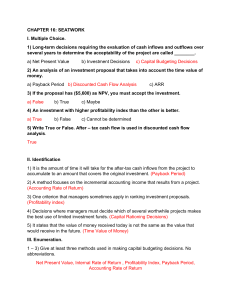

Answers

advertisement

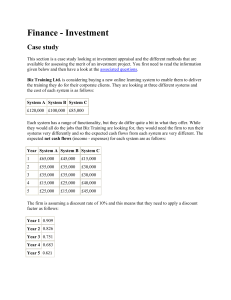

e 1. a. b. c. d. e. c 2. The length of time required for a project’s discounted cash flows to equal the initial cost of the project is called the: net present value. internal rate of return. payback period. discounted profitability index. discounted payback period. a. b. c. d. e. A situation in which accepting one investment prevents the acceptance of another investment is called the: net present value profile. operational ambiguity decision. mutually exclusive investment decision. issues of scale problem. multiple choices of operations decision. e 3. I. II. III. IV. a. b. c. d. e. Which of the following are capital budgeting decisions? determining whether to sell bonds or issue stock deciding which product markets to enter deciding whether or not to purchase a new piece of equipment determining which, if any, new products should be produced I only III only II and IV only I, III, and IV only II, III, and IV only c 4. You are comparing two mutually exclusive projects. The crossover point is 9 percent. You determine that you should accept project A if the required return is 6 percent. This implies that you should: I. reject project B if the required return is 6 percent. II. always accept project A and always reject project B. III. always reject project A any time the discount rate is greater than 9 percent. IV. accept project A any time the discount rate is less than 9 percent. a. I and II only b. III and IV only c. I, III, and IV only d. I, II, and IV only e. I, II, III, and IV e 5. You are considering a project with the following data: Internal rate of return Profitability ratio Net present value Payback period Required return a. b. c. d. e. b 6. Which one of the following is correct given this information? The discount rate used in computing the net present value must have been less than 8.7 percent. The discounted payback period will have to be less than 2.44 years. The discount rate used to compute the profitability ratio was equal to the internal rate of return. This project should be accepted based on the profitability ratio. This project should be rejected based on the internal rate of return. What is the net present value of a project with the following cash flows and a required return of 12 percent? Year 0 1 2 3 a 8.7 percent .98 -$393 2.44 years 9.5 percent Cash Flow -$28,900 $12,450 $19,630 $ 2,750 a. b. c. d. e. -$287.22 -$177.62 $177.62 $204.36 $287.22 7. You are considering the following two mutually exclusive projects. The required rate of return is 11.25 percent for project A and 10.75 percent for project B. Which project should you accept and why? a. b. c. d. e. Year Project A Project B 0 -$48,000 -$126,900 1 $18,400 $ 69,700 2 $31,300 $ 80,900 3 $11,700 $ 0 project A; because its NPV is about $335 more than the NPV of project B project A; because it has the higher required rate of return project B; because it has the largest total cash inflow project B; because it returns all its cash flows within two years project B; because it is the largest sized project d 8. a. b. c. d. e. c 9. a. b. c. d. e. A project has an initial cost of $1,900. The cash inflows are $0, $500, $900, and $700 over the next four years, respectively. What is the payback period? 2.71 years 2.98 years 3.11 years 3.71 years never Yancy is considering a project which will produce cash inflows of $900 a year for 4 years. The project has a 9 percent required rate of return and an initial cost of $2,800. What is the discounted payback period? 3.11 years 3.18 years 3.82 years 4.18 years never d 10. A project has an initial cost of $38,000 and a four-year life. The company uses straight-line depreciation to a book value of zero over the life of the project. The projected net income from the project is $1,000, $1,200, $1,500, and $1,700 a year for the next four years, respectively. What is the average accounting return? a. 3.55 percent b. 4.13 percent c. 4.28 percent d. 7.11 percent e. 14.21 percent e 11. You are analyzing the following two mutually exclusive projects and have developed the following information. What is the crossover rate? a. b. c. d. e. Year 0 1 2 3 11.113 percent 13.008 percent 14.901 percent 16.750 percent 17.899 percent Project A Cash Flow -$84,500 $29,000 $40,000 $27,000 Project B Cash Flow -$76,900 $25,000 $35,000 $26,000