MS&E 242 Investment Science

advertisement

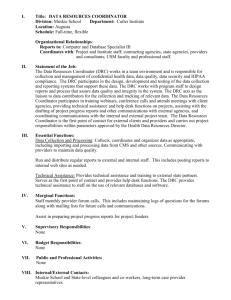

MS&E 242 Investment Science Professor: Kay Giesecke, giesecke@stanford.edu Course Assistant: Dmitry Smelov, dsmelov@stanford.edu Synopsis: We live in an uncertain world. Every day, we need to make decisions about alternatives whose consequences cannot be predicted with certainty. Here are a few examples: • • • You have saved 2,000 dollars from your summer internship. Should you put it under your mattress, buy a Certificate of Deposit, Apple stock or an S&P 500 index fund? You manage a mutual fund specializing in technology stocks. Which proportion of the fund's total assets should you invest in each of the stocks recommended by your analysts? You work for a venture capital firm that wants to exit an investment. How can you compute the fair value the firm's share in the venture? In each of these situations, you need to commit resources (time, money, effort, etc.) in the face of uncertainty about the future. This course develops concepts and tools to address these types of situations. The focus is on basic principles and how they are applied in practice. No prior knowledge of finance required. A basic preparation in mathematics (probability, statistics, and optimization) is desirable; however many technical concepts and tools will be reviewed in the course. The course is appropriate for engineering or science students wishing to apply their quantitative skills to develop a basic understanding of financial modeling and markets. The following topics will be covered: 1. 2. 3. 4. 5. 6. 7. Time is money: understand basic interest rates Evaluating investments: present value and internal rate of return Fixed-income markets: bonds, yield, duration, portfolio immunization Term structure of interest rates Measuring risk: volatility and value at risk Designing optimal security portfolios The capital asset pricing model This 8-week hybrid course will employ both virtual and in-person dimensions for which students are responsible, and is only open to students who will be on-campus this summer (residential or commuting students). Course requirements include: • • • Attending a virtual lecture per week. A lecture (which comes in several sections) lasts for approximately 1.5 hours. Lectures for each week will be available for viewing at the VentureLab platform (http://venture-lab.org/MSandE242/) on Monday and must be viewed by Wednesday 10am. Weekly Review Sessions with instructor, Wednesday 10 to 11am (Room TBA). During this session, the instructor will review key concepts and answer questions related to the material covered in the weekly lecture. Two course projects involving 3-4 students. • • • • Required weekly readings (see course text information below). Required weekly homework assignments. Weekly CA section (Duration: 1hr 30min; Fridays, Room TBA). During this section, students will be able to discuss the assignments and team projects with the CA. Final Exam. Required Course Text: The lecture material will heavily draw from Investment Science by David G. Luenberger, Oxford University Press, 1998. It is recommended that students buy this book. Prerequisites: MS&E 120, ENGR 60, Math 51. Calculus, Probability, and Optimization. Students should be well versed in multivariable differential and integral calculus, including Lagrange multipliers and the theory of constrained optimization. Students should also know probability with a single and multiple random variables. Familiarity with Excel, Matlab or Mathematica etc. is helpful. Homework: Students may use financial calculators, spreadsheets, or other computational tools to solve homework problems. However, all answers must be clearly justified. Questions regarding homework grading must be written down and submitted along with the entire homework assignment. Any resubmission of the homework will result in the entire homework assignment being regraded. This means that your score after regrading can be above or below your original score. Regrading requests will only be accepted within one week of the date of return of the graded assignment. Project: There will be two course projects involving teams of 3-4 students. Students arrange their own teams. Project details will be handed out during the quarter. Final Exam: There will be a final in-class exam. Calculators are allowed in the exam, but spreadsheet programs are not. Regrading requests will only be accepted within one week of the date of return of the exam and must be written down. The entire exam will be regraded, hence your score after regrading may be above or below your original score. Grading: The weights for grading are Homework 30%, Projects 40%, Final 30%. Honor Code: We expect the students to create an environment in which honor code violation is not to be tolerated. For the exam, this means all work must be done individually. For homework, students may consult with the CA and with other students, but must write up solutions independently based on their own understanding. Students with documented disabilities: Students who have a physical or mental impairment that may necessitate an academic accommodation or the use of auxiliary aids and services in a class must initiate the request with the Disability Resource Center (DRC). The DRC will evaluate the request along with the required documentation, recommend appropriate accommodations, and prepare a verification letter dated in the current academic term in which the request is being made. Please contact the DRC as soon as possible; timely notice is needed to arrange for appropriate accommodations. The DRC is located at 123 Meyer Library (phone 723-1066 Voice; 725-1067 TTY).