Corporate Finance

advertisement

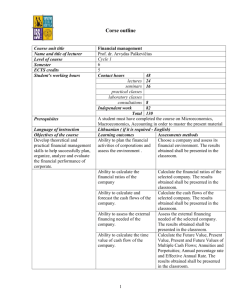

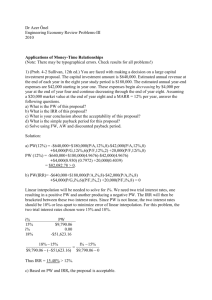

Course outline Course unit title Name and title of lecturer Level of course Semester ECTS credits Student’s working hours Prerequisites Language of instruction Objectives of the course Develop theoretical and practical skills in financial management of capital investment that would facilitate abilities to plan, organise, analyse and assess a company‘s development and expansion projects. Corporate Finance Prof. Dr. Arvydas Paškevičius Cycle 1 5 5 Contact hours 48 lectures 24 seminars 16 practical classes laboratory classes consultations 8 Independent work 82 Total 130 Subjects previously graduated by students: finance management, microeconomics, macroeconomics, accounting Lithuanian, English Learning outcomes Assessments methods Abilities to plan a company‘s Choose a company and assess its financial performance and feasibility for capital investment. assess the expediency and The results obtained shall be reasonableness of capital presented in the classroom. investment. Ability to calculate the net current value using the discounted cash flow method. Calculate the net current value of a sample investment project. The results obtained shall be presented in the classroom. Ability to calculate the criteria Calculate the indices of payback of payback period, discounted period, discounted payback period, payback period, average average accounting rate of return, accounting return, internal rate internal rate of return and the rate of of return, and the profitability return index. index. The results obtained shall be presented in the classroom. Ability to identify the Draw up the tables for the cash flow proceeds from and costs of a calculations of a capital investment capital investment project and project. The results obtained shall present the same in financial be presented in the classroom. cash flow forms. Ability to assess the costCalculate the net current value of a reducing investment and sample investment project. The calculate the minimum tender results obtained shall be presented price. in the classroom. 1 Be able to analyse capital investment projects applying the “what-if” analysis method, also to calculate the accounting and financial “break-even” points. Teaching methods Course unit content Develop a pessimistic, most probable and optimistic scenarios of the sample investment project, also to calculate the accounting and financial “break-even” points. The results obtained shall be presented in the classroom. During the lectures students shall be presented and explained the theoretical material. At home and during the seminars (practical classes) by solving problems-tasks and analysing specific cases the students will take in the theoretical material and acquire practical skills. The course is used to introduce the students to the fundamentals of the management the capital investment in a public company. the range of subjects covered by the course include: net present value, the payback rule, discounted payback, average accounting return, internal rate of return, profitability index, project cash flows: a first look; incremental cash flows; pro forma financial statements and project cash flows; more on project cash flow; alternative definitions of operating cash flow; some special cases of cash flow analysis; evaluating NPV estimates, scenario and other “what-if” analyses; break-even analysis; operating cash flow, sales volume, and breakeven; operating leverage; additional considerations in capital budgeting. Subject title Subject listing Contact hours 1. Introduction to the “Course on 4 Corporate Finance“ 2. Net Present Value and Other 14 Investment Criteria 3. Making Capital Investment 14 Decisions 4. Project Analysis and 16 Evaluation Total 48 Reading list Independent work hours 6 24 24 28 82 Publication year Author and title of the publication Publishing house 1994 Pinigų laiko vertė [Money time value] A. Paškevičius. 2009 Fundamentals of Corporate Finance, Stephen A. Ross, Randolph W. Westerfield, Bradford D. Jordan, Brealey R.A., Myers S., Allen F. „Principles of Corporate Finance“ Additional reading Apskaitos apžvalga 1994m. McGraw-Hill 2010 Publication year Author and title of the publication 2010 2010 Financial Management, Ray M. Brooks Capital Markets, Fabozzi Modigliani McGrawHill Publishing house 2 Pearson Pearson Assessment requirements Final assessment criteria Composition of the final accumulative grade: The subject description prepared by: Approved by the Department: Approved by the Study Programme Committee: Analysis and solutions of tasks and problems at seminars, attendance of lectures and practical classes, interim tests, examination. The grade assigned for problem solution at seminars is multiplied by 0.15. The grade assigned for case study task solution is multiplied by 0.10. Colloquium tests shall be taken by electronic means at the Examination centre. Students are required to solve not less than 50% of all tasks presented in four tests. Where the grade for the colloquium is above 4, it is multiplied by 0.25 and shall be added to the final result. The final accumulative grade shall be composed of: Problem solutions at seminars – 15 % Case study task solution – 10% Grade from colloquium 1 – 25% Grade from colloquium 2 – 25% Grade from colloquium 3 – 25% Prof. Dr. Arvydas Paškevičius Name, date Chairman: signature, date 3