dabur india ltd initiate buy target price 163

advertisement

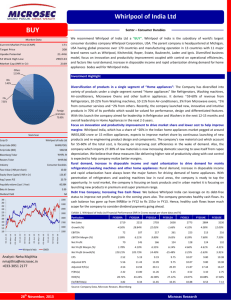

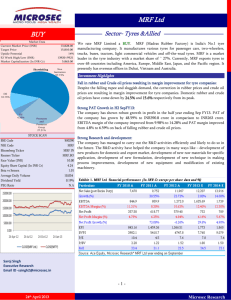

DABUR INDIA LTD INITIATE BUY TARGET PRICE 163 Analyst : Naveen Vyas Email_id : nvyas@microsec.in -126 APRIL 2013 Microsec Research DABUR India Ltd BUY Sector – FMCG Market Data Current Market Price (INR) Target Price % Upside 52 Week High / Low (INR) Market Capitalization (In INR cr) 146 163 12% 148 / 101 25,455 S har e holding Others 6.85% DII 4.25% We Initiate Dabur India Ltd a BUY. The 128-year-old company, promoted by the Burman family, had started operations in 1884 and is today one of India’s leading FMCG Companies with Revenues of more than US$1 Billion. Dabur is today India’s most trusted name and the world’s largest Ayurvedic and Natural Health Care Company. Dabur is a household brand having large distribution network and strong rural presence. Dabur has successfully transformed itself from being a family-run business to become a professionally managed enterprise. Dabur's products also have a huge presence in the overseas markets and are today available in over 60 countries across the globe. Investment Highlights ‘Volume is expected to grow in a range of 9-10% for FY14E in a challenging business environment : Dabur is expected to maintain a volume growth of 9-10% for FY14E which we think is positive for the company in a challenging business enironment, witnessing slowdown in economy and cap in subsidies across sectors. The company’s mass product appeal, limited discretionary products portfolio and rural expansion will help it to maintain the volume growth. FIIS 20.24% Promoters 68.66% STOCK SCAN BSE Code NSE Code Bloomberg Ticker Reuters Ticker Face Value (INR) Equity Share Capital (Rs. cr.) Average 3 Year P/E Beta vs Sensex Average Daily Volmes (6 M) Dividiend Yield Return (%) 1YR 500096 DABUR DABUR.IN DABUR.BO 1.00 174.29 33.1x 0.4x 1,222,000 0.89 32 140.00 Strong Portfolio of Powerful Brands and wide distrubution network : Dabur has strong portfolio of powerful brands like ‘Dabur, Vatika, Hajmola, Real and FEM ’. It spends around 13-14% of its sales on the advertisement every year to increase its brand presence. The company has build a wide distribution network covering 5.8 million retailers across the country to support its growth. Namaste Business to seek strong revival in FY14: Namaste which contributes around 10% of the total sales of the company is expected to perform better in FY14 on back of current restructuring initiatives taken by the company. The company is undertaking brand re-launches for key products like ORS, working on distribution restructuring and creating an efficient supply chain for Namaste in the African market.It is also setting up a manufacturing base in West Asia, Nigeria and South Africa. Well Diversified Business Model: Dabur India business operation is well diversified. Around 30% of its sales comes from international business and 70% from domestic business. The products range of the company are also well diversified covering key consumer product categories like Hair Care, Oral Care, Health Care, Skin Care, Home Care and Foods. Exhibit 1.Dabur India – Historical Financials and Projections – INR crores 120.00 100.00 Dabur SENSEX 3 /2 7 /2 0 1 3 2 /2 7 /2 0 1 3 1 /2 7 /2 0 1 3 1 2 /2 7 /2 0 1 2 1 1 /2 7 /2 0 1 2 1 0 /2 7 /2 0 1 2 9 /2 7 /2 0 1 2 8 /2 7 /2 0 1 2 7 /2 7 /2 0 1 2 6 /2 7 /2 0 1 2 5 /2 7 /2 0 1 2 4 /2 7 /2 0 1 2 80.00 Particulars Net Sales Growth (%) EBITDA EBITDA Margins (%) Adjusted Net Profit Net Profit Margins (%) Net Profit Growth (%) EPS (Adjusted) P/E P/BV RoE FY10A 3,416.0 648.0 19.0% 503.0 14.7% 2.90 50.36 27.50 58.8% FY11A 4,105.0 20% 801.0 19.5% 569.0 13.9% 13% 3.27 44.66 19.90 51.8% FY12A 5,305.0 29% 890.0 16.8% 645.0 12.2% 13% 3.70 39.47 15.70 44.7% FY13E 6,205.0 17% 1,024.0 16.5% 767.0 12.4% 19% 4.40 33.19 12.07 41.0% FY14E 7,318.0 18% 1,237.0 16.9% 948.0 13.0% 24% 5.44 26.85 9.36 39.3% Source: Company, Microsec Research -226 APRIL 2013 Microsec Research Company Profile Dabur India Ltd is one of India’s leading FMCG Companies with Revenues of more than US$1 Billion. The 128-year-old company, promoted