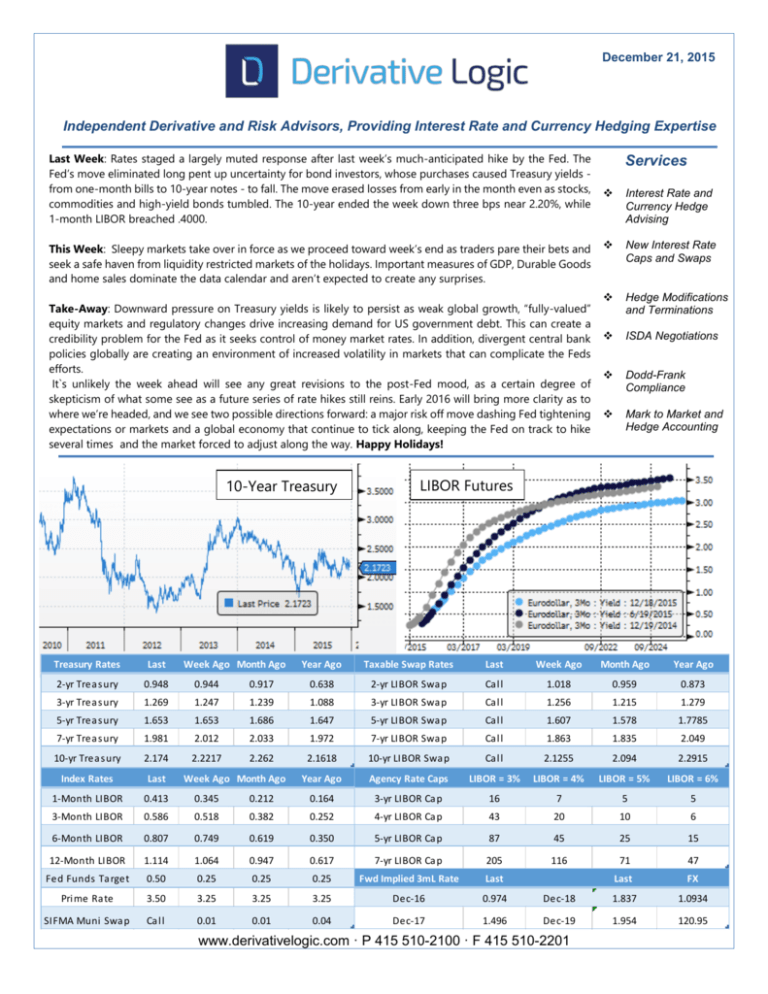

Services 10-Year Treasury LIBOR Futures

advertisement

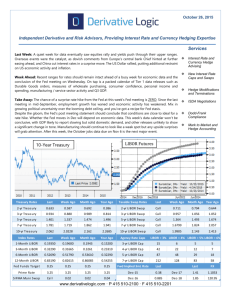

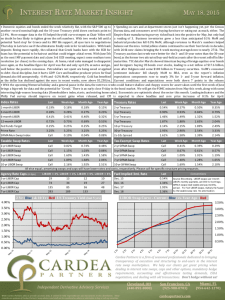

December 21, 2015 Independent Derivative and Risk Advisors, Providing Interest Rate and Currency Hedging Expertise Last Week: Rates staged a largely muted response after last week’s much-anticipated hike by the Fed. The Fed’s move eliminated long pent up uncertainty for bond investors, whose purchases caused Treasury yields from one-month bills to 10-year notes - to fall. The move erased losses from early in the month even as stocks, commodities and high-yield bonds tumbled. The 10-year ended the week down three bps near 2.20%, while 1-month LIBOR breached .4000. This Week: Sleepy markets take over in force as we proceed toward week’s end as traders pare their bets and seek a safe haven from liquidity restricted markets of the holidays. Important measures of GDP, Durable Goods and home sales dominate the data calendar and aren’t expected to create any surprises. Take-Away: Downward pressure on Treasury yields is likely to persist as weak global growth, “fully-valued” equity markets and regulatory changes drive increasing demand for US government debt. This can create a credibility problem for the Fed as it seeks control of money market rates. In addition, divergent central bank policies globally are creating an environment of increased volatility in markets that can complicate the Feds efforts. It`s unlikely the week ahead will see any great revisions to the post-Fed mood, as a certain degree of skepticism of what some see as a future series of rate hikes still reins. Early 2016 will bring more clarity as to where we’re headed, and we see two possible directions forward: a major risk off move dashing Fed tightening expectations or markets and a global economy that continue to tick along, keeping the Fed on track to hike several times and the market forced to adjust along the way. Happy Holidays! 10-Year Treasury Treasury Rates Last Week Ago Month Ago 2-yr Trea s ury 0.948 0.944 3-yr Trea s ury 1.269 1.247 5-yr Trea s ury 1.653 7-yr Trea s ury 1.981 10-yr Trea s ury 2.174 Index Rates Last 1-Month LIBOR 0.413 0.345 3-Month LIBOR 0.586 6-Month LIBOR Services Interest Rate and Currency Hedge Advising New Interest Rate Caps and Swaps Hedge Modifications and Terminations ISDA Negotiations Dodd-Frank Compliance Mark to Market and Hedge Accounting LIBOR Futures Year Ago Taxable Swap Rates Last Week Ago Month Ago Year Ago 0.917 0.638 2-yr LIBOR Swa p Ca l l 1.018 0.959 0.873 1.239 1.088 3-yr LIBOR Swa p Ca l l 1.256 1.215 1.279 1.653 1.686 1.647 5-yr LIBOR Swa p Ca l l 1.607 1.578 1.7785 2.012 2.033 1.972 7-yr LIBOR Swa p Ca l l 1.863 1.835 2.049 2.2217 2.262 2.1618 10-yr LIBOR Swa p Ca l l 2.1255 2.094 2.2915 Year Ago Agency Rate Caps LIBOR = 3% LIBOR = 4% LIBOR = 5% LIBOR = 6% 0.212 0.164 3-yr LIBOR Ca p 16 7 5 5 0.518 0.382 0.252 4-yr LIBOR Ca p 43 20 10 6 0.807 0.749 0.619 0.350 5-yr LIBOR Ca p 87 45 25 15 116 Week Ago Month Ago 12-Month LIBOR 1.114 1.064 0.947 0.617 7-yr LIBOR Ca p 205 Fed Funds Ta rget 0.50 0.25 0.25 0.25 Fwd Implied 3mL Rate Last Pri me Ra te 3.50 3.25 3.25 3.25 Dec-16 0.974 SIFMA Muni Swa p Ca l l 0.01 0.01 0.04 Dec-17 1.496 71 47 Last FX Dec-18 1.837 1.0934 Dec-19 1.954 120.95 www.derivativelogic.com · P 415 510-2100 · F 415 510-2201