MRF Ltd BUY - Moneycontrol

advertisement

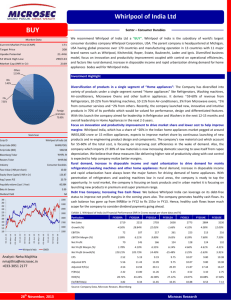

MRF Ltd Sector- Tyres &Allied BUY Market Data Current Market Price (INR) Target Price Upside Potential 52 Week High/Low (INR) Market Capitalization (In INR Cr) 13,828.00 15,810.00 14% 13920 /9521 5,863.00 Sha reholding Non Institution 57.73% We rate MRF Limited a BUY. MRF (Madras Rubber Factory) is India's No.1 tyre manufacturing company. It manufactures various tyres for passenger cars, two-wheelers, trucks, buses, tractors, light commercial vehicles and off-the-road tyres. MRF is a market leader in the tyre industry with a market share of ~ 27%. Currently, MRF exports tyres to over 65 countries including America, Europe, Middle East, Japan, and the Pacific region. It presently has overseas offices in Dubai, Vietnam and Australia. Investment Highlights Fall in rubber and Crude oil prices resulting in margin improvement for tyre companies: Despite the falling rupee and sluggish demand, the correction in rubber prices and crude oil prices are resulting in margin improvement for tyre companies. Domestic rubber and crude oil prices have come down by 24.5% and 15.6% respectively from its peak. DII 10.73% FII 4.33% Strong PAT Growth in H2 SepFY13: The company has shown robust growth in profit in the half year ending Sep FY13. PAT of the company has grown by 48.59% to INR390.8 crore in comparison to INR263 crore. EBITDA margin of the company improved from 9.98% to 14.28% and PAT margin improved from 4.8% to 6.59% on back of falling rubber and crude oil prices. Promoter and Promoter Group 27.21% STOCK SCAN BSE Code NSE Code Bloomberg Ticker Reuters Ticker Face Value (INR) Equity Share Capital (In INR Cr) Beta vs Sensex Average Daily Volume Dividend Yield PEG Ratio 500290 MRF MRF IN MRF.BO 10.00 4.24 1.01 10,034 0.19% N.A Strong Research and development: The company has managed to carry out the R&D activities efficiently and likely to do so in the future. The R&D activity have helped the company in many ways like – development of new products for domestic and export market, development of new raw materials for specific application, development of new formulation, development of new technique in making process improvements, development of new equipment and modification of existing machinery. 25000.00 20000.00 15000.00 10000.00 5000.00 0.00 24‐Apr‐12 24‐Jul‐12 CLOSE(MRF Ltd.) 24‐Oct‐12 24‐Jan‐13 CLOSE(NIFTY) Saroj Singh Executive Research Email ID ‐ssingh2@microsec.in -124th April 2013 Microsec Research Industry Snapshot Market share‐Indian Tyre Industry(%) Others Tyre, 26% MRF Tyre, 27% Ceat, 12% Apollo Tyres, 19% JK Tyre, 16% In India, ~65% of tyre demand comes from replacement market, in which the T&B (Truck &Bus) segment contributes ~57% to the total volume. T&B tyre segment is highly dominated by MRF, Apollo, CEAT and JK tyre. Currently top four players possess ~74% market share in Indian tyre Industry. Peer Group Comparison Sales FY12 Company (23rd Apr 2012) No.of CMP share EBITDA EBITDA ROE (%) FY12 (%) PAT FY12 PAT (%) EPS FY12 FY12 D/E EPS FY13E MCAP EPS FY14E P/E FY13E P/E FY14E *MRF Ltd 11,967 1,272 10.6 579 4.8 1,366.5 22.5 0.6 13828 0.42 5863 1773.0 1860.0 7.8 7.4 Apollo Ltd Ceat Ltd J K Tyres 12,153 4,649 6,947 1,166 282 329 9.6 6.1 4.7 410 18 -32 3.4 0.4 -0.5 8.13 5.3 -7.8 15.6 2.7 -4.0 1.0 1.9 3.0 92 103 115 50.41 3.42 4.10 4643 352 472 11.8 33.0 37.9 14.0 39.5 41.2 7.8 3.1 3.0 6.6 2.6 2.8 Source: ACE, Company Database. * MRF Ltd year ending on September. Financials in INR crore. Automobile Domestic sales growth trends Category Passenger Vehicles Commercial Vehicles Three Wheelers Two Wheelers Grand Total 2006‐07 2007‐08 21% 33% 12% 12% 14% 2008‐09 12% 5% ‐10% ‐8% ‐5% 2009‐10 0% ‐22% ‐4% 3% 1% 2010‐11 26% 39% 26% 26% 26% 2011‐12 28% 29% 19% 26% 26% 2012‐13 5% 18% ‐2% 14% 12% 3% ‐2% 5% 3% 3% Valuation At the CMP of INR13828, the stock is trading at a P/E of 7.8x its FY13E EPS of INR1773 and 7.4x its FY14E EPS of INR1860. The company has sound business