Price Differentiation

advertisement

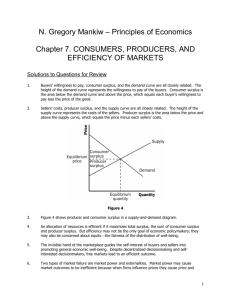

Price Differentiation Where firms charge different prices for the same good to different consumers, for reasons not associated with differences in cost. Aim: to transfer consumer surplus over to producer surplus Types: 1. First-Degree, sellers charge each customer the maximum he or she will pay. E.g. flea markets bargaining, reverse auctioning, bandwidth tender 2. Second-Degree, sellers change the price according to how much the customer buys, market according to quantity e.g. staggered pricing. 3. Third-degree, where consumers are grouped together and charged different prices, must ensure that markets are kept separate and that there are different demand conditions. Conditions: 1. Market imperfection – the firm must have an ability to set prices and put up barriers to entry 2. No seepage – the markets must be separate: people shouldn’t be able to move from the more expensive market into the cheaper one or resell cheaper goods in the more expensive one 3. P-Ed must differ between markets. The firm will charge higher prices in the market with less elastic demand. Effects of P.D. Earn more revenue for given level of sales, increasing profits and even allowing for certain firms that would otherwise be unable to make a profit to survive. A firm may use P.D. to drive competitors out of a market. If it is a monopoly at home then it may cross subsidize its sales overseas to undercut competition and gain market share. E.g. Japanese motor bikes, Chinese goods (dumping) P.D. may allow for better use of fixed facilities. Higher prices leave facilities less congested for those willing to pay more, and lower prices may allow customers to afford something they otherwise could not. E.g. off peak prices for sports facilities or even hotels, golf courses, sports courts, parking facilities, “evening out” of demand to allow optimize use of spare capacity and fixed factors Cross-subsidy between customers e.g. plastic surgeons, POSBank