Payback time!

advertisement

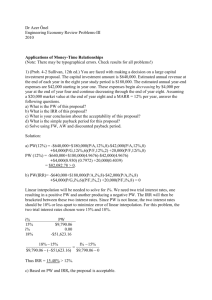

Payback time! Which has the shortest payback time? Which will save the most money in 5 years? 1 Payback time Each insulation method has a different cost and saving, so we calculate ‘payback time’ for a direct comparison. 2 Loft insulation A thick layer of insulation of the loft floor. It works because it’s a poor conductor and traps air, stopping convection. Cost - £450 Saves - £150 every year. What is the payback time? How much saved after 5 years? 3 Draught excluders Brushes and seals on doors. Prevents warm air escaping from the home via convection. Cost - £30 Saves - £20 every year. What is the payback time? How much saved after 5 years? 4 Payback time Use this equation to determine the payback time of each method. Then decide which method you would decide to do first. 5 Application 1. 2. 3. 4. 5. 6. Explain what is meant by the term ‘payback time’. The double-glazing for a house costs £3,000 but saves £150 per year in fuel costs. What is its payback time? The cavity wall insulation in a house costs £6000 to install. It has a payback time of 15 years. How much money does the insulation save each year in fuel costs? A draught excluder has a payback time of 2 years and saves £20 in fuel costs per year. How much did the draught excluder cost? A family purchase loft insulation costing £3000 which saves them £250 per year in fuel costs. The family plan to remain in this house for another 10 years. Was this a worthwhile investment? Explain your answer. A family spend £4000 on double glazing which saves them £250 per year in fuel costs. How long will the family have to remain in this house to recoup their investment 6 Cost effectiveness If savings are bigger than initial and running costs then the method is cost effective and worth doing. All costs need to be accounted for such as installing costs, interest on loan to buy equipment etc… 7