Home Buyer Readiness - Bend Area Habitat for Humanity

advertisement

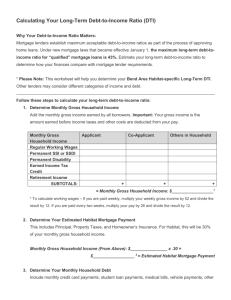

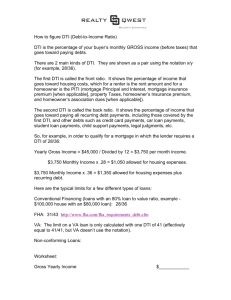

Home Buyer Readiness Are You Ready To Buy A Habitat Home? Buying a home is often a very big step that can bring with it a lot of responsibilities. Purchasing a Habitat home has other considerations as well. We recommend you take the time to closely examine your financial and emotional readiness for this decision. Buying a home has many benefits, but it can have some pressures that go along with it. Financial Readiness Buying a first home does come with its share of financial responsibility. Homeowners not only have to pay a mortgage, but they also have insurance costs, property taxes, routine maintenance expenses and also repair costs for anything that goes wrong in a home. So, being ready to buy can mean a whole lot more than having the financial ability to pay a monthly mortgage bill. Some of the financial matters you will want to consider include: Your credit-worthiness for obtaining a mortgage loan Your personal monthly budget and how much can be safely dedicated to home-related expenses With a conventional home loan: your ability to come up with a down payment of 5 to 20 percent if required by the terms of a home loan. This is not required for Habitat home buyers. You will however, need to save for closing costs. DID YOU KNOW… You can get a free credit report once a year at https://www.annualcreditreport.com/index.action Review this report with the credit coaches (no charge) at NeighborImpact by calling 541-318-7506. These same coaches can also help you prepare a budget Questions you will want to ask yourself include: How good is my credit? (Do I have accounts in collections? If so, how much?) Do I know what my Debt-to-Income ratio is? Do I know what this needs to be in order to qualify for a home loan? What does Bend Area Habitat for Humanity (BAHFH) like to see for a DTI ratio? (see side bar) What will my monthly payments look like with taxes, insurance and other incidentals included? (Typically, you do not want to pay more than 30-35% of your monthly income to your mortgage payment) Determining your Debt-toIncome (DTI) Ratio: Your debt-to-income ratio compares the amount of your debt (excluding your rent payment) to your income. The ratio is best figured on a monthly basis. For example, if your monthly take-home pay is $2,000 and you pay $400 per month in debt payment for loans and credit cards, your debtto-income ratio is 20% ($400 divided by $2,000 = .20). What is included in monthly debt? Credit card payments, medical bills, other loans, car payments, even deferred school loans (usually estimated at 1-1.5% of total amount) For most lenders, the term “creditworthy” means keeping your DTI below 20%. A higher percentage means a higher risk (of credit trouble). BAHFH prefers a DTI ratio of about 10-12%. This is because we are typically working with applicants in a lower income range. When we estimate your mortgage payment to be 30% of your income, then add your debt of 10% = 40%. This leaves you with 60% of your income for other life expenses. Emotional Readiness Choosing to buy a home really shouldn't be a split-second decision. This purchase is a long-term investment that can place demands on a buyer that go well beyond standard rental situations. Would-be buyers may want to ask themselves such question as: Am I willing to put the time and effort into the maintenance of a home? Or am I ready to learn the skills it takes to do this maintenance? Am I willing to make the commitment that goes into making a purchase and maintaining the investment? Do I plan on staying in this area for an extended period of time? Is everyone in my family supportive of this decision? Wants vs. needs: Am I willing to give up something to purchase a home? With a Habitat home: are you willing to accept the neighborhood and home that is offered to you? Homebuyer Checklist To help you determine if buying a home is right for you, or if this is the right time, there are some things you can do to explore and/or prepare yourself: Check into your personal credit standing – Take the time to pull credit reports from the three major bureaus and look for any issues that may need to be addressed. Generally, the better your credit ranking, the more likely it is you will be able to secure a loan with favorable terms. Repair damage to your credit – If there are errors on the credit reports, get them fixed. Each credit bureau has its own process to follow. Should issues be valid, take steps in advance of attempting to secure a home loan to fix trouble spots such as old, unpaid bills or maxed out credit cards. Examine your personal motivations for buying – Just because it is "expected" or your peers are doing it doesn't mean you are necessarily ready. Be honest with yourself and you will make the right decision. Consider taking homeownership or finance classes though NeighborImpact or Housing Works. They also have other resources and would be a good connection for you to explore and to learn about other services that can support you. Consider all your options for housing. For example, if you are interested in living outside Bend city limits or in a rural community (even Redmond is considered rural) look into the United States Department of Agriculture (USDA) Direct Home Loan Program. For more information, contact Renee' Robinson, Area Loan Technician, 200 SE Hailey Ave., Ste. 105, Pendleton, Oregon 97801, (541)278-8049 ext. 4. www.rurdev.usda.gov Get your paperwork ready. Most lenders, including BAHFH, will require 3-6 months of rent payment verification, identification, previous year’s tax return, w2’s, 3-6 months utility statements, and bank statements. Usually there are other documents as well. With BAHFH, fill out and return a Preliminary Housing Questionnaire. This will help you determine if you meet the basic guidelines. Attend the next Housing Information Session* (offered 3 times per year) and then decide if you want to apply for the Habitat Homeownership Housing Program. *By returning your Preliminary Questionnaire we will keep your contact information and notify you of the upcoming housing information session. We will also post the details on our website and through all media sources. Let us know if you need more information on any of these items.