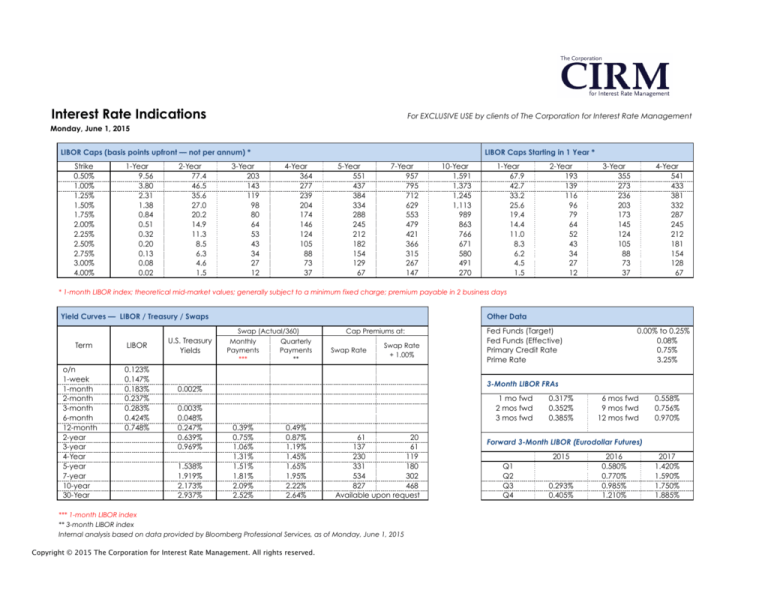

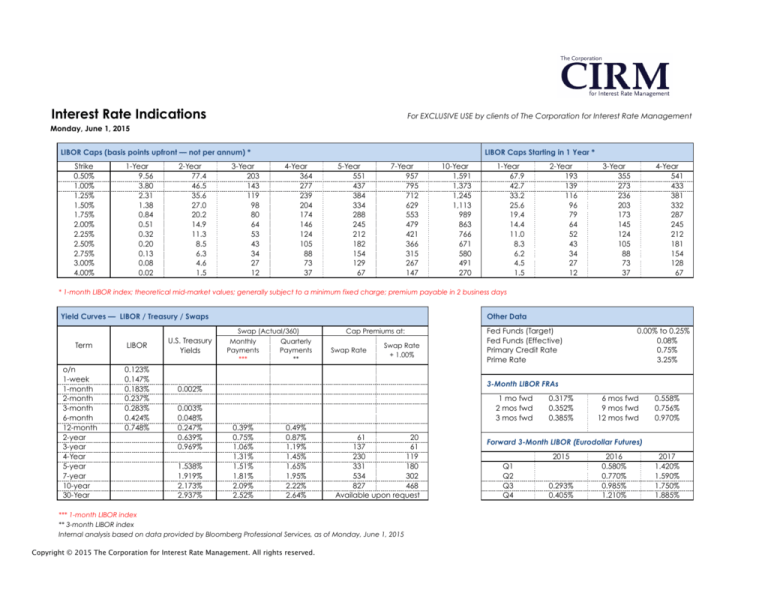

Interest Rate Indications

For EXCLUSIVE USE by clients of The Corporation for Interest Rate Management

Monday, June 1, 2015

LIBOR Caps (basis points upfront — not per annum) *

Strike

0.50%

1.00%

1.25%

1.50%

1.75%

2.00%

2.25%

2.50%

2.75%

3.00%

4.00%

1-Year

9.56

3.80

2.31

1.38

0.84

0.51

0.32

0.20

0.13

0.08

0.02

2-Year

77.4

46.5

35.6

27.0

20.2

14.9

11.3

8.5

6.3

4.6

1.5

3-Year

203

143

119

98

80

64

53

43

34

27

12

LIBOR Caps Starting in 1 Year *

4-Year

364

277

239

204

174

146

124

105

88

73

37

5-Year

551

437

384

334

288

245

212

182

154

129

67

7-Year

957

795

712

629

553

479

421

366

315

267

147

10-Year

1,591

1,373

1,245

1,113

989

863

766

671

580

491

270

1-Year

67.9

42.7

33.2

25.6

19.4

14.4

11.0

8.3

6.2

4.5

1.5

2-Year

193

139

116

96

79

64

52

43

34

27

12

3-Year

355

273

236

203

173

145

124

105

88

73

37

4-Year

541

433

381

332

287

245

212

181

154

128

67

* 1-month LIBOR index; theoretical mid-market values; generally subject to a minimum fixed charge; premium payable in 2 business days