by the Burman family, had started operations in 1884 and is today India’s most trusted name and the world’s largest Ayurvedic and Natural Health Care Company. Dabur India is also a world leader in Ayurveda with a portfolio of over 250 Herbal/Ayurvedic products. Dabur's FMCG portfolio today includes five flagship brands with distinct brand identities -- Dabur as the master brand for natural healthcare products, Vatika for premium personal care, Hajmola for digestives, Réal for fruit juices and beverages and Fem for fairness bleaches and skin care products. Dabur today operates in key consumer products categories like Hair Care, Oral Care, Health Care, Skin Care, Home Care and Foods. The company has a wide distribution network, covering over 5.8 million retail outlets with a high penetration in both urban and rural markets. Dabur's products also have a huge presence in the overseas markets and are today available in over 60 countries across the globe. Its brands are highly popular in the Middle East, SAARC countries, Africa, US, Europe and Russia. Dabur's overseas revenue today accounts for over 30% of the total turnover. From its humble beginnings in the bylanes of Calcutta, Dabur India Ltd has come a long way today to become one of the biggest Indian-owned consumer goods companies with the largest herbal and natural product portfolio in the world. Overall, Dabur has successfully transformed itself from being a family-run business to become a professionally managed enterprise. Key Milestones 1884 1972 • The company shifted its base to Delhi from Kolkata. • Dr. SK Burman started an Ayurvedic Pharmacy in Kolkata. 1998 2003 • Professionalized with Burman Family handling over day to management 2006 • Pharma Business de-merged to focus on core FMCG Business. 2008 • Acquired Fem Care Pharma entering mainstream skin care. • Dabur figured in Top 10 Great places to work. 1986 • Registered as a Public Limited Company. 2004 • International Business set up in Dubai to tap overseas opportunity. 2010 • Overseas acquisitions – Hobi Group, Turkey and Namaste Laboratories, US. 1994 • Listed on the Bombay Stock Exchange. 2005 • Acquired Balsara strengthening oral Care & gaining entry into Home Care. 2012 • Crossed INR50 Billion mark in annual revenues and Market Cap of US$4 Billion -326 APRIL 2013 Microsec Research Business Overview of Dabur India Dabur India Ltd business is divided into two broad categories i.e. Domestic Business and International Business. Domestic Business contributes around 70% of its sales and the rest is international. Domestic Business includes Consumer Care, Foods, Retail and Others whereas International Business includes Dabur international, Namaste Lab and Hobi Group sales. Consumer Care Business The Consumer Care Business is the largest segment, contributing to 56% of consolidated sales and grew by 11.4% during fiscal 2011-12. The segment is divided into the key verticals of Health care and Home and Personal care. Contribution to Consumer Care Business Skin care 6% Home care 6% Hair care 30% Digestives 8% OTC 12% Oral care 17% Health care 21% Source : Company database -426 APRIL 2013 Microsec Research -526 APRIL 2013 Microsec Research Foods Business The Foods business at present includes packaged fruit juices and nectars under the brands Real and Real Activ and culinary pastes under the brand Hommade International Business Dabur's International Business continued on a strong growth trajectory with sales growing by 78.3% to INR1616 crores. The International Business now contributes 30.3% to consolidated sales. The growth in International business has been supported by two overseas acquisitions - Hobi Group and Namaste Laboratories, LLC which came under the Dabur fold. International Sales Regional Break up Others 6% Middle East 30% Asia 16% Af rica 22% US 26% Source : Company database -626 APRIL 2013 Microsec Research FMCG Industry Overview The Indian FMCG sector is the fourth largest sector in the economy with a total market size of INR189500 crore. The market is estimated to grow to US$ 100 billion by 2025, according to market research firm Nielsen. In the last decade the FMCG sector has grown at an