Financial Risk Management of Insurance Enterprises

advertisement

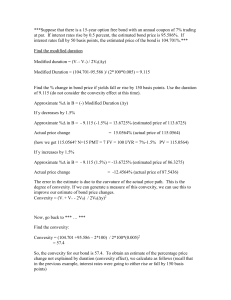

Financial Risk Management of Insurance Enterprises Duration and Convexity – Part 2 Applications of Duration • Remember, ALM evaluates the interaction of asset and liability movements • Insurers attempt to equate interest sensitivity of assets and liabilities so that surplus is unaffected – Surplus is “immunized” against interest rate risk • Immunization is the technique of matching asset duration and liability duration Why Worry About Interest Rate Risk? • The 1970s Savings & Loan industry didn’t – Asset-liability “mismatch” • Interest rates can and do fluctuate substantially • Examples of 7 Year U.S. T-bond interest rates: r at r at t t-12 months t i March 1980 July 1981 Oct 1982 May 1984 April 1986 Dec 1995 9.15% 9.84 15.33 10.30 11.34 7.80 13.00% 14.49 10.88 13.34 7.16 5.63 3.85% 4.65 - 4.45 3.04 - 4.18 - 2.17 Assumptions Underlying Macaulay and Modified Duration • Cash flows do not change with interest rates This does not hold for: – Collateralized Mortgage Obligations (CMOs) – Callable bonds – P-L loss reserves – due to inflation-interest rate correlation • Flat yield curve Generally, yield curves are upward-sloping • Interest rates shift in parallel fashion Short term interest rates tend to be more volatile than longer term rates Assuming Parallel Shifts • The assumption of parallel shifts in the yield curve is not plausible • In reality, short-term rates move more than long-term rates • Also, it is possible that the yield curve “twists” – Short-term and long-term rates move in opposite directions An Illustration • There are two cash flows, 100 at the end of year 1 and 100 at the end of the second year – The interest rate is a flat 5% • Calculating modified duration 100 100 P 185.94 2 1.05 1.05 1 1 100 2 100 D 1.42 2 3 1.05 185.94 1.05 Partial Duration • Each term in the calculation tells us something about interest rate sensitivity – It is the sensitivity of the cash flow to that interest rate • In this example, define two “partial” durations – One for each cash flow period 1 100 1 D1 0.49 2 1.05 185.94 2 100 1 D2 0.93 3 1.05 185.94 Interpreting Partial Duration • Note that the sum of the partial durations is equal to the original duration calculation • Using partial duration, we can determine the interest rate sensitivity to any non-parallel shift in the yield curve • We can use partial duration to predict price changes Percentage change in bond value - D1 r1 D2 r2 Example • From our two period cash flow, what is the change in value if the one year rate goes to 4% and the two year rate goes to 6% Predicted price change -0.49 (-0.01) - 0.93 0.01 - 0.44% Predicted price 185.12 Actual price 185.15 Key Rates • Interest rates of “similar” maturities move in the same fashion – The 10 year rate and the 10½ year rate move similarly • Therefore, partial durations can be based on a few points on the yield curve • These are called key rates – Partial durations are sometimes referred to as key rate durations Typical Key Rates • Popular key rates are: 6 o m o 1 yr 2 yr 3 yr 5 yr 7 y 10 r y 30 r yr m 3 – 3 month and 6 month rate – 1 year – 2 years – 3 years – 5 years – 7 years – 10 years – 30 years Key Rates Applications of Key Rate Durations • Key rate durations are very useful for hedging purposes • Because multiple partial durations provide more information than a single duration number, insurers can determine their sensitivity to interest rates based on various parts of the yield curve • If the insurer is not immunized, it can use interest rate derivatives to hedge the risk Cash Flows Change with Interest Rates • Effective Duration • Effective Convexity Effective Duration PV - - PV + Effective duration = ED0 = 2PV0 ( r) Effective Convexity (Note – Fabozzi includes a 2 in denominator) PV PV 2 PV0 Effective convexity= 2 PV0 (r ) Calculation of the Change in Economic Value of a Cash Flow V = (-1)(Effective Duration)(r) + (1/2)(Convexity)(r)2 (Note: if using Fabozzi convexity calculation, omit the (1/2) in the second term.) Example – Fixed Cash Flow Cash flow of $1000 in 10 years No interest rate sensitivity Current interest rate = 10% Macaulay Duration = 10 Modified Duration = 9.0909 Convexity = 90.909 Example – Variable Cash Flow Cash flow of $1000 occurs at x years if r = x% Current r = 10%, cash flow at year 10 PV = 1000/(1.10)^10 = 385.5433 ∆r = 50 basis points PV_= 422.2463 PV+= 350.5065 Effective Duration = 18.6075 