Module3.5

advertisement

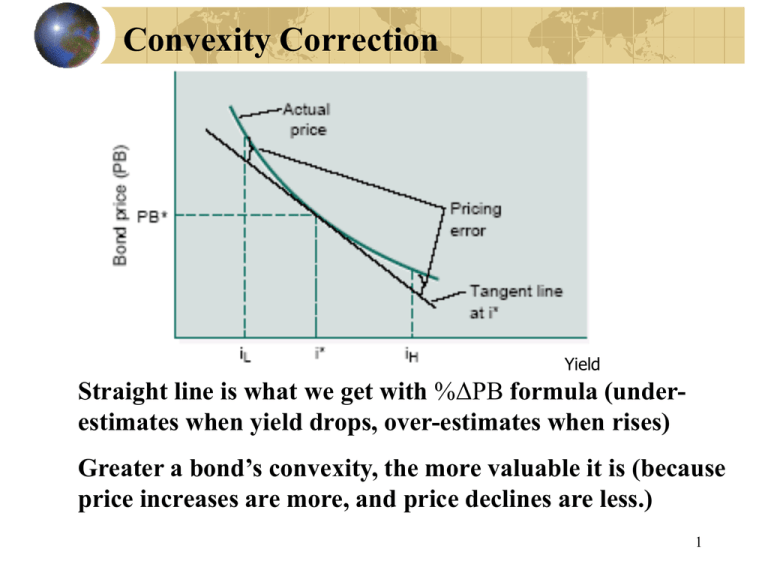

Convexity Correction Yield Straight line is what we get with %ΔPB formula (underestimates when yield drops, over-estimates when rises) Greater a bond’s convexity, the more valuable it is (because price increases are more, and price declines are less.) 1 Not To Be Naïve about Duration 1. The duration D we have been discussing also known as Macaulay duration. 2. First derivative of price-yield curve is D (1 i ) and is known as modified duration. Found in %ΔPB formula. 3. Convexity is second derivative of price-yield curve. Complicated, not studied here. 2 Closer in the Payments, Less the Duration Holding a bond’s yield fixed (at 10% in the below), D increases with maturity and varies inversely with coupon rate. 3 Managing Interest Rate Risk (a) Duration is the holding period for which reinvestment risk exactly offsets price risk. Gives investor the YTM that was in effect at time bond purchased. A way duration is used: If have a $5 million liability 7.5 years from now, buy a bond (or a portfolio of bonds) today that has a duration of 7.5 years. 10/31 4 Example 22: Portfolio Duration: N P ortfolio D wD i i i 1 Assume $4,000 in D = 5, $10,000 in D = 7, and $6,000 in D = 9 bonds. What is Portfolio D? 5 Example 23: Rebalancing Bond Portfolio Consider the $20,000 portfolio of Example 22. How much in D = 9 bonds should be sold, and how much in D = 5 bonds should be purchased, to reduce Portfolio D to 6.80? 6 Summary • Zero-coupon approach (best way). Buy high quality “zeros” with maturity equal to desired holding period. Locks in YTM. No reinvestment risk because no coupons payments, and no price risk when held to maturity. • Duration matching (next best way). Selecting a portfolio of bonds whose duration matches desired holding period. Theoretically perfect, but only approximately perfect in real world as per footnote 8 on p. 162. • Maturity matching (don’t use). Selecting bonds with terms to maturity equal to desired holding period doesn’t lock in YTM. 7