average of 11% a year and in the last five years, annual growth accelerated to 17%. FMCG sector in India continues to grow well in both urban and rural areas. Rural India contributes to around one third of FMCG sales in India Emerging FMCG Trends In India -726 APRIL 2013 Microsec Research Penetration Level Of Various Products In India Industry Outlook With a big demand push from rural India, the fast moving consumer goods (FMCG) industry is expected to witness a robust growth of 18 per cent over the next 4-5 years and emerge as the sector which will claim the biggest component of the consumer expenditure by the end of the 12th Plan, an ASSOCHAM Eco Pulse study has indicated. It said within the FMCG industry, the product categories which are expected to see attractive growth are the packaged foods category, toiletries, beverages, detergents, edible oil, and cosmetics. In the food category, thanks to improving purchasing power, consumption pattern is shifting towards high value and protein products such as vegetables, fruits, milk, meat, fish and eggs. Rural India is evolving as the engine of growth for FMCG sector Risks and Challenges Diverse consumer preferences Increasing competition Rising logistics, procurement costs Ability to win rural consumers Slowdown in rural demand High Inflation Removal of import restrictions resulting in replacement of domestic brands Increasing clutter – advent of price wars -826 APRIL 2013 Microsec Research Investment Thesis 9.5% 12.0% Jun-12 11.0% 12.0% Mar-12 11.0% 9.0% Jun-11 10.0% 9.0% Mar-11 12.0% Volum e Grow th (%) of Last 12 Quarters 10.0% 16.0% 12.0% 20.0% 14.0% 17.0% ‘Volume is expected to grow in a range of 9-10% for FY14E in a challenging business environment : Dabur is expected to maintain a volume growth of 9-10% for FY14E which we think is positive for the company in a challenging business enironment, witnessing slowdown in economy and cap in subsidies across sectors. The company’s mass product appeal, limited discretionary products portfolio and rural expansion will help it to maintain the volume growth.The Volume growth of Dabur India ltd, on an average, has been in double digits from the last 12 quarters 8.0% 4.0% Dec-12 Sep-12 Dec-11 Sep-11 Dec-10 Sep-10 Jun-10 Mar-10 0.0% Strong Portfolio of Powerful Brands and wide distrubution network : Dabur has strong portfolio of powerful brands like ‘Dabur, Vatika, Hajmola, Real and FEM ’. It spends around 13-14% of its sales on the advertisement every year to increase its brand presence. The company has build a wide distribution network covering 5.8 million retailers across the country to support its growth. Dabur's FMCG portfolio today includes five flagship brands with distinct brand identities -- Dabur as the master brand for natural healthcare products, Vatika for premium personal care, Hajmola for digestives, Réal for fruit juices and beverages and Fem for fairness bleaches and skin care products. Distribution Network with total reach of 5.8 mn Retail Outlets -926 APRIL 2013 Microsec Research Namaste Business to seek strong revival in FY14E: Namaste which contributes around 10% of the total sales of the company is expected to perform better in FY14 on back of current restructuring initiatives taken by the company. The company is undertaking brand re-launches for key products like ORS, working on distribution restructuring and creating an efficient supply chain for Namaste in the African market.It is also setting up a manufacturing base in West Asia, Nigeria and South Africa The slow growth of Namaste business in US was due to change in the brand name from Organic Root Stimulator to ORS because of some regulatory issue as a result of which the company has to do alteration of the entire brand architecture and incur brand cost for the same in FY13. Now the process has been complete and the business is expected to revive strongly in FY14E. Overview of Namste Business: Dabur India Limited through its subsidiary Dabur International Limited acquired 100% stake in Namaste Laboratories LLC for $100 million (about INR450 crore), in an all-cash deal on November 2010. Namasté is a leading ethnic hair care products company, having