Whirlpool of India Ltd

advertisement

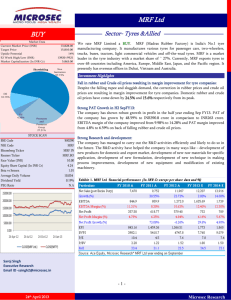

Whirlpool of India Ltd BUY Sector – Consumer Durables Market Data Current Market Price (CMP) 171 Target Price 208 Upside Potential 21.44% 52 Week High Low 290/124 Market Cap (INR in Cr) 2169 Others 12.54% recommend Whirlpool of India Ltd a “BUY”. Whirlpool of India is the subsidiary of world's largest We consumer durables company Whirlpool Corporation, USA. The parent company is headquartered at Michigan, USA having global presence over 170 countries and manufacturing operation in 13 countries with 11 major brand names such as Whirlpool, KitchenAid, Roper, Estate, Bauknecht, Laden and Ignis. Diversified business model, focus on innovation and productivity improvement coupled with control on operational efficiencies, and factors like rural demand, increase in disposable income and rapid urbanization driving demand for home appliances bodes well for Whirlpool India. Investment Highlight DIIs 5.45% FIIs 7.01% Foreign promoters 75.00% Stock Scan Scrip ID Whirlpool of India Ltd Scrip Code (NSE) WHIRLPOOL Scrip Code (BSE) 500238 WHIRL IN Bloomberg Ticker Reuters Ticker WHIR.BO Industry Consumer Durables Face Value ( INR per share) 10.00 Equity Share Capital ( INR in Cr) 126.87 Avg 3 years P/E 20.79 Avg daily volume (Last 1 Year) 60,984 Beta Vs Sensex 0.99 Dividend Yield NA 300 280 260 240 220 200 180 160 140 120 100 22000 21000 20000 19000 Analyst: Neha Majithia nmajithia@microsec.in +033‐3051 2177 02‐Nov‐13 02‐Jul‐13 02‐Sep‐13 02‐Jan‐13 02‐Mar‐13 02‐Nov‐12 02‐Jul‐12 02‐Sep‐12 02‐May‐12 02‐Jan‐12 02‐Mar‐12 02‐May‐13 SENSEX Exhibit 1. Whirlpool of India Ltd Financial Performance (INR in Crores except per share data and %) 18000 Particulars 17000 Net Sales 16000 Growth (%) 15000 Whirlpool of India Diversification of products in a single segment of “Home appliances”: The Company has diversified into variety of products under a single segment named “Home appliances” like Refrigerators, Washing machines, Air‐conditioners, Microwave Ovens and other built‐in appliances. It derives ~59‐60% of revenue from Refrigerators, 20‐22% from Washing machines, 10‐11% from Air‐conditioners, 3% from Microwave ovens, ~5% from consumer services and ~2% from others. Recently, the company launched new, innovative and intuitive products in 70% of its portfolio which would be valued for performance, design and differentiated features. With this launch the company aimed for leadership in Refrigerator and Washers in the next 12‐15 months and overall leadership in Home Appliances in the next 2‐3 years. Focus on innovation and productivity improvement to drive market share and lower cost to help improve margins: Whirlpool India, which has a share of ~20% in the Indian home appliances market pegged at around INR35,000 crore or 15 million appliances, expects to improve market share by continuous launching of new products and re‐engineering product design and components. The company’s raw material cost which account for 55‐60% of the total cost, is focusing on improving cost efficiencies in the wake of demand. Also, the company which imports 27‐30% of raw materials is now increasing domestic sourcing to save itself from rupee depreciation. We believe that these measures like delivering higher rate of productivity along with cost control is expected to help company realize better margins. Rural demand, increase in disposable income and rapid urbanization to drive demand for mainly refrigerators/washing machines and other home appliances: Rural demand, increase in disposable income and rapid urbanization have always been the major factors for driving demand of home appliances. With penetration of refrigerators and washing machines low in rural areas, the company is ready to tap the opportunity. In rural market, the company is focusing on basic products and in urban market it is focusing on launching new products in premium and super premium range. Debt Free Company; Increasing free Cash flows: We believe Whirlpool India can leverage on its debt‐free status to improve net profit margins in the coming years also. The company generates healthy cash flows. Its cash balance has gone up from INR86cr in FY12 to Rs 155cr in FY13. Hence, healthy cash flows leave much scope for the company to consider dividend payments going ahead. EBITDA EBITDA Margin (%) Net Profit FY2009A FY2010A FY2011A FY2012A FY2013 FY2014E 2215 2703 2658 2773 2884 3230 ‐4.50% 28.84% 22.03% ‐1.66% 4.32% 4.00% 12.00% 72 107 217 261 223 213 216 3.99% 6.21% 9.80% 9.65% 8.39% 7.68% 7.50% 70 145 166 124 128 124 132 Net Profit Margin (%) 1.78% 4.10% 6.55% 6.14% 4.66% 4.61% 