Yield Curves — LIBOR / Treasury / Swaps

Other Data

Swap (Actual/360)

Term

o/n

1-week

1-month

2-month

3-month

6-month

12-month

2-year

3-year

4-Year

5-year

7-year

10-year

30-Year

LIBOR

0.123%

0.147%

0.183%

0.237%

0.283%

0.424%

0.748%

U.S. Treasury

Yields

Monthly

Payments

***

Quarterly

Payments

**

Cap Premiums at:

Swap Rate

Swap Rate

+ 1.00%

1.538%

1.919%

2.173%

2.937%

0.00% to 0.25%

0.08%

0.75%

3.25%

3-Month LIBOR FRAs

0.002%

0.003%

0.048%

0.247%

0.639%

0.969%

Fed Funds (Target)

Fed Funds (Effective)

Primary Credit Rate

Prime Rate

1 mo fwd

2 mos fwd

3 mos fwd

0.39%

0.75%

1.06%

1.31%

1.51%

1.81%

2.09%

2.52%

0.49%

0.87%

1.19%

1.45%

1.65%

1.95%

2.22%

2.64%

61

20

137

61

230

119

331

180

534

302

827

468

Available upon request

*** 1-month LIBOR index

** 3-month LIBOR index

Internal analysis based on data provided by Bloomberg Professional Services, as of Monday, June 1, 2015

Copyright © 2015 The Corporation for Interest Rate Management. All rights reserved.

0.317%

0.352%

0.385%

6 mos fwd

9 mos fwd

12 mos fwd

0.558%

0.756%

0.970%

Forward 3-Month LIBOR (Eurodollar Futures)

2015

Q1

Q2

Q3

Q4

0.293%

0.405%

2016

0.580%

0.770%

0.985%

1.210%

2017

1.420%

1.590%

1.750%

1.885%

Interest Rate Indications

For EXCLUSIVE USE by clients of The Corporation for Interest Rate Management

Monday, June 1, 2015

Historical Daily Interest Rates for the Past 12 Months

10-Year Swap Rates & Treasury Yields

LIBOR

3.25%

1.50%

1.00%

1-Month LIBOR

3.00%

12-Month LIBOR

2.75%

10-Year Swap

10-Year Treasury

2.50%

2.25%

0.50%

2.00%

1.75%

0.00%

6/1/14

9/1/14

12/1/14

3/1/15

6/1/15

1.50%

6/1/14

9/1/14

12/1/14

Economic News

Monday

Jun 1, 2015

Personal Income & Outlays (May)

PMI Manufacturing Index

ISM Manufacturing Index (May)

Construction Spending (Apr)

Auction 13-Week Bill

Auction 26-Week Bill

Tuesday

2

Motor Vehicle Sales (May)

Factory Orders (Apr)

Auction 4-Week Bill

Wednesday

3

International Trade (Apr)

PMI Services Index (May)

ISM Non-Mfg Index (May)

Beige Book

Thursday

4

Weekly Unemployment Claims

Productivity & Costs (Q1:15)

8

Auction 13-Week Bill

Auction 26-Week Bill

9

Wholesale Trade (Apr)

Auction 4-Week Bill

Auction 3-Year Note

10

Treasury Budget (May)

Auction 10-Year Note

11

Weekly Unemployment Claims

Retail Sales (May)

Import & Export Prices (May)

Business Inventories (Apr)

Auction 30-Year Bond

Internal analysis based on data provided by Bloomberg Professional Services, as of Monday, June 1, 2015

Copyright © 2015 The Corporation for Interest Rate Management. All rights reserved.

3/1/15

6/1/15

2-Week Outlook

Friday

5

Employment Situation (May)

Consumer Credit (Apr)

12

PPI-FD (May)

Consumer Sentiment (Jun)