us watch - CBRE Global Investors

advertisement

U.S. WATCH

JULY 2015

News about the U.S. economy took a back seat in June. Supreme Court decisions, Charleston's tragedy, the Greek dra(ch)ma and Puerto Rico's troubles

grabbed headlines. And the economic news was largely positive and indicative of an economy on a strong footing that had a momentary lapse in Q1.

The ISM indices stayed in expansionary mode, the job market had a nice upside surprise, retail sales experienced an uptick and, best of all, the housing

market indicators boosted optimism about the sector's recovery. Fundamentals warrant a better spending profile from consumers and businesses, who

have remained stubbornly cautious despite lower energy prices and constant drumbeat of good news about improving economic indicators. There are

early signs that consumer spending is starting to catch up with consumer sentiment as wage gains begin to appear. The energy industry's pullback is also

gradually fading and business investment spending is expected to gain momentum. All signs point to continued economic expansion and raises the

likelihood of a September rate hike.

S&P 500 2063.1

-2.1%

FED FUNDS RATE 0-0.25%

10-YR. T-NOTE

2.34%

24 bps

OIL $58.34

-3.2%

Data points through end of June. Change represents month-over-month change.

1. A Slower Start For Manufacturing This Year

Institute of Supply Management

Manufacturing & Non-Manufacturing Indices

65

ISM Indices

60

55

50

45

40

Non-Manufacturing

Manufacturing

35

30

May-05 May-06 May-07 May-08 May-09 May-10 May-11 May-12 May-13 May-14 May-15

Source: Institute of Supply Management

Labor Markets

Are Strong

2.2. Mortgage

Apps FALLING

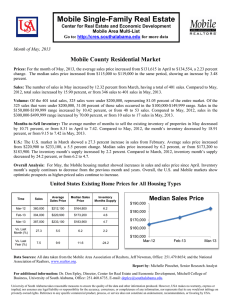

The ISM manufacturing index (light green line) came perisoulsy close to the allimportant 50 threshold earlier this year but has recovered since and continues

to signal expansion in the sector. It has notably cooled in 2015 from a

stronger second half of 2014 when it averaged a reading of nearly 57. The

index, at 52.8 in May, showed 14 of the 18 industries in the index growing.

Respondents were largely positive, mentioning an improving economy,

increased demand, and normalization of flow of goods from West Coast ports.

Manufacturing is likely to have a more modest year as the dollar has

strengthened and global demand for American goods has softened. The

Services sector of the economy, represented by the non-manufacturing index

(dark green line) has been stronger this year, with the most recent reading at

55.7. Survey respondents consistently cited confidence in the economy and

improved business conditions.

Initial Unemployment Insurance Claims

4 wk MA, Ths

Initial Jobless Claims

700

650

U.S. jobless claims held steady at 271,000 for the most recent weekly reading.

Despite some low-level modest volatility, claims continue their overall trend

downward. On a 4-week MA basis, claims are slightly elevated at 274,000

but still down 13% from a year ago. The claims are 3% above their lowest

reading in this recovery cycle, which was roughly a month ago. As the business

and consumer confidence are restored to pre-recession levels and layoffs

continue to fade from headlines, jobless claims continue to recede sharply.

The 4-week MA has consistently remained below the 350,000 mark for nearly

20 consecutive month, indicating a robust job market.

600

550

500

450

400

350

300

250

Jun-05 Jun-06 Jun-07 Jun-08 Jun-09 Jun-10 Jun-11 Jun-12 Jun-13 Jun-14 Jun-15

Source: Employment and Training Administration

3. Retail Spending Picks Up Momentum

Total Retail Sales & Sales Ex Autos

YoY, % Change

15%

Retail Sales

10%

5%

0%

-5%

Ex Auto

-10%

Total Retail Sales

-15%

May-05 May-06 May-07 May-08 May-09 May-10 May-11 May-12 May-13 May-14 May-15

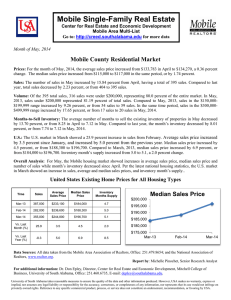

Retail sales figures have disappointed so far in 2015 but May figures gave

some reasons for optimism. On a MoM basis, May's 1.2% gain was the third

consecutive month of gains after three months of MoM declines. There is hope

that the consumers are more optimistic as the strength of the economic

expansion has been reinforced after the West Coast port strikes, a long winter,

and the recent appreciation of the dollar. Retailers are expected to see greater

gains in the second half of the year, as consumers finally start spending some

of the savings from the lower gas prices. Continued low oil prices and an

expected uptick in wage growth should be tailwinds going forward for

consumer spending trends.

Source: U.S. Census Bureau

This information is for our clients and investors only. Please note that the content of this report is for informational purposes only and should not be

viewed as investment advice or an offer or solicitation. Any opinions are solely those of the Strategy & Research Team of CBRE Global Investors and

are subject to change without notice, and may not be consistent with market trends or future events. This research is based on current public

information that we consider reliable, but we do not represent it is accurate, updated or complete, and it should not be relied on as such.

4. Retail

Lending

Markets

Are Robust

4.

Sales

Is Softening

Net Percentage of

Domestic Respondents

Tightening Standards for CRE

Loans

100%

Reporting Stronger Demand

for CRE Loans

80%

60%

CRE debt markets remain robust, driven by increased capital flows to U.S. real

estate in a depressed interest rate environment. On balance, survey respondents

reported having eased standards. A few large banks also indicated that they had

eased standards on construction and land development loans, and some large

banks reported that they had eased standards on loans secured by multifamily

properties. Regarding changes in demand for CRE loans, modest net fractions of

banks indicated that they had experienced stronger demand for loans secured by

multifamily residential properties and loans secured by nonfarm nonresidential

properties.

40%

20%

0%

-20%

-40%

-60%

-80%

Apr-03

Apr-05

Apr-07

Apr-09

Apr-11

Apr-13

Senior Loan Officer Opinion Survey

Apr-15

Source: Federal Reserve Board

Strong Capital

Flows

YearSupply

To Date

5.5. Housing

Starts and

Months

(Billions)

$50

$40

Retail

Apartment

Industrial

Office

Investment Volume

May was the weakest month of the year and saw the least dollar volume since

March 2014. At $25.2 billion, volume was down 11% from April and 41% from

the strongest month of the year, January. Apartments saw the greatest activity

(36% of total volume), followed by office (34%). One building, 230 Park Avenue

in Manhattan, represented 15% of the total office transaction volume in May! CBD

office assets and mid/highrise apartments had cap rates hovering around 5%, the

most sough-after asset types. On a year-do-date basis, transaction volume is the

most it has been since 2007, at just over $168 billion. Capital flows are expected

to remain strong throughout the rest of 2015.

$30

$20

$10

$0

May-10 Nov-10 May-11 Nov-11 May-12 Nov-12 May-13 Nov-13 May-14 Nov-14 May-15

Source: Real Capital Analytics

6.6. Jobless

Claims

Caps Rates

Doing the Limbo?

10%

Spread b/w Implied Cap Rate and 10-yr Treasury (R)

Implied REIT Cap Rate (L)

Transaction Cap Rate (L)

9%

(bps)

800

700

600

Avg Spread = 337 bps ('00-'15 YTD)

8%

500

400

7%

300

200

6%

100

5%

May-09

May-10

May-11

May-12

May-13

May-14

Capitalization Rates

How low can they go? Cap rates continue to demonstrate heady pricing.

Although the implied REIT cap rate has ticked up in recent months, there is no

reason to think this is a lasting trend and, if anything, pricing will continue to get

more agressive for the near-to-mid term. However, it is a trend that bears close

watching. In May, the implied REIT cap rate and transaction cap rate were 5.54%

and 6.36%, respectively. On an absolute basis this is historically low, but taken in

the context of the current low interest rate environment, pricing can be considered

fair, based on the historical spread between the 10-year treasury and implied cap

rates.

0

May-15

Sources: Real Capital Analytics, Green Street Advisors

Superior Yields

7.7. Employment

7%

6%

S&P 500

10-Year Treasury

REITs

5%

REIT Performance

Avg REIT Div Yield

5.44% ('00-'11)

4%

3%

2%

Although total returns have trended negative year-to date, REIT dividend yield's

positive spread relative to equities and fixed income continue to be attractive.

Over the last three months, the spread relative to 10-year T-bills has averaged

151 bps, just a tad bit better than the 142 bps average since 2007. The low

interest rate environment coupled with improving NOIs and property market

fundamentals continue to make REIT dividend yields attractive. With the S&P 500

offering a 2.1% dividend yield and 10-yr Treasuries hovering in the low-2% range,

investors can still capture a yield of 4% by investing in REITs.

1%

Jun-10 Dec-10 Jun-11 Dec-11 Jun-12 Dec-12 Jun-13 Dec-13 Jun-14 Dec-14 Jun-15

Sources: Reuters, NAREIT

STRATEGY AND RESEARCH TEAM

Principal Contributors: Shubhra Jha • Ryan Patap

15:001-7