4.31% Net Profit Growth(%) 120.21% 105.73% 14.49% ‐25.48% 3.25% ‐2.63% 5.91% EPS 2.52 5.19 9.19 9.75 10.07 9.80 10.38 Adjusted EPS 5.56 11.43 13.09 9.75 10.07 9.80 10.38 Adjusted P/E(x) 4.54 14.94 20.11 20.39 21.87 17.44 16.47 P/BV(x) 2.32 13.00 11.26 5.15 4.52 3.10 2.75 ROE(%) 28.72% 43.24% 42.08% 27.12% 23.07% 18.88% 17.68% 3.82 8.34 11.65 10.35 10.88 8.53 7.13 EV/EBITDA(x) Source: Company Data, Microsec Researc, Bloomberg 28th November, 2013 FY2015E 1719 Microsec Research Quarterly Snapshot Particulars Q2FY14A Q2FY13A Q1FY14A YoY QoQ H1FY14 H1FY13 Var Net Sales 614.64 633.24 880.9 ‐2.9% ‐30.2% 1496 1527.2 Expenditure 583.03 585.61 798.99 ‐0.4% ‐27.0% 1382 1379 0.2% 31.61 47.63 81.91 ‐33.6% ‐61.4% 114 148.38 ‐23.5% 5.14% 7.52% 9.30% (238)bps (416)bps 7.59% 9.72% (213)bps 16.54 28.38 49.59 ‐41.7% ‐66.6% 66 92.94 ‐28.8% 2.69% 4.48% 5.63% (179)bps (294)bps 4.42% 6.09% (167)bps 1.3 2.24 3.91 ‐42.0% ‐66.8% 5.21 7.33 ‐28.8% EBITDA EBITDA Margin PAT PAT Margin EPS ‐2.1% Diversified Product Portfolio Refrigerators Air‐ Conditioners Washing Machines Product Portfolio Other appliances like water purifier, Induction cooker, etc Microwave Ovens Built ‐in Appliances Valuation At the CMP of INR171, the stock is trading at forward P/E of 17.44x its FY14e EPS of 9.80 and P/E of 16.47x its FY15e EPS of 10.38. With improving product mix, debt free status, healthy cash flows the company is likely to outperform in future. Hence, we have assigned a P/E multiple of 20x to arrive at a target price of INR208 per share; an upside of 21%. Key Risks 28th November, 2013 Late onset of summer as summer accounts for ~40 % of annual sales of whirlpool. Late onset of summer leads to lower off‐take of summer products like Refrigerators and Air Conditioners, impacts volume growth. Rupee depreciation as company imports 27‐30% of its raw materials. Higher input costs due to higher commodity prices can impact the margins. Microsec Research Microsec Research: Phone No.: 91 33 30512100 Email: microsec_research@microsec.in Ajay Jaiswal: President, Investment Strategies, Head of Research: ajaiswal@microsec.in Fundamental Research Name Sectors Designation Email ID Nitin Prakash Daga IT, Telecom & Entertainment VP‐Research npdaga@microsec.in Naveen Vyas FMCG, Midcaps, Mkt VP‐Research nvyas@microsec.in Sutapa Roy Economy Research Analyst s‐roy@microsec.in Sanjeev Jain BFSI Research Analyst sjain@microsec.in Neha Majithia Metal, Mineral & Mining Research Analyst nmajithia@microsec.in Soumyadip Raha Oil & Gas Executive Research sraha@microsec.in Saroj Singh Auto, cement Executive Research ssingh2@microsec.in Kapil Bhati Fert, Chem & Agri Executive Research kbhati@microsec.in Technical & Derivative Research Vinit Pagaria Derivatives & Technical Senior VP vpagaria@microsec.in Ranajit Saha Technical Research Sr. Manager rksaha@microsec.in Institutional Desk Puja Shah Institutional Desk Dealer pdshah@microsec.in Abhishek Sharma Institutional Desk Dealer Asharma3@microsec.in PMS Division Siddharth Sedani PMS Research VP ssedani@microsec.in Ketan Mehta PMS Sales AVP ksmehta@microsec.in Research‐Support Subhabrata Boral Research Support Asst. Manager Technology sboral@microsec.in Recommendation Expected absolute returns (%) over 12 months Strong Buy >20% Buy between 10% and 20% Hold between 0% and 10% Underperform between 0% and ‐10% Sell < ‐10% MICROSEC RESEARCH IS ALSO ACCESSIBLE ON BLOOMBERG AT <MCLI> 28th November, 2013 Microsec Research 28th November, 2013 Microsec Research Disclaimer: This document is prepared by the research team of Microsec Capital Ltd. (hereinafter referred as “MCL”) circulated for purely information purpose to the authorized recipient and should not be replicated or quoted or circulated to any person in any form. This document should not be interpreted as an Investment / taxation/ legal advice. While the information contained in the report has been procured in good faith, from sources considered to be reliable, no statement in the report should be considered to be complete or accurate. Therefore, it should only be relied upon at one’s own risk. MCL is not soliciting any action based on the report. No indication is intended from the report that the transaction undertaken based on the information contained in this report will be profitable or that they will not result in losses. Investors must make their own investment decisions based on their specific investment objectives and financial position and using such independent advisors, as they believe necessary. Neither the Firm, nor its directors, employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. 28th November, 2013 Microsec Research