Finance Homework

Finance Homework

Julian Vu

May 28, 2008

Assignment: p. 28-29 Problems 1-1 and 1-2 p. 145-147 Questions 4-2, 4-3, and 4-4, and Problems 4-1, 4-2, 4-3, and 4-13

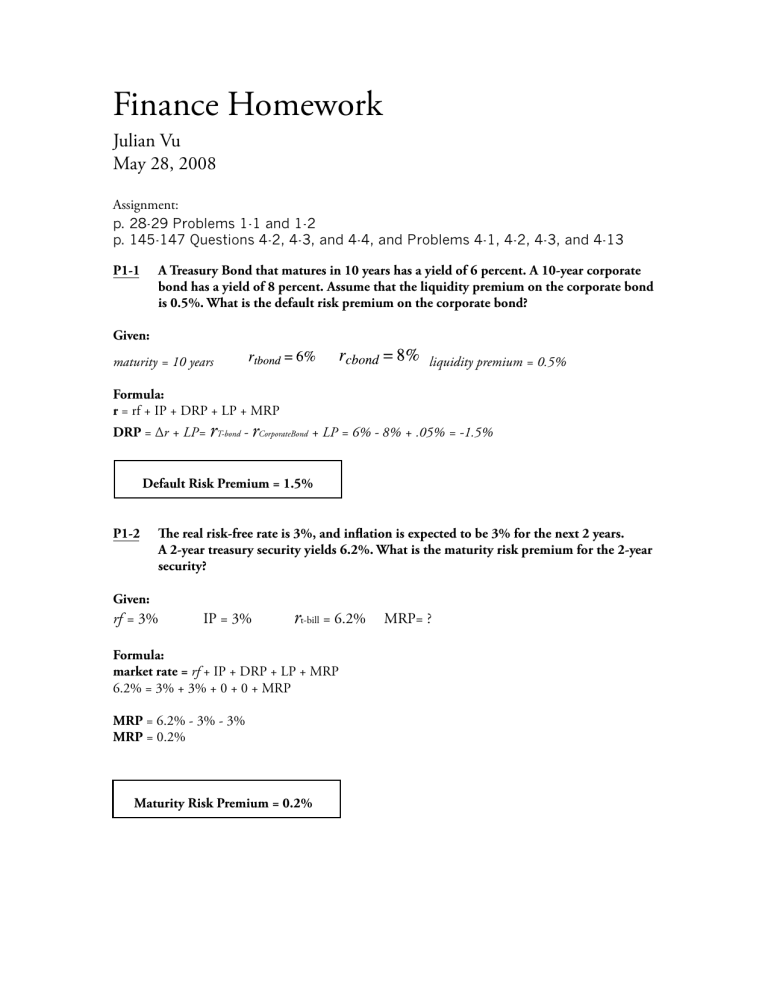

P1-1 A Treasury Bond that matures in 10 years has a yield of 6 percent. A 10-year corporate bond has a yield of 8 percent. Assume that the liquidity premium on the corporate bond is 0.5%. What is the default risk premium on the corporate bond?

Given: maturity = 10 years liquidity premium = 0.5%

Formula: r = rf + IP + DRP + LP + MRP

DRP = ∆ r + LP= r

T-bond

- r

CorporateBond

+ LP = 6% - 8% + .05% = -1.5%

Default Risk Premium = 1.5%

P1-2 e real risk-free rate is 3%, and inflation is expected to be 3% for the next 2 years.

A 2-year treasury security yields 6.2%. What is the maturity risk premium for the 2-year security?

Given: rf = 3% IP = 3% r t-bill

= 6.2% MRP= ?

Formula: market rate = rf + IP + DRP + LP + MRP

6.2% = 3% + 3% + 0 + 0 + MRP

MRP = 6.2% - 3% - 3%

MRP = 0.2%

Maturity Risk Premium = 0.2%

Q4-2 e values of outstanding bonds change whenever the going rate of interest changes. In general, short-term interest rates are more volatile than long-term interest rates.

erefore, short-term bond prices are more sensitive to interest rate changes than are long-term bond prices. Is this statement true or false? Explain.

is statement is partially true in that values are affected by changes in interest rates. e statement is false however, in the sense that short-term bonds are more volatile than long-term bonds. is is in fact, not the case, because interest rate risk has two factors; change in rates, and the time factor. e longer the time is (in this case, the longer the maturity), the greater the effect will be on subsequent bond.

