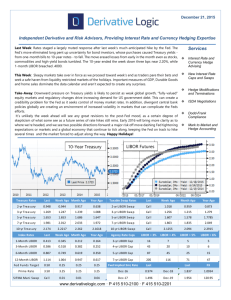

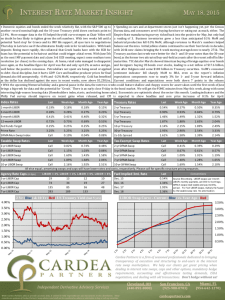

Services 10-Year Treasury LIBOR Futures

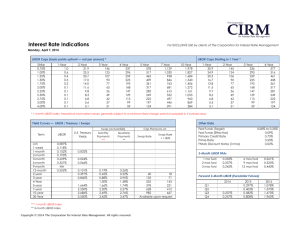

advertisement

October 26, 2015 Independent Derivative and Risk Advisors, Providing Interest Rate and Currency Hedging Expertise Services Last Week: A quiet week for data eventually saw equities rally and yields push through their upper ranges. Overseas events were the catalyst, as dovish comments from Europe’s central bank Chief hinted at further easing ahead, and China cut interest rates in a surprise move. The US Dollar rallied, putting additional restraint on US economic activity and inflation. Week Ahead: Recent ranges for rates should remain intact ahead of a busy week for economic data and the conclusion of the Fed meeting on Wednesday. On tap is a packed calendar of Tier 1 data releases such as Durable Goods orders, measures of wholesale purchasing, consumer confidence, personal income and spending, manufacturing / service sector activity and Q3 GDP. Take Away: The chance of a surprise rate hike from the Fed at this week’s Fed meeting is ZERO. Since the last meeting in mid-September, employment growth has waned and economic activity has weakened. Mix in growing political uncertainty over the looming debt ceiling, and you’ve got a recipe for Fed stasis. Despite the gloom, the Fed’s post meeting statement should conclude that conditions are close to ideal for a rate hike. Whether the Fed moves in Dec will depend on economic data. This week's data calendar won’t be conclusive, with GDP likely to report slowing but solid domestic demand, and other releases unlikely to show a significant change in tone. Manufacturing should continue to look like a weak spot but any upside surprises will grab attention. After this week, the October jobs data due on Nov 6 is the next major event. Interest Rate and Currency Hedge Advising New Interest Rate Caps and Swaps Hedge Modifications and Terminations ISDA Negotiations Dodd-Frank Compliance Mark to Market and Hedge Accounting LIBOR Futures 10-Year Treasury Treasury Rates Last Week Ago Month Ago Year Ago Taxable Swap Rates Last Week Ago Month Ago Year Ago 2-yr Trea s ury 0.633 0.587 0.692 0.386 2-yr LIBOR Swa p Ca l l 0.711 0.794 0.644 3-yr Trea s ury 0.934 0.880 0.989 0.814 3-yr LIBOR Swa p Ca l l 0.957 1.056 1.052 5-yr Trea s ury 1.401 1.337 1.474 1.496 5-yr LIBOR Swa p Ca l l 1.364 1.493 1.674 7-yr Trea s ury 1.781 1.719 1.862 1.941 7-yr LIBOR Swa p Ca l l 1.6799 1.824 2.057 10-yr Trea s ury 2.062 2.0228 2.162 2.2685 10-yr LIBOR Swa p Ca l l 1.9905 2.143 2.413 Index Rates Last Week Ago Month Ago Year Ago Agency Rate Caps 1-Month LIBOR 0.19350 0.19600 0.1943 0.15200 3-yr LIBOR Ca p 15 6 5 5 3-Month LIBOR 0.32290 0.31665 0.3261 0.23310 4-yr LIBOR Ca p 42 22 12 7 LIBOR = 3% LIBOR = 4% LIBOR = 5% LIBOR = 6% 6-Month LIBOR 0.52690 0.51790 0.53610 0.32290 5-yr LIBOR Ca p 87 48 29 18 12-Month LIBOR 0.83190 0.82615 0.86085 0.54255 7-yr LIBOR Ca p 212 128 83 58 Fed Funds Ta rget 0.25 0.25 0.25 0.25 Fwd Implied 3mL Rate Last Last FX Pri me Ra te 3.25 3.25 3.25 3.25 Dec-15 0.38 Dec-17 1.41 1.1053 SIFMA Muni Swa p Ca l l 0.02 0.02 0.04 Dec-16 0.885 Dec-18 1.85 120.95 www.derivativelogic.com · P 415 510-2100 · F 415 510-2201