Effective Convexity = 172.8719 Example – Variable Cash Flow 2 Cash flow of $1000 occurs at 10 years if r = 10% Cash flow changes at ½ the percentage change that interest rates change (from 10%) If interest rates rise to 10.5%, cash flow is $1025 If interest rates fall to 9.5%, cash flow is $975. PV = 1000/(1.10)^10 = 385.5433 ∆r = 50 basis points PV_= 393.4263 PV+= 377.6601 Effective Duration = 4.0894 Effective Convexity = -0.0169 Estimated Impact of Change in Economic Value for 100 Basis Point Rise in Interest Rate V = (-1)(Effective Duration)(r) + (1/2)(Convexity)(r)2 Fixed cash flow Variable cash flow 1 Variable cash flow 2 -8.6% -17.7% -4.1% Surplus Duration • Sensitivity of an insurer’s surplus to changes in interest rates D S S = DA A - D L L DS = (DA - DL)(A/S) + DL where D = duration S = surplus A = assets L = liabilities Surplus Duration and Asset-Liability Management • To “immunize” surplus from interest rate risk, set DS = 0 • Then, asset duration should be: DA = DL L / A • Thus, an accurate estimate of the duration of liabilities is critical for ALM Are Property-Liability Insurers Exposed to Interest Rate Risk? • Absolutely!! • Long-term liabilities – Medical malpractice – Workers’ compensation – General liability • Assets – Significant portion of assets invested in long term bonds The Liabilities of Property-Liability Insurers • Major categories of liabilities: – Loss reserves – Loss adjustment expense reserves – Unearned premium reserves Loss Reserves • Major categories: – In the process of being paid – Value of loss is determined, negotiating over share of loss to be paid – Damage is yet to be discovered – Continuing to develop: some of loss has been fixed, remainder is yet to be determined • Inflation, which is correlated with interest rates, will affect each category of loss reserves differently. What Portion of the Loss Reserve is Affected by Future Inflation (and Interest Rates)? • If the damage has not yet occurred, then the future loss payments will fully reflect future inflation • If the loss is continuing to develop, then a portion of the future loss payments will be affected by future inflation (and another portion will be “fixed” relative to inflation) How to Reflect “Fixed” Costs? • “Fixed” here means that portion of damages which, although not yet paid, will not be impacted by future inflation • Tangible versus intangible damages • Determining when a cost is “fixed” could require – Understanding the mindset of jurors – Lots and lots of data A Possible “Fixed” Cost Formula Proportion of loss reserves fixed in value as of time t: f(t) = k + [(1 - k - m) (t / T) n] k = portion of losses fixed at time of loss m = portion of losses fixed at time of settlement T = time from date of loss to date of payment Proportion of Ultimate Payments Fixed k 1 m n<1 n=1 n>1 0 1 0 Proportion of Payment Period “Fixed” Cost Formula Parameters • Examples of loss costs that might go into k – Medical treatment immediately after the loss occurs – Wage loss component of an injury claim – Property damage • Examples of loss costs that might go into m – Medical evaluations performed immediately prior to determining the settlement offer – General damages to the extent they are based on the cost of living at the time of settlement – Loss adjustment expenses connected with settling the claim Loss Reserve Duration Example For the values: k = .15 m = .10 r = 5% rr,i = 0.40 Exposure growth rate = 10% Automobile Insurance Macaulay duration: 1.52 Modified duration: 1.44 Effective duration: 1.09 Convexity Effective convexity 5.75 1.99 n = 1.0 Workers’ Compensation 4.49 4.27 3.16 50.77 16.04 Example of ALM for a Hypothetical WC Insurer Loss & LAE Reserve UPR Other liabilities Total liabilities 710 Dollar Modified Effective Value Duration Duration 590 4.271 3.158 30 3.621 1.325 90 0.952 0.952 3.823 2.801 Total assets 1,000 Asset duration to immunize surplus: 2.714 1.989 Conclusion • Asset-liability management depends upon appropriate measures of effective duration (and convexity) • Potentially significant differences between effective and modified duration values • Critical factors and parameters – – – – Line of business Payment pattern Correlation between interest rates and inflation Interest rate model (?) Next • • • • Review for first exam First exam – February 27, 2008 An introduction to stochastic processes The use of stochastic movements in modeling interest rates • Using interest rate models to calculate duration and convexity