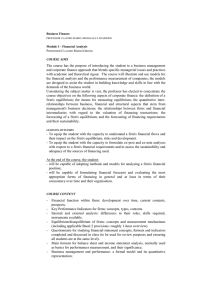

Corporate Finance - the School of Economics and Finance

advertisement

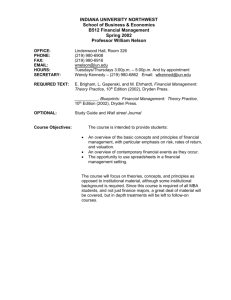

University of Hong Kong School of Economics and Finance ECON6033 CORPORATE FINANCE Semester B, 2008/2009 Instructor: Dr. Xianming ZHOU Office Hours: 5:30 pm – 6:30 pm, Friday, Room 924, K. K. Leung Phone: 2857-8564; E-mail: xianming.zhou@hku.hk Course Objectives This course is structured to analyze important financial decisions made at the firm level, which include: what capital structure to adopt (financing decision); how to value a firm or an investment project (valuation and investment decision); how to raise capital in the equity market (equity issuance decision); how to return cash to investors (dividend and share repurchase decision); what mechanisms to put in place to discipline the manager or controlling shareholders (corporate governance decision); and whether a firm should engage in a merger and acquisition and how to value the target firm (M&A decision). The objective of this course is to expose students to the types of financial issues that they are likely to encounter as corporate managers and investors. The course will use seven weeks to discuss fundamental issues in financial theory and related analytical techniques, and use the remaining weeks to discuss corporate finance cases and a term project. By going through analyses and discussions of real-life financial situations facing corporate managers and investors, students will gain experiences in the application of financial theory and techniques to evaluate a firm’s investment and financing decisions. At the end of the course, students are expected to be able to define a firm’s financial problem and to determine an appropriate course of action. Course Material and References 1. Ross, Westerfield, Jaffe, and Jordan, Modern Financial Management, 8th edition (2008), McGraw-Hill (required text) 2. Selected cases from Darden School of Business and Harvard Business School 3. Class notes and assigned readings Assessment 1. Problem sets: 10% 2. Case write-ups: 26% Students will form case/project groups. Four cases in corporate finance will be discussed. For each case, each group will submit a case analysis (before class discussion on the case). Detailed requirements for case write-ups will be discussed in class. 3. Presentation and class participation: 24% This component will be determined on the basis of both group performance and individual contribution to class discussion. Active class participation is anticipated for each student. Student performance in class participation will depend on case preparation, which is made evident by meaningful comments and appropriate responses to questions as well as asking clear, constructive questions. A necessary requirement for participation is presence. Absence from class discussions will materially reduce your participation grade. 4. Final examination: 40% Schedule of Classes Week Topic Readings and cases 1 Introduction, financial statements, financial planning Chapters 1, 2, 3 2 Discounted cash flow, value of bonds and stocks Chapters 4, 5 3 Investment rules, capital investment decisions Chapters 6, 7 4 Risk and return, CAPM Chapters 9, 10 5 Cost of capital, capital structure Chapters 12, 15 6 Case 1: Cost of capital Ameritrade 7 Valuation, long-term financing, IPOs Chapter 17, 19 8 Case 2: Valuing the enterprise Arcadian 9 Case 3: Valuing an IPO Jetblue IPO valuation 10 Mergers and acquisitions Chapter 29 11 Case 4: Merger-negotiation To be announced 12 Corporate governance issues Class notes