products for women of colour, with revenues of $95 million (CY2010) from US, Europe, Middle East and African markets. Well Diversified Business Model: Dabur India business operation is well diversified. Around 30% of its sales comes from international business and 70% from domestic business. The products range of the company are also well diversified covering key consumer product categories like Hair Care, Oral Care, Health Care, Skin Care, Home Care and Foods. This structural shift in consumption pattern, termed popularly as ‘the consumption Source : Company database - 10 26 APRIL 2013 Microsec Research Financials Snapshot Net Sales [INR‐Crore] 6,000 5,305 5,000 4,105 4,000 3,000 3,416 2,831 2,385 2,000 1,000 ‐ FY08 FY09 FY10 FY11 FY12 EBIDTA [INR‐Crore] 1000 890 40.0% 801 800 35.0% 648 600 492 428 19.0% 30.0% 25.0% 19.5% 16.8% 400 17.9% 45.0% 20.0% 15.0% 17.4% 10.0% 200 5.0% 0.0% 0 FY08 FY09 FY10 FY11 FY12 Normalised PAT [INR‐Crore] 800 720 645 640 569 560 503 480 400 391 333 320 240 160 80 0 FY08 FY09 FY10 FY11 FY12 - 11 26 APRIL 2013 Microsec Research 9M Financials INR cr Peer comparison Source: Bloomberg Consensus, company database; Financials in INR crores Note: Nestle India and Glaxosmithkline Consumer financial year end in December. - 12 26 APRIL 2013 Microsec Research Valuation At the CMP of INR146, the stock discounts its FY13E EPS of INR4.4 by 33x and its FY14E EPS of INR5.4 by 27x. Its 3 year and 5 year Average P/E works out to be 33x and 31x respectively as per Bloomberg. With Strong Brand Value, larger rural penetration, revival expected in international business and stable business outlook, makes Dabur India a good bet for investment. We assign a multiple of 30x on its FY14EPS of INR5.44 to arrive at a Target price of INR163 (i.e. 12% upside from CMP) for a time horizon of 12 months. Key concern Highly Competitive Industry: FMCG Industry is highly competitive industry with more players coming in the fields of personal care, oral care and skin care. Consumers are very price sensitive in this industry. Major Slowdown in the economy - Any major slowdown in the economy will have a negative impact on the volume growth of the company and may affect its topline . - 13 26 APRIL 2013 Microsec Research Recent Launches - India Recent Launches - International - 14 26 APRIL 2013 Microsec Research Income Statement (INR crore) Ratio Analysis - 15 26 APRIL 2013 Microsec Research Balance-Sheet (INR crore) Cash Flow - 16 26 APRIL 2013 Microsec Research Microsec Research: Phone No.: 91 33 30512100 Email: microsec_research@microsec.in Ajay Jaiswal: President, Investment Strategies, Head of Research: ajaiswal@microsec.in Fundamental Research Name Sectors Designation Email ID Nitin Prakash Daga IT, Telecom & Entertainment AVP‐Research npdaga@microsec.in Naveen Vyas Midcaps, Market Strategies AVP‐Research nvyas@microsec.in Sutapa Roy Economy Research Analyst s‐roy@microsec.in Sanjeev Jain BFSI Research Analyst sjain@microsec.in Anik Das Mid Cap Research Analyst adas4@microsec.in Neha Majithia Mid Cap Research Analyst nmajithia@microsec.in Soumyadip Raha Mid Cap Executive Research sraha@microsec.in Saroj Singh Mid Cap Executive Research ssingh2@microsec.in Kapil Bhati Mid Cap Executive Research kbhati@microsec.in Technical & Derivative Research Vinit Pagaria Derivatives & Technical VP vpagaria@microsec.in Ranajit Saha Technical Research Sr. Manager rksaha@microsec.in Institutional Desk Dhruva Mittal Institutional Equities Sr. Manager dmittal@microsec.in Puja Shah Institutional Desk Dealer pdshah@microsec.in PMS Division Siddharth Sedani PMS Research AVP ssedani@microsec.in Ketan Mehta PMS Sales AVP ksmehta@microsec.in Research: Financial Planning Division Shrivardhan Kedia FPD Products Manager Research skedia@microsec.in Research‐Support Subhabrata Boral Research Support Asst. Manager Technology Recommendation Expected absolute returns (%) over 12 months Strong Buy >20% Buy between 10% and 20% Hold between 0% and 10% Underperform between 0% and ‐10% Sell < ‐10% sboral@microsec.in MICROSEC RESEARCH IS ALSO ACCESSIBLE ON BLOOMBERG AT <MCLI> - 17 26 APRIL 2013 Microsec Research - 18 26 APRIL 2013 Microsec Research