model and ROE of 22.5%. We assign a P/E multiple of 8.5x to its FY14E EPS to arrive at a Target price of INR15810 for a time period of 12-15 months. Key Concern Tyre Industry is related with the automobile sector, if there is any slowdown in the auto sector for a longer period of time, the demand of tyres will have a negative impact. -224th April 2013 Microsec Research Microsec Research: Phone No.: 91 33 30512100 Email: microsec_research@microsec.in Ajay Jaiswal: President, Investment Strategies, Head of Research: ajaiswal@microsec.in Fundamental Research Name Sectors Designation Email ID Nitin Prakash Daga IT, Telecom & Entertainment AVP‐Research npdaga@microsec.in Naveen Vyas Sutapa Roy Midcaps, Market Strategies Economy AVP‐Research Research Analyst nvyas@microsec.in s‐roy@microsec.in Sanjeev Jain BFSI Research Analyst sjain@microsec.in Anik Das Mid Cap Research Analyst adas4@microsec.in Neha Majithia Soumyadip Raha Mid Cap Mid Cap Research Analyst Executive Research nmajithia@microsec.in sraha@microsec.in Saroj Singh Mid Cap ssingh2@microsec.in Kapil Bhati Mid Cap Executive Research Associate Research Executive kbhati@microsec.in Technical & Derivative Research Vinit Pagaria Derivatives & Technical VP vpagaria@microsec.in Ranajit Saha Technical Research Sr. Manager rksaha@microsec.in Institutional Desk Dhruva Mittal Institutional Equities Sr. Manager dmittal@microsec.in Puja Shah Institutional Desk Dealer pdshah@microsec.in PMS Division Siddharth Sedani PMS Research AVP ssedani@microsec.in Ketan Mehta PMS Sales AVP ksmehta@microsec.in Research: Financial Planning Division Shrivardhan Kedia Manager Research skedia@microsec.in FPD Products Research‐Support Subhabrata Boral Research Support Asst. Manager Technology Recommendation Expected absolute returns (%) over 12 months Strong Buy >20% Buy between 10% and 20% Hold between 0% and 10% Underperform between 0% and ‐10% Sell < ‐10% sboral@microsec.in MICROSEC RESEARCH IS ALSO ACCESSIBLE ON BLOOMBERG AT <MCLI> -324th April 2013 Microsec Research Microsec Benchmark its Research Benchmarking Fundamental Research 50.00% As on 31st Mar 2013 45.00% 40.00% 35.00% 30.00% 25.00% 20.00% 15.00% 10.00% 5.00% 0.00% Microsec Research Nifty CNX Midcap An amount of ` 1,00,000 invested individually in all 196 stocks ie, ` 1,96,00,000 investment as and when recommended has appreciated to ` 2,54,17,093 giving a return of 29.7 percent. On the same basis Nifty has given a return of 9.2 percent and CNXMID CAP has given a return of 9.6 percent. Microsec benchmark its Research and the same is updated on our website at www.microsec.in. Come, strike the right balance through Benchmarking Research. Plan and monitor your resources through www.prpsolutions.com Recommendation Expected absolute returns (%) over 12 months Strong Buy >20% Buy between 10% and 20% Hold between 0% and 10% Underperform between 0% and -10% Sell < -10% Disclaimer The investments discussed or recommended in this report may not be suitable for all investors. Investors should use this research as one input into formulating an investment opinion. Additional inputs should include, but are not limited to, the review of other. This is not an offer (or solicitation of an offer) to buy/sell the securities/instruments mentioned or an official confirmation. Microsec Capital Limited is not responsible for any error or inaccuracy or for any losses suffered on account of information contained in this report. This report does not purport to be offer for purchase and sale of share/ units. We and our affiliates, officers, directors, and employees, including persons involved in the preparation or issuance of this material may: (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation discussed herein or act as advisor or lender I borrower to such company (ies) or have other potential conflict of interest with respect to -4any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without Microsec Capital Limited’ prior written consent. 24th April 2013 Microsec Research