Q4-3 e rate of return you would get if you bought a bond and held it to its maturity date is called the bond’s yield to maturity. If interest rates in the economy rise after a bond has been issued, what will happen to the bond’s price and to its YTM? Does the length of time to maturity affect the extent to which a given change in interest rates will affect the bond’s price?

e risk from a change in interest rates can be either more or less effective depending on the time left until maturity. A bond with a longer time to maturity will be affected greater because a bond with a greater maturity will have a higher YTM. A shorter maturity will not affect the YTM as much (from interest-rate change), because there rate will already be lower.

Q4-4 If you buy a callable bond and interest rates decline, will the value of your bond rise by as much as it would have risen if the bond had not been callable? Explain.

With callable bonds, there are several factors for example how much the callable rate/price is, as well as the term to call. Depending on the callable rate/price in comparison with the par rate, and depending on the term to call in relation to the TTM, a decline in interest rates may result in varied results.

P4-1 Callaghan Motors’ bonds have 10 years remaining to maturity. Interest is paid annually, the bonds have a $1,000 par value, and the coupon interest rate is 8%. e bonds have a yield to maturity of 9%. What is the current market price of these bonds?

Given:

TTM = 10 years

Formula:

Par = $1,000 C = 8% ($80) YTM = 9% Price = ?

Using Finance Functions on 12c: n = 10 i = 9(%) PMT = 80 FV = 1000

PV = $935.82

PV = solve

Current Market Price = $935.82

P4-2 Wilson Wonders’ bonds have 12 years remaining to maturity. Interest is paid annually, the bonds have a $1,000 par value, and the coupon interest rate is 10%. e bonds sell at a price of $850. What is their yield to maturity?

Given :

TTM = 12 years

Formula:

Par = $1,000 C = 10% ($100) Price = $850 YTM = solve

Using Finance Functions on 12c: n = 12 PMT = 100 PV = -850 i = 12.4751%

PMT = 100 i = solve

Yield to Maturity = 12.48%

P4-3 atcher Corporation’s bonds will mature in 10 years. e bonds have a face value of

$1,000 and an 8% coupon rate, paid semiannually. e price of the bonds is $1,100.

e bonds are callable in 5 years at a call price of $1,050. What is their yield to maturity? What is their yield to call?

Given:

TTM = 10 years

Price callable

= $1,050

Formula:

Face Value = $1,000

TTC = 5 years

C = 8% ($40 semi-annual)

YTM = solve

Price = $1,100

YTC = solve

Using Finance Functions on 12c: (For Yield to maturity) n = 20 PMT i/2 = 3.3085%

= 40 PV = -1100 FV = 1000 i = solve i = 6.617%

YTM = 6.62%

Using Finance Functions on 12c: (For Yield to call) n = 9 PMT = 40 PV = -1100 FV = 1050 i = solve

Note: Instead of having a tenth payment, the ex-dividend assumption accounts for the tenth cashflow in addition to the final value.

i/2 = 3.1924% i = 6.3849%

YTC = 6.38%

Yield to Maturity = 6.62%

Yield to Call = 6.38%

P4-13 Suppose Ford Motor Company sold an issue of bonds with a 10-year maturity, a $1,000 par value, a 10 percent coupon rate, and semiannual interest payments.

a. Two years after the bonds were issued, the going rate of interest in bonds such as these fell to 6%. At what price would the bonds sell?

Given:

TTM = 10 years r = 6% (after two years)

Par = $1,000 Coupon = 10% ($50 payments)

Formula:

Using Financial Functions on 12c: n = (10 x 2) - (2 x 2) = 16 i = 6% x .5 = 3

PMT = $100 x .5 = 50

FV = 1000

PV = solve

PV = -$1,251.2220

Bond Price = $1,251.22

b. Suppose that, 2 years after the initial offering, the going interest rate had risen to

12%. At what price would the bonds sell?

Given:

TTM = 10 years r = 12% (after two years)

Par = $1,000 Coupon = 10% ($50 payments)

Formula:

Using Financial Functions on 12c: n = (10 x 2) - (2 x 2) = 16 i = 12% x .5 = 6

PMT = $100 x .5 = 50

FV = 1000

PV = solve

PV = -$898.9410

Bond Price = $898.94

c. Suppose that the conditions in part a existed—that is, interest rates fell to 6 percent

2 years after the issue date. Suppose further that the interest rate remained at 6% for the next 8 years. What would happen to the price of the Ford Motor Company bonds over time?

As time progresses, the price/value of the bond will slowly decrease.

is table illustrates that:

Using Financial Functions in 12c: (Assume i, PMT, and FV remain constant for following figures)

8

4

2 n

20

16

12

Price

$1,297.55

$1,251.22

$1,199.08

$1,140.39

$1,074.34

$1,038.27

erefore, the price decreases over time.