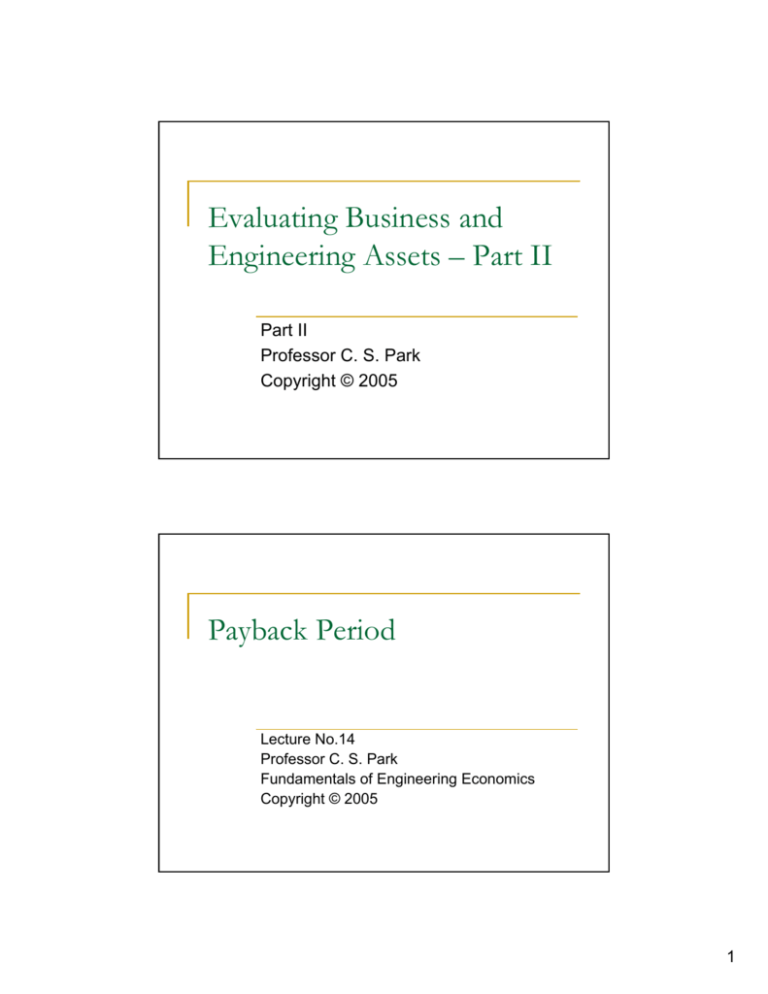

Evaluating Business and Engineering Assets – Part II Payback Period

advertisement

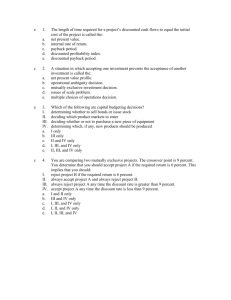

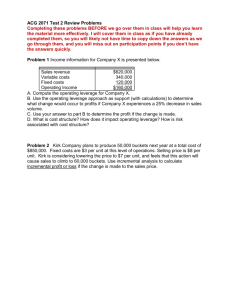

Evaluating Business and Engineering Assets – Part II Part II Professor C. S. Park Copyright © 2005 Payback Period Lecture No.14 Professor C. S. Park Fundamentals of Engineering Economics Copyright © 2005 1 Chapter 5 Present-Worth Analysis Loan versus Project Cash Flows Initial Project Screening Methods Present-Worth Analysis Methods to Compare Mutually Exclusive Alternatives Chapter Opening Story – Federal Express Nature of Project: Equip 40,000 couriers with PowerPads Save 10 seconds per pickup stop Investment cost: $150 million Expected savings: $20 million per year Federal Express 2 Ultimate Questions Is it worth investing $150 million to save $20 million per year, say over 10 years? How long does it take to recover the initial investment? What kind of interest rate should be used in evaluating business investment opportunities? Mr. Bracewell’s Investment Problem • Built a hydroelectric plant using his personal savings of $800,000 • Power generating capacity of 6 million kwhs • Estimated annual power sales after taxes - $120,000 • Expected service life of 50 years Was Bracewell's $800,000 investment a wise one? How long does he have to wait to recover his initial investment, and will he ever make a profit? 3 Mr. Brcewell’s Hydro Project Bank Loan vs. Investment Project Bank Loan Loan Customer Bank Repayment Investment Project Investment Project Company Return 4 Describing Project Cash Flows Year (n) Cash Inflows (Benefits) 0 0 1 Cash Outflows (Costs) Net Cash Flows $650,000 -$650,000 215,500 53,000 162,500 2 215,500 53,000 162,500 … … … … 8 215,500 53,000 162,500 Payback Period Principle: How fast can I recover my initial investment? Method: Based on cumulative cash flow (or accounting profit) Screening Guideline: If the payback period is less than or equal to some specified payback period, the project would be considered for further analysis. Weakness: Does not consider the time value of money 5 Example 5.1 Payback Period N Cash Flow 0 1 2 3 4 5 6 Cum. Flow -$85,000 -$50,000 -$5,000 $45,000 $95,000 $140,000 $175,000 -$105,000+$20,000 $35,000 $45,000 $50,000 $50,000 $45,000 $35,000 Payback period should occurs somewhere between N = 2 and N = 3. $45,000 $45,000 Annual cash flow $35,000 $35,000 $25,000 $15,000 0 1 2 Years 3 4 5 4 5 6 Cumulative cash flow ($) $85,000 150,000 3.2 years Payback period 100,000 50,000 0 -50,000 -100,000 0 1 2 3 6 Years (n) 6 Practice Problem How long does it take to recover the initial investment for Federal Express? How long does it take to recover the investments made by Mr. Bracewell from his hydroelectric project? Discounted Payback Period Principle: How fast can I recover my initial investment plus interest? Method: Based on cumulative discounted cash flow Screening Guideline: If the discounted payback period (DPP) is less than or equal to some specified payback period, the project would be considered for further analysis. Weakness: Cash flows occurring after DPP are ignored 7 Example 5.2 Discounted Payback Period Calculation Period Cash Flow 0 -$85,000 1 Cost of Funds (15%)* Cumulative Cash Flow 0 -$85,000 15,000 -$85,000(0.15) = -$12,750 -82,750 2 25,000 -$82,750(0.15) = -12,413 -70,163 3 35,000 -$70,163(0.15) = -10,524 -45,687 4 45,000 -$45,687(0.15) =-6,853 -7,540 5 45,000 -$7,540(0.15) = -1,131 36,329 6 35,000 $36,329(0.15) = 5,449 76,778 * Cost of funds = (Unrecovered beginning balance) X (interest rate) Summary Payback periods can be used as a screening tool for liquidity, but we need a measure of investment worth for profitability. 8