $1,318 million

as of October 31, 2000 will create net tax deductions, which, if not utilized

previously, will expire subsequent to 2011.

Copyright © 2001 by Robert F. Halsey. All rights reserved.