ALM – Managing Interest Rate Risk

advertisement

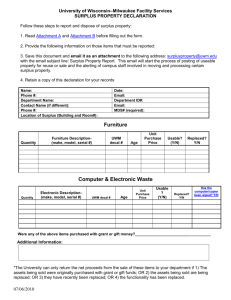

1 ALM – Managing Interest Rate Risk Wei Hao FSA, MAAA September 2010 2 Outline Background Duration and convexity Duration management Liability Duration Assumptions Summary of results Asset Duration Target Effect of interest rate changes Surplus protection 3 Background Variations of Duration Macaulay Duration Modified Duration Effective Duration (option (option-adjusted) adjusted) Key Rate Duration Interpretations of Duration Weighted average time where CFs from a FIS are received (Macaulay D) First derivative of P-Y relationship of FIS (Modified D) Measure of sensitivity of bond price to small changes in parallel yield curve shift (Effective D) 4 Variations on Duration (I) • Macaulay Duration: weighted average timetime to-maturity of the cash flows of a bond. (the weight of each cash flow is based on its discounted present value) n n t 1 t 1 Mac D wt * t PVt *t Pr ice P r % P Mac D * P 1 r 5 Variations on Duration (II) • Modified Duration: an adjusted measure of Macaulay duration that produces a more accurate estimate of bond price sensitivity Mac D Modified Duration (MD)= ( ) r 1 m m is s the t e#o of co compounding pou d g pe period od pe per yea year P P % P M D * r 6 Variations of Duration (III) • A duration/convexity measure that includes the effect of embedded options on a bond’s price behavior P P • Effective Duration D E 2 P0 r P P 2 P 0 • Effective Convexity C E 2 2 P0 r • Bond price to interest rate change: P 1 %P DE r CE r 2 P 2 7 Effective Duration and Convexity • Duration calculation is valid for small changes g in interest rate. It is less accurate for large changes. • The duration approximation – a straight line relating change in bond price to change in i t interest t rate t – always l understates d t t the th price i off the bond; it underestimates the increase in bond price when rates fall, and overestimates the fall i price in i when h rates rise. i 8 Price Convexity Adjustment Pricing Error from Convexity Duration Interest rate 9 Duration Management introduction • An immunized portfolio is largely g y protected from fluctuations in market interest rates. • seldom possible to eliminate interest rate risk completely l t l • a portfolio’s immunization can wear out, requiring managerial action to reinstate • continually immunizing a portfolio can be timeconsuming g and costly y 10 Duration Management (cont’d) (cont d) duration matching g • Duration matchingg selects a level of duration that minimizes the combined effects of reinvestment rate and interest rate risk • Two versions of duration matching • bullet immunization (target date immunization) • bank immunization (surplus immunization) 11 Duration Management (cont’d) (cont d) bullet immunization • Seeks to ensure that a predetermined sum of money is available at a specific time in the future regardless of interest rate movement • Obj Objective i is i to get the h effects ff off interest i rate and reinvestment rate risk to offset • If interest rates rise, rise coupon proceeds can be reinvested at a higher rate • If interest rates fall, coupon proceeds can be reinvested at a lower rate 12 Duration Management (cont’d) (cont d) surplus immunization • Addresses the problem that occurs if interestsensitive liabilities are included in the portfolio • Interest rate changes cause changes in both assets and d liliabilities bili i and dh hence iin surplus. l Can we eliminate this effect? • Yes: match dollar duration of assets and liabilities! 13 Duration Management (cont’d) (cont d) surplus immunization • To immunize surplus, must reorganize balance sheet such that: $A DA $L DL where $A,L = dollar value of assets or liabilities DA,A L = dollar dollar-weighted weighted duration of assets or liabilities 14 Duration Management g ((cont’d)) surplus immunization Price Price Surplus Assets S 0 Surplus Liabilities change of interest rate change of interest rate 15 Duration Management (cont’d) (cont d) Assets Liabilities surplus immunization 1 A DA A y C A A (y ) 2 2 1 L DL L y C L L (y ) 2 2 Surplus change (assuming asset convexity C A 0 ) 1 S A L DA A y DL L y C L L (y ) 2 2 16 Duration Management (cont’d) (cont d) surplus immunization Surplus percentage change recognizing A S L A 1 L S 2 ( DL DA ) y DL y C L (y ) S S 2 S S For a given g surplus p p percentage g change g S S 1 L 2 DL y C L (y ) 2 S DA DL S A y S 17 Liability Duration Calculation assumptions p • Corporate model used as the baseline. • Due to low interest rate environment,, a shift of 10bp p is used. • Durations are calculated for each line of business g and theyy are dollar-weighted. 18 Liability Duration Calculation summary of results Left Blank Intentionally 19 Interest Rate Risk on Surplus A 1 L S 2 ( DL DA ) y DL y C L (y ) S S 2 S Given currently DA 5 , DL 5.5 rate change 0.25% 0.50% 0.75% 1.00% 1.25% 1.50% 1.75% 2.00% Surplus % change ‐1.7% ‐4.1% ‐7.3% ‐11.2% ‐15.9% ‐21.4% ‐27.6% 27.6% ‐34.5% 20 Asset Duration Target S For a given surplus percentage change , and interest rate S change y S 1 L DL y CL ( y )2 S 2 S